FRENCH PHARMACEUTICAL GIANT SANOFI RALLIED ON MONDAY following revised full-year earnings guidance suggesting 5 percent growth, the

stock

advanced 2.31 percent

.

Sanofi bonds

also traded notably higher in particular,

Sanofi (EUR) 1.25% 3/21/2034.

The growth was driven by the launch of a new brand Dupixent, in addition,

“Our increased focus in R&D delivered important results with several positive data read-outs and the achievement of regulatory milestones.”

FTSE 100 +1.87%,

German DAX +0.06%,

CAC 40

-0.06%,

STOXX Europe 600

+0.18%. The

10-year

Gilt lost 3.6 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

U.S. DURABLE GOODS ORDERS SURGED BY 2 PERCENT IN JUNE largely due to an increase in civilian aircraft orders. Core capital goods orders rose 1.9 percent on year-over-year basis suggesting the economy is picking up steam after two months of weak data. “The U.S. economy is stronger today because the rest of the world is in a recession. That’s not the way it’s supposed to work, but that’s the way it’s working now. Because the rest of the world is in a recession, our interest rates are scraping bottom. And because our interest rates are scraping bottom, our economy is actually doing pretty darn well,” said Todd Buchholz, former White House director of economic policy under President George H.W. Bush “Eighty-eight percent of our economy has pretty much nothing at all to do with exports or imports.”

Read More

Topics:

High Yield,

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

Finance,

Fixed Income,

News,

Syndicated Bonds,

syndicated,

research,

market update

U.S. DURABLE GOODS ORDERS SURGED BY 2 PERCENT IN JUNE largely due to an increase in civilian aircraft orders.

Core capital goods orders rose 1.9 percent on year-over-year basis suggesting the economy is picking up steam after two months of weak data.

“The U.S. economy is stronger todaybecause the rest of the world is in a recession. That’s not the way it’s supposed to work, but that’s the way it’s working now. B

ecause the rest of the world is in a recession, our interest rates are scraping bottom. And because our interest rates are scraping bottom, our economy is actually doing pretty darn well,” said Todd Buchholz,

former White House director of economic

policy under President George H.W. Bush

“Eighty-eight percent of our economy has pretty much nothing at all to do with exports or imports.”

Read More

Topics:

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

News,

Syndicated Bonds,

syndicated,

research,

market update

EUROPEAN JUNK BONDS SLIGHTLY edged out investment-grade debt in net prices linked to actual trades following a day after the

European Central Bank’s

decision

to hold interest rates. ECB President

Mario Draghi

said the economic outlook is

“getting worse and worse”

referring to manufacturing dragging the economy lower.

FTSE 100 +0.81%,

German DAX +0.44%,

CAC 40 +0.55%,

STOXX Europe 600+0.31%. The

10-year

Gilt lost 1.9 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

THE EUROPEAN CENTRAL BANK SIGNALED FOR ADDITIONAL MONETARY EASING in the months ahead resuming its

mass bond-buying program

in November. TD Securities Analysts say, The ECB

“is clearly preparing for a package of policy easing in September.” Negative interest rates have

rippled across Europe offering investors no incentives to purchase sovereign bonds.

FTSE 100 -0.20%,

German DAX -1.61%,

CAC 40

-0.82%,

STOXX Europe 600

-0.82%. The

10-year

Gilt advanced 2.1 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EURO ZONE PMI PLUMMETED IN JULY

as

German manufacturing

hits a seven-year low suggesting

further deterioration within the European economy;

PMI across the Euro Zone fell from 52.6 to 51.4. The

German automotive industry significantly contracted, however, the labor market and household spending remains robust preventing an all-out recession. “

The health of German manufacturing went from bad to worse in July.”

FTSE 100 -0.70%,

German DAX +0.39%,

CAC 40 +0.18%,

STOXX Europe 600

+0.50%. The

10-year

Gilt lost 1.1 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN MARKETS RALLY FOLLOWING a number of

upbeat earnings

propelling

the indices higher on Tuesday. The DAX gained nearly 2 percent as

German luxury automotive giant Daimler spiked 4.77 percent following an announcement Chinese automotive group BAIC bought a five percent stake in Daimler.

FTSE 100 +0.8%,

German DAX +1.93%,

CAC 40

+1.26%,

STOXX Europe 600

+1.20%. The

10-year

Gilt dipped 2.4 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN MARKETS INITIALLY EDGED HIGHER as investors await the

critical European Central Bank policy meeting update on Thursday. The central bank will disclose if they will cut the interest rate or wait until the next meeting in September. Investors will focus on

Mario Draghi

and how dovish his remarks are gauging the state of the economy.

“Largely European markets are lacking direction and probably shaping up for the ECB meeting this week.”

FTSE 100 +0.04%,

German DAX +0.22%,

CAC 40+0.08%,

STOXX Europe 600

+0.02%. The

10-year

Gilt dipped 1.4 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

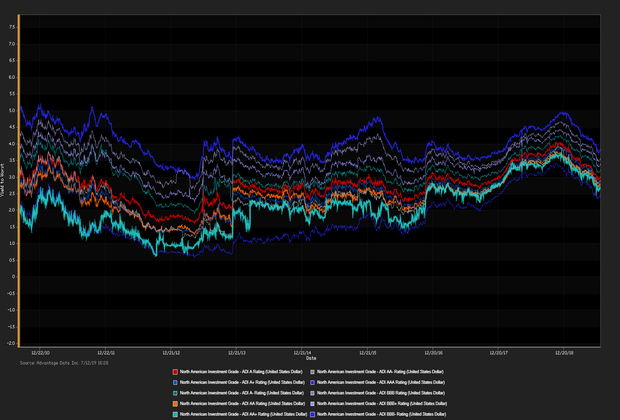

INVESTMENT GRADE DEBT ROSE AGAINST junk bonds in net prices linked to actual trades. Total assets in US money market funds retreated from nearly 10-year highs last week as yields fall. Traders are estimating a 65 percent chance of a 25 basis point cut. “Even though the Fed will almost certainly cut rates at the end of the month, additional cuts depend heavily on the balance of economic data.” S&P-0.47%, DOW -0.30, NASDAQ -0.24% The 10-year note dipped 4.6 basis points.

Read More

Topics:

High Yield,

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

Finance,

Fixed Income,

News,

Syndicated Bonds,

syndicated,

research,

market update

INVESTMENT GRADE DEBT ROSE AGAINST

junk bonds in net prices linked to actual trades. Total assets in US money market funds

retreated from nearly 10-year highs last

week as yields fall. Traders are estimating a

65 percent chance of a 25 basis

point cut.

“Even though the Fed will almost certainly cut rates at the end of the month, additional cuts depend heavily on the balance of economic data.”

S&P-0.47%,

DOW -0.30,

NASDAQ

-0.24%

The 10-year note dipped 4.6 basis points

.

Read More

Topics:

Investment Grade,

Loans,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

New Issues,

News,

Syndicated Bonds,

syndicated,

research,

market update

.png)