RETAIL SALES SLUMP IN BRITAIN rising at their

slowest average pace on record

in the twelve trailing months,

reporting a dismal 0.6 percent growth.

Low unemployment

has kept the economy afloat placing money into pockets of consumers however, they are

reluctant to reach in and spend it. “

Overall, the picture is bleak: rising real wages have failed to translate into higher spending as ongoing Brexit uncertainty led consumers to put off non-essential purchases.”

FTSE 100 -0.20%,

German DAX -0.88%,

CAC 40

-0.30%,

STOXX Europe 600

-0.54%. The

10-year

Gilt rose 0.2 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

IRELAND IS UNER PRESSURE FROM EU MEMBER STATES

to detail how it plans to keep its

border with Northern Ireland open

and remain a fully

compliant member of the EU's single market

as no-deal Brexit is on the horizon;

Prime Minister Leo Varadkar

says it would be

difficult but possible. Philip Rycroft, who resigned as the permanent secretary of the Department for Exiting the European Union (DExEU), says

everyone should be worried about a no-deal situation

"because that is a very major change and it would be a very

abrupt change to our major trading relationship."

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

THE CONTINUED BREXIT CRISIS CAUSES A UK ECONOMY SLOWDOWN as British employers and shoppers are

growing increasingly cautious. Although the

unemployment rate fell

to its lowest rate since 1975 at 3.8% in the first quarter of 2019, The Bank of England said Britain's economy

had nearly no growth in the April to June period. The

Bank of England Governor Mark Carney

suggests the no-deal Brexit and the rise in

protectionist trade policies pose great risk

to the British economy.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

MAJOR EU BANKS FACE A 135 BILLION EURO DEFICIT in order to comply with

global capital requirements

to be implemented in 2027 according to the Basel III, an international banking regulation standard in

response to the 2008 financial crisis. Banks on average need to

raise their capital by 24.4 percent

in order to fully comply with the regulation.

FTSE 100 +0.78%,

German DAX +0.02%,

CAC 40+0.16%,

STOXX Europe 600

+0.35%. The

10-year

Gilt plummeted 7.8 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EURO ZONE LENDING HELD STEADY IN MAY a relief to many investors

fearing an imminent recessionis upon the bloc.

Corporate lending grew

at an annual rate of 3.9 percent and

household lending

advanced

by 3.3 percent, both expanding at a faster rate than expected. In spite of the positive report, European Central Bank chief Mario Draghi stated

“In the absence of improvement... additional stimulus will be required”

hinting to

Quantitative Easing.

FTSE 100 +1.17%,

German DAX +1.18%,

CAC 40+0.83%,

STOXX Europe 600

+0.86%. The

10-year

Gilt slipped 2.8 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

CONSUMER CONFIDENCE IN THE UNITED KINGDOM

SLIPPED

in June to minus 13 from a reading of minus 10 in May. Analysts are calling this the new normal,

"While UK consumers continue to remain concerned about the wider economy, over which the woman or man in the street has no control, of greater worry, are the falls in the measures for personal finance,"

FTSE 100 +0.13%,

German DAX +1.06%,

CAC 40

+0.83%,

STOXX Europe 600

+0.63%. The

10-year

Gilt rose 0.5 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

INVESTMENT-GRADE EUROPEAN DEBT ROSE AGAINST

its high-yielding junk bond counterparts in net prices linked to actual trades. German inflation chimed in at 1.6 percent

remaining subdued, well below the

European Central Bank’s June target of 2 percent. Euro zone economic sentiment fell

to nearly a three year low suggesting the Central Bank will not raise rates this year.

FTSE 100 +0.01%

, German DAX +0.37%

, CAC 40 +0.05%

, STOXX Europe 600 +0.13%

. The 10-year Gilt lost 0.05 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN MARKETS WAVER AS INVESTORS KEEP A KEEN EYE ON

the G20 summit scheduled to commence this weekend. The market

expects a solution from US and China

soon after the summit regarding the ongoing trade spat.

Mark Carney implied in the event Britain crashes out of the EU the

Bank of England will be compelled to slash rates

.

FTSE 100 -0.04%,

German DAX +0.4%,

CAC 40 -0.29%,

STOXX Europe 600 -0.31%. The

10-year Gilt rose 3.3 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

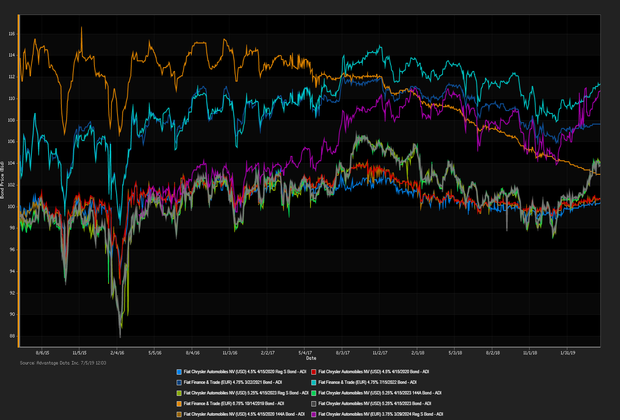

BRITAIN’S AUTOMOTIVE INDUSTRY FEARS an abrupt Brexit will

cripple the already deteriorated industry

by adding billions of pounds in tariffs. The sector is facing its

steepest downturn since 2012

with production in some plants grinding to a halt

. “Leaving the EU without a deal would trigger the most seismic shift in trading conditions ever experienced by automotive

.”

FTSE 100 -0.04%,

German DAX -0.32%,

CAC 40

-0.05%,

STOXX Europe 600

-0.12%. The

10-year

Gilt slipped 2.3 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

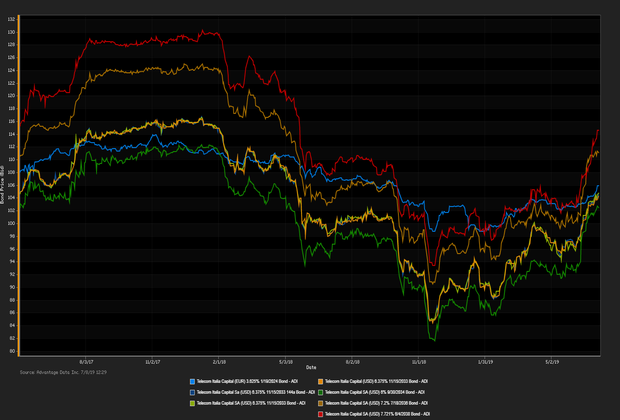

ITALY’S DEPOSITOR PROTECTION FUND, FITD rejected a plan backed by

Apollo Global Management

to salvage the distressed Carige bank. The FITD stated they would consider a solution involving private equity in tandem with the

banks' current shareholders; Carige bank has a

capital deficit of 630 million euros.

FTSE 100 +0.13%,

German DAX -0.62%,

CAC 40 -0.19%,

STOXX Europe 600 -0.29%. The

10-year Gilt dipped 3.2 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

.png)