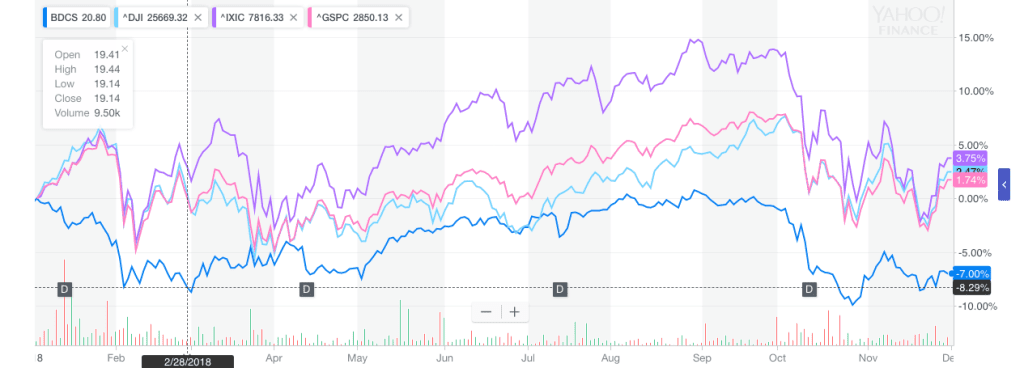

Back In Sync: As we expected, in the week ended November 30, 2018 the BDC common stock and the broader indices adjusted to get more in sync. The major markets raced ahead, while the BDC sector – which had performed better the week before – followed behind, up 0.62% in price terms. As this 2018 year-to-date chart comparing BDCS to the Dow Jones, NASDAQ and the S&P 500 shows all four have followed a similar shape even if there are short term divergences. If you adjust for the fact that the BDC sector pays out much higher distributions, even the total return is highly similar.

Nicholas Marshi, BDC Reporter

Recent Posts

BDC Preview: Week Of December 3 – December 7, 2018

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Fixed Income, News, bdc reporter

BDC Preview: Week Of November 26 – November 30, 2018

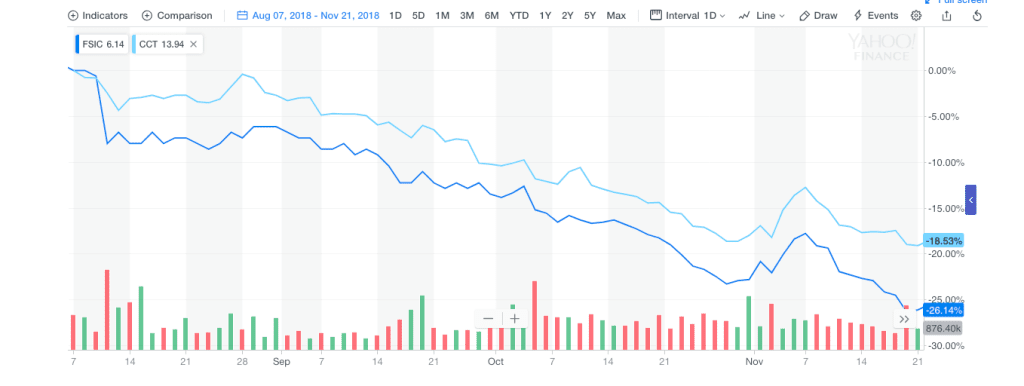

Market Mayhem: As we discussed at length already in our premium BDC Common Stocks Market Recap, last week was surprising as the BDC sector – and many individual BDCs – fared much better than the main indices and all the main categories from investment grade to “junk”. However, we’d be very surprised if the BDC sector can continue to remain uncorrelated with the broader markets for very much longer. As this chart below shows – comparing the price progress of the Exchange Traded Fund SPY, which is based on the S&P 500, and the exchange traded note with the ticker BDCS,which reflect the BDC sector – the two have moved pretty much in tandem since the decline began in the markets on September 20.

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Finance, Fixed Income, News, bdc reporter

BDC Preview: Week Of November 19 – November 23, 2018

Whence The BDC Rally ? : Last week, the two week long BDC rally ground to a halt. Based on the Wells Fargo BDC Index for the period, the sector pulled back (2.2%). Only 9 individual BDC companies were up in price or flat, while 37 were down. Using the UBS Exchange Traded Note which invests in most every common stock in the sector – ticker BDCS – we dropped to (6.6%) down in price terms on a year-to date basis.

It’s hard to imagine a huge turnaround coming this week, what with the broad markets all in various stages of disarray. In addition, the general leveraged loan market – a kissing cousin of the BDC sector – is just coming off its lowest price point in two years, and knocking their total return to below 4%. (The Wells Fargo Index measured comparable return for BDCs is a very close 2.8%). Then there’s the Thanksgiving break coming up with many investors more focused on turkey and family. We expect a non-eventful to lower shade on BDC prices.

Topics: Loans, Middle Market, BDC, market analytics, business development company, Fixed Income, News, bdc reporter

BDC Common Stocks Market Recap: Week Ended November 16, 2018

BDC Common Stocks

Two Weeks Forward. One Week Back

The BDC common stock winter “rally” took some time off this week, after two weeks of upward momentum.

Topics: Loans, Middle Market, BDC, market analytics, business development company, Fixed Income, News, bdc reporter

BDC Common Stocks Market Recap: Week Ended November 9, 2018

BDC COMMON STOCKS

Back In The Saddle. Again.

It’s Week Two of the late 2018 BDC rally.

More than three-quarters of the 45 BDCs we track were up in price, just like the week before.

The price of the UBS Exchange Traded Note which covers most of the companies in the sector – BDCS – was up to $19.76.

That’s 2.0% on the week, and 5.0% over a fortnight.

The Wells Fargo BDC Index – which provides more of a total return picture – was up 2.7%.

Topics: Analytics, market analytics, business development company, Finance, BDC Filings, Fixed Income, News, bdc reporter

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)