Corey Mahoney

Recent Posts

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

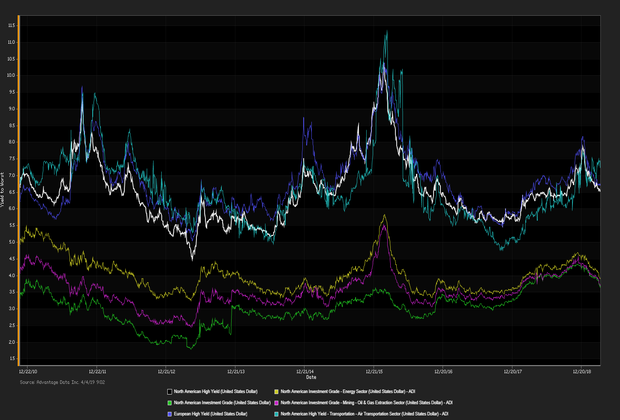

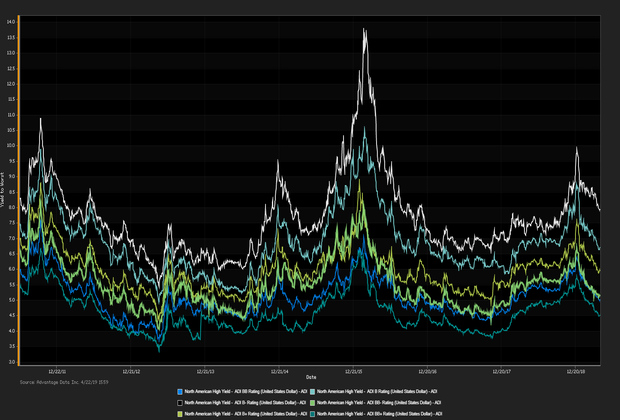

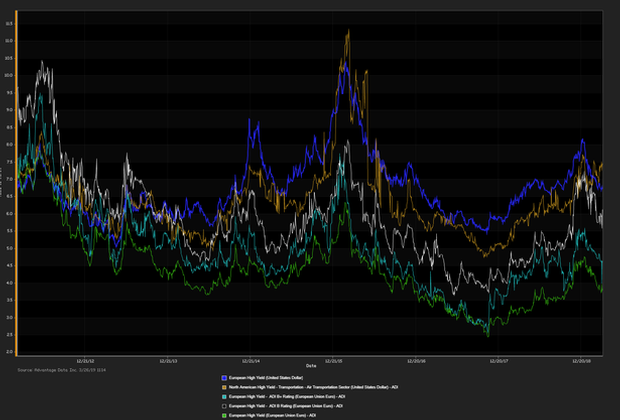

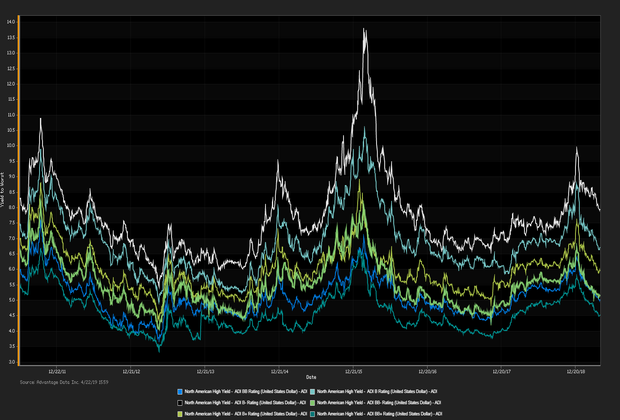

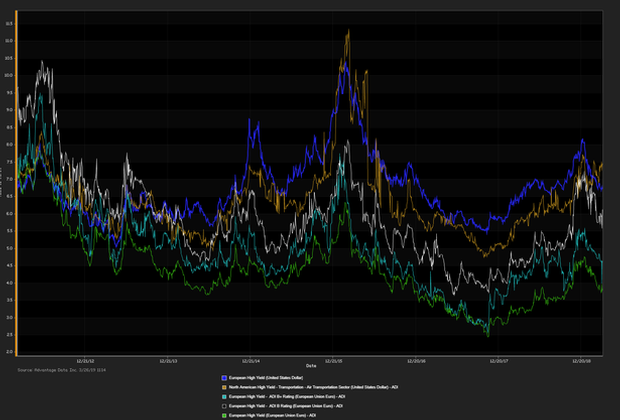

HIGH-YIELD DEBT RETAINED AN EDGE AGAINST INVESTMENT GRADE BONDS in net prices linked to actual trades. Muted signs of inflation have agitated bond investors to be the most bullish on longer-dated U.S. Treasuries since 2016. The Fed’s preferred method of evaluating inflation, the rate of Personal consumption expenditure increased by 1.7 percent on a year-over-year basis. The 10-year note lost 2.3 basis points. S&P -0.01%, DOW +0.08%, NASDAQ -0.75%.

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Home Depot Inc. 3.75% 2/15/2024 GE Capital Intl. Funding Co. 4.418% 11/15/2035 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | New Issues [Continued] |

|---|---|

| 1. Lear Corp. (USD) 4.25% 5/15/2029 (04/29/2019): 375MM Senior Unsecured Notes, Price at Issuance 99.691, Yielding 4.29%. 2. Norfolk Southern Corp. (USD) 4.1% 5/15/2049 (04/29/2019):400MM Senior Unsecured Notes, Price at Issuance 99.264, Yielding 4.14%. |

Additional Commentary

Textron Inc. The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 4/26/19, with a net outflow of $0.520B, year-to-date $13.8B flowed into high-yield.

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Weatherford International LTD (5Y Sen USD XR14) Hertz Corp. (5Y Sen USD CR14) |

SuperValu Inc. (5Y Sen USD MR14) Atmos Energy Corp. (5Y Sen USD MR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:Deals recently freed for secondary trading, notable secondary activity:

- JBS USA LLC, Sundyne US Purchaser, Prysmian, Project Maple II BV, Trade Me Group LTD

Long-term bond yields are expected to hit a cyclical peak in 2019 given tight fiscal policy and lagging global economies. Europe remains checked by stubbornly low inflationary forces. Positive effects remained in force:

- TED spread held below 17 bp (basis points), as of 04/30/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

HCA Inc. 4.5% 2/15/2027 Petrobras Global Finance BV 7.375% 1/17/2027 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | Forward Calendar |

|---|---|

| 1. Moss Creek Resources LLC (USD) 10.5% 5/15/2027 144A (04/29/2019): 500MM Senior Unsecured Notes, Price at Issuance 100, Yielding 10.5%. |

1. Twin River Management Group Inc.: $350M bonds, Expected Q2 2019 |

Additional Commentary

Moss Creek Resources LLC. The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 4/26/19, with a net outflow of $0.520B, year-to-date $13.8B flowed into high-yield.

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Hertz Corp. (5Y Sen USD XR14) Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

Cable & Wireless Communication (5Y Sen USD CR14) SuperValu Inc. (5Y Sen USD MR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:Deals recently freed for secondary trading, notable secondary activity:

- JBS USA LLC, Sundyne US Purchaser, Prysmian, Project Maple II BV, Trade Me Group LTD

Long-term bond yields are expected to hit a cyclical peak in 2019 given tight fiscal policy and lagging global economies. Europe remains checked by stubbornly low inflationary forces. Positive effects remained in force:

- TED spread held below 17 bp (basis points), as of 04/30/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

JUNK BONDS ROSE AGAINST INVESTMENT GRADE DEBT as investors anticipate a sound jobs report showing growth despite the rocky start to 2019. Gold edged lower as positive Chinese economic data revealed industrial firms reported a rise in profits for the first time in four months.The S&P 500 and NASDAQ closed at record highs lifted by more positive earnings.The 10-year note rose 2.6 basis points. S&P +0.11%, DOW +0.04%, NASDAQ +0.19%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

US ECONOMY GROWS BY 3.2% IN FIRST QUARTER, beating expectations. Retailers boosted strong sales gains in March, contributing to the pickup in consumer spending; contrary there was a slowdown in spending on services as well as automobiles. Residential construction fell at a 2.8 percent rate, making it the fifth straight quarterly decline.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Western Digital Corp. 4.75% 2/15/2026 Chesapeake Energy Corp. 7% 10/1/2024 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | Forward Calendar |

|---|---|

| 1. Adient US LLC (USD) 7% 5/15/2026 144A (04/25/2019): 800MM Secured Notes, Price at Issuance 100, Yielding 7%. 2. Truck Hero Inc (USD) 8.5% 4/21/2024 (04/26/2019): 335MM First Lien Notes, Price at Issuance 100, Yielding 8.5%. |

1. Twin River Management Group Inc.: $350M bonds, Expected Q2 2019 |

Additional Commentary

Xplornet Communications The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 4/18/19, with a net inflow of $1.1B, year-to-date $14.4B flowed into high-yield.

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Weatherford International LTD (5Y Sen USD XR14) Hertz Corp. (5Y Sen USD CR14) |

Road King Infrastructure LTD (5Y Sen USD MR14) Cable & Wireless Communication (5Y Sen USD CR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:Deals recently freed for secondary trading, notable secondary activity:

- JBS USA LLC, Sundyne US Purchaser, Prysmian, Project Maple II BV, Trade Me Group LTD

Long-term bond yields are expected to hit a cyclical peak in 2019 given tight fiscal policy and lagging global economies. Europe remains checked by stubbornly low inflationary forces. Positive effects remained in force:

- TED spread held below 17 bp (basis points), as of 04/26/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)