RISK-OFF SENTIMENT PREVAILED ON MONDAY IN EUROPEAN MARKETS as trade tensions

intensified over the weekend

after China announced an

increase in tariffs to 25 percent

for goods exported to the US. France’s economy is

expected to expand at a consistent rate

in the second quarter of 2019 with

GDP forecasted to grow 0.3 percent. The

10-year

Gilt rose 3.6 basis points.

FTSE 100 -0.48%,

German DAX -1.30%,

CAC 40

-1.20%,

STOXX Europe 600

-1.13%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

BRITAIN’S ECONOMY EXPANDED IN THE FIRST THREE MONTHS OF 2019

as businesses prepared for Brexit delivering orders before the deadline.

GPD grew at an annual rate of 2 percent

compared to the previous quarter of 0.9 percent.

German exports bounced

back at rapid pace soaring 1.5 percent month-over-month in March,

exceeding analyst expectations.

The

10-year

Gilt rose 0.6 basis points. Equities settled higher on the positive economic placing trade concerns on the backburner,

FTSE 100 +0.14%,

German DAX +0.86%,

CAC 40 +0.41%,

STOXX Europe 600

+0.43%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN SHARES PLUMMETED ON THURSDAY AMID escalating trade

tensions

between U.S. and China. Beijing announced they would retaliate taking

"necessary countermeasures" sending European automaker stocks lower.

Shares of BMW and Daimler

sank 3 percent. The

10-year

Gilt dipped 1.2 basis points.

FTSE 100 -0.87%,

German DAX -1.69%,

CAC 40 -1.93%,

STOXX Europe 600

-1.64%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN MARKETS WAVERED ON WEDNESDAY struggling for direction amid

escalating global trade tensions. “Now we’re left wondering

whether it will happen at all

and what impact more tariffs will have on the

global economy

and markets.

The next few days could be massive.” Craig Erlam market analyst at Oanda in London. The

British pound

edged 0.47 percent lower against the dollar. The

10-yearGilt dipped 2.3 basis points.

FTSE 100 +0.18%,

German DAX +0.86%,

CAC 40 +0.41%,

STOXX Europe 600

+0.19%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

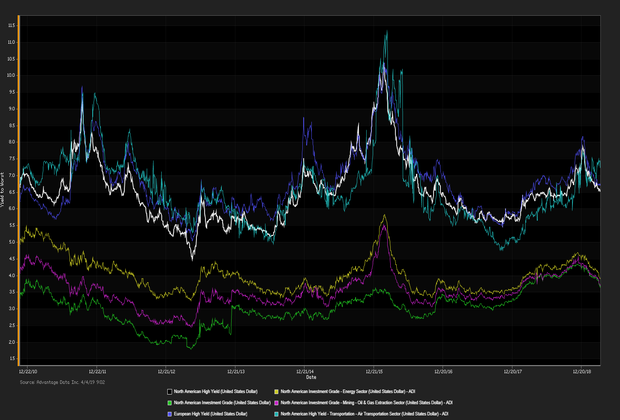

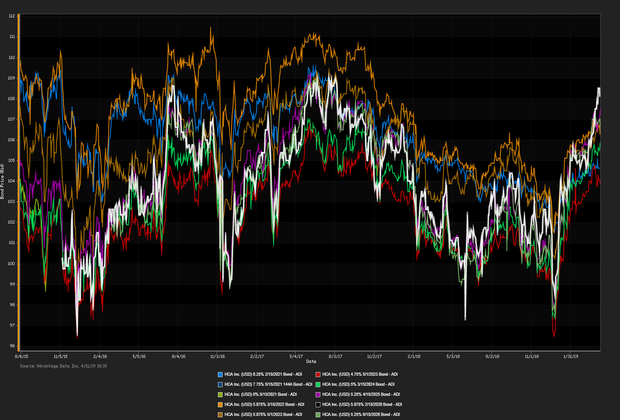

INVESTMENT-GRADE BONDS EDGED OUT its high-yield counterparts in net prices linked to actual trades

. Equities continue to fight for guidance

as investors keep a keen eye on the U.S. and China trade dispute. The

10-year

Gilt declined 5.6 basis points.

FTSE 100 -1.61%,

German DAX -1.80%,

CAC 40 +1.7%,

STOXX Europe 600

-1.47%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN SHARES SLIPPED UPON A SPARK

in geopolitical risk as the U.S. affirmed a rise in tariffs on China claiming a

slowdown in trade talks. Automakers BMW, Daimler, and Volkswagen took a

significant hit losing between 2 and 3 percent following

the escalation of trade tensions.

German DAX -1.38%,

CAC 40 -1.43%,

STOXX Europe 600

-1.09%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

BRITAIN’S SERVICES SECTOR EXPANDED IN APRIL despite weak demand and

ongoing uncertaintyaround Brexit; the

PMI index rose to 50.4 from last month’s two year low of 48.9. European equities bounce back supported by

solid bank earnings,

Societ General soared 4 percent

as the bank’s capital ratio held steady at 11.7

offsetting a 26 percent nosedive in net profit. The

10-year

Gilt rose 1.9 basis points.

FTSE 100 +0.48%,

German DAX +0.40%,

CAC 40 +0.12%,

STOXX Europe 600

+0.38%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

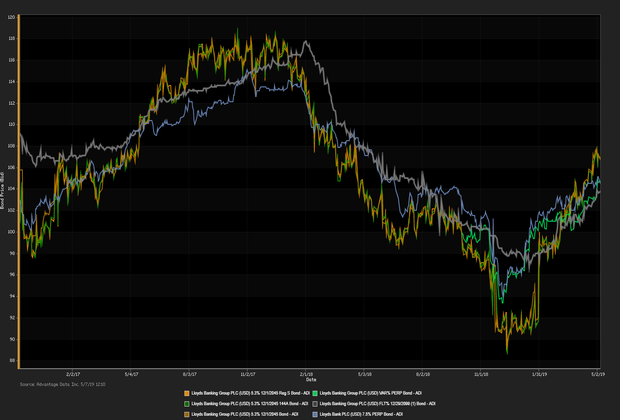

LLOYDS BANK REPORTED STRONG FIRST QUARTER EARNINGS

but

shares fell

due to a decline in home loans and borrowing from businesses as

confidence softens. European equities settled lower after the

U.S. Fed’s dovish tone yesterday

announcing “

transitory factors”

caused subdued inflation. The

10-year

Gilt rose 0.3 basis points.

FTSE 100 -0.38%,

German DAX +0.17%,

CAC 40 -0.64%,

STOXX Europe 600

-0.46%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

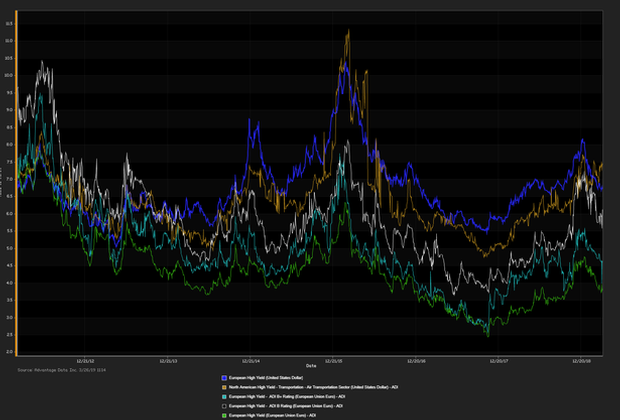

RISK TAKING WAS SCALED BACK AS INVESTMENT-GRADE DEBT ROSE against its high-yield counterpart in net prices linked to actual trades. The Federal Reserve held interest rates at their current levels following the meeting on Wednesday. Jerome Powell stated softening inflation is likely to be “transient,” but if easing inflation persists it is “something we would be concerned about.” The 10-year note gained 0.7 basis points. S&P -0.57%, DOW -0.44%, NASDAQ -0.32%.

Read More

Topics:

High Yield,

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

Finance,

Fixed Income,

News,

Syndicated Bonds,

syndicated,

research,

market update

RISK TAKING WAS SCALED BACK AS INVESTMENT-GRADE DEBT ROSE

against its high-yield counterpart in net prices linked to actual trades. The Federal Reserve held interest rates at their current levels following the meeting on Wednesday. Jerome Powell stated softening inflation is likely to be “transient,” but if easing inflation persists it is “something we would be concerned about.”

The 10-year note gained 0.7 basis points

. S&P

-0.57%,

DOW

-0.44%,

NASDAQ

-0.32%.

Read More

Topics:

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

News,

Syndicated Bonds,

syndicated,

research,

market update

.png)