Defensive bias stepped higher, amid increasing attention by investors to statements by the U.K.'s Theresa May, and the U.S.' Donald Trump. Accordingly, investment-grade bonds easily outpaced junk debt on the European front, reflected in price gains linked to actual trades. High-yield bonds in the banking and retail sectors gave up some of last week's gains, while airline securities followed Lufthansa shares higher.

Topics: High Yield, Investment Grade, debt

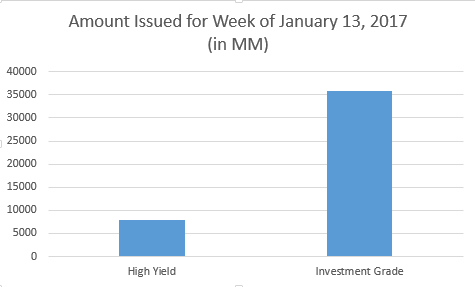

The amount issued in North American investment grade debt was more than quadruple the amount of that issued in high yield this week, with investment grade debt totaling $35.25 billion and high yield debt totaling $7.97 billion. Broadcom Corporation (NasdaqGS:AVGO) led investment grade deals with four new issues of senior unsecured notes totaling $13.55 billion to replace an old credit facility. This represented 38.4% of total investment grade debt issued this week. General Motors (NYSE:GM) led high yield deals with three new issues of senior unsecured notes totaling $2.5 billion, about 31.4% of total high yield debt issued this week.

Topics: High Yield, Investment Grade, New Issues, General Motors

European high yield debt held a slight edge over investment grade names, even as the pan-European Stoxx 600 equities index stayed mired in the shallow red.

Topics: High Yield, Investment Grade, debt

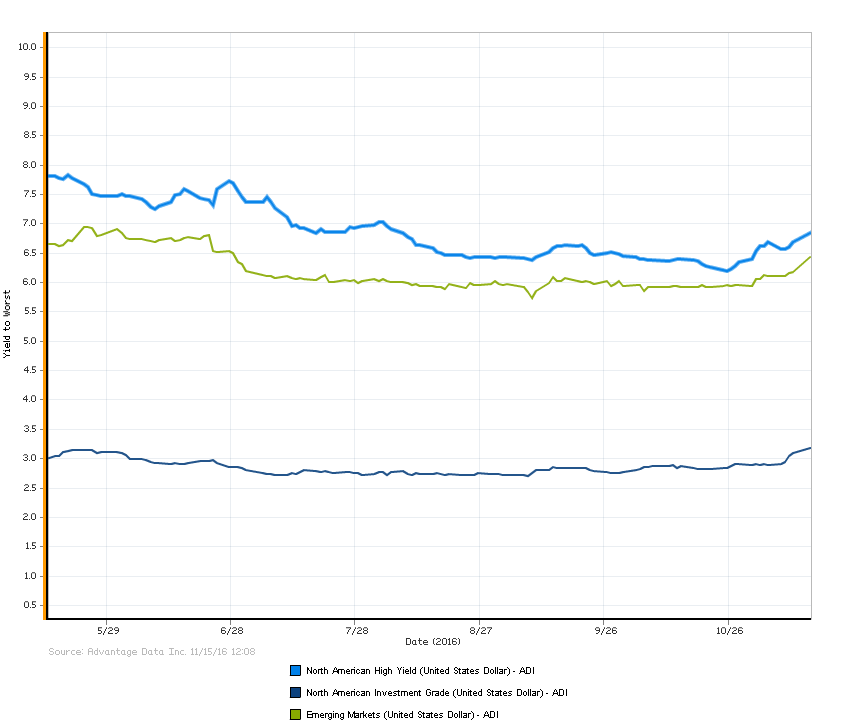

Following last week's presidential election, the bond markets were sent into a frenzy with anticipation that Trump's policies would lead to economic growth, and thus inflation. Today, Janet Yellen announced that an interest rate hike "could well become appropriate relatively soon", furthering the sentiment that an increase is coming in December. Through AdvantageData's Market Analytics, yields by industry can be tracked in real-time and broken out into Custom Indices.

Topics: High Yield, Investment Grade, Yields by Industry, Election, Janet Yellen

Corporate yields increased considerably following an upset victory from U.S. Presidential-elect Donald Trump on November 8th. This increase can be attributed to investors fleeing for the post-election rally in stocks due to Trump's promise of deregulation. This corporate bond sell-off is captured by the AdvantageData North American High Yield and High Grade Corporate Bond Indices.

Topics: High Yield, Investment Grade, emerging markets

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)