Still 150,000 businesses do not have the proper paperwork

needed in order to continue

exporting

to the EU in the event of a

no-deal Brexit. While many have built up

contingency stocks,

these are estimated to

only last a few weeks

and so businesses will be

reliant on what the governments

are able to do to keep the

ports open. However, it was noted that the

financial system is prepared for a no-deal outcome.

FTSE 100 -0.38%,

German DAX -0.20%,

CAC 40 -0.19%,

STOXX Europe 600 -0.40%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

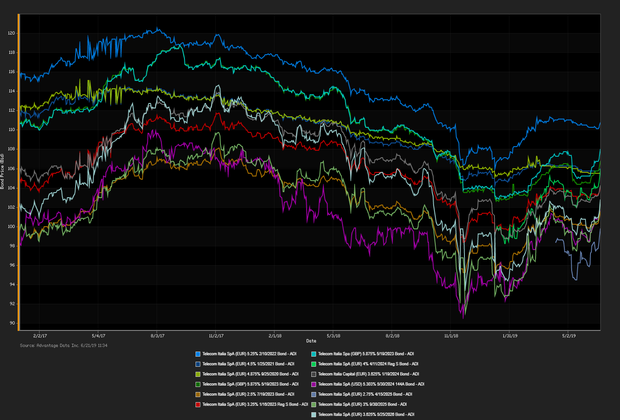

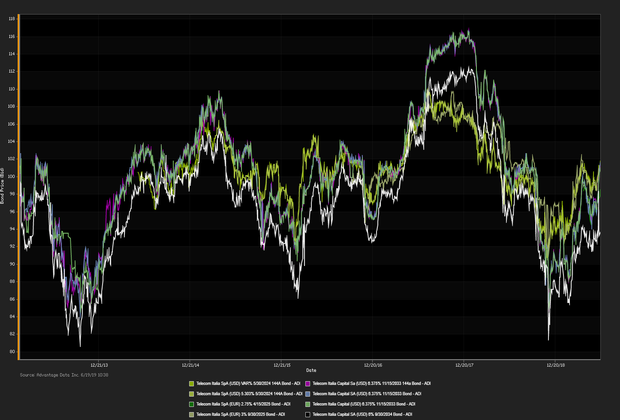

THE ITALIAN GOVERNMENT

PROPOSES

to use 5.2 billion euros in order to reduce the

budget deficit

for 2019 and avoid EU financial sanctions.

Crude oil prices surge

following Iran shooting down a US military surveillance drone in the

Strait of Hormuz rattling the oil markets

. The

pound rose 0.44 percent

against the

dollar

and

slipped 0.25 percent against the

euro

.

FTSE 100 +0.62%,

German DAX +0.80%,

CAC 40+0.71%,

STOXX Europe 600

+0.64%. The

10-year

Gilt lost 4.8 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

THE EUROPEAN COMMISSION REQUESTED ITALY to reduce its debt in order to

avoid disciplinary action

that could include

financial sanctions

. Last year Italy reached a budget deal averting sanctions after the commission had

rejected the initial budget

.

Currently, Italy’s debt is 132.2 percent of the GDP and according to forecasts it's expected to increase.

FTSE 100 -0.25%,

German DAX -0.14%,

CAC 40 +0.16%,

STOXX Europe 600 +0.01%. The

10-year Gilt rose 5.2 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

BREXIT IS TAKING ITS TOLL ON INVESTMENT IN BRITISH COMPANIES. Businesses are on track to slash investments by the most in 10 years as the economic future of the country looms. Focus has shifted away from long-term plans given uncertainties,

“Businesses are putting resources into contingency plans, such as stockpiling, rather than investing in ventures that would positively contribute to long-term economic growth”.

FTSE 100 +1.42%,

German DAX +2.19%,

CAC 40

+2.29%,

STOXX Europe 600+1.81%. The

10-year

Gilt lost 4.7 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

BRITAIN CLAIMS THE GOVERNMENT IS IN “PRETTY GOOD SHAPE”

in the event the country needs to leave the European Union without a deal. Officials believe a

No Deal would provoke a 10 percent spike in food prices catapulting the

economy into a recession.

FTSE 100 -0.4%,

German DAX -0.77%,

CAC 40-0.4%,

STOXX Europe 600

-0.53%. The

10-year

Gilt rose 0.3 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROZONE CREDITORS FOREWARN THAT GREECE

is in danger of missing its budget targets, therefore, risk of

falling short

of its agreed upon commitment last year. “

We are concerned that the fiscal measures adopted last month put the fiscal target of the primary surplus of 3.5% of GDP at risk.” Investors remain optimistic as

Greek stocks surge

meanwhile

Greek bond yields plummet

to record lows.

FTSE 100 -0.07%,

German DAX +0.37%,

CAC 40

+0.02%,

STOXX Europe 600

+0.15%. The

10-year Gilt dropped 3.2 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

GERMAN INVESTMENT LEADER DEUTSCHE BANK

alerted 1,000 clients they are at

risk of severing relationships

in a compliance effort. The bank is referring to the initiative as

“Know your customer”

in a statement said, “

This is a standardized notification that has been sent to thousands of clients globally”

. Deutsche bank is

demanding company-ownership information

and other sensitive documentation by the end of June.

FTSE 100 -0.39%,

German DAX -0.25%,

CAC 40

-0.51%,

STOXX Europe 600

-0.22%. The

10-year

Gilt rose 0.4 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROZONE INVESTOR CONFIDENCE DETERIORATED IN JUNE following suit with business confidence as escalating global trade tensions

take a toll on the market. On Tuesday, investors looked beyond the report,

Hugo Boss

a German-based luxury brand

jumped 4.3 percent

and the

automotive industry

saw marginal gains after

easing tariff concerns.

FTSE 100 +0.40%,

German DAX +1.25%,

CAC 40+0.75%,

STOXX Europe 600

+0.85%. The

10-year

Gilt gained 1.1 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

A TOP FRENCH REGULATOR

believes it is time to

reform the financial markets

across the European Union

reviewing and changing existing laws. Robert Ophele, chairman of AMF, France’s financial markets stated,

“The time is ripe to think about the main areas of work and principles that should guide the action of EU legislators and regulators for the coming years.”

FTSE 100 +0.60%,

German DAX +0.77%,

CAC 40

+0.33%,

STOXX Europe 600

+0.22%. The

10-year

Gilt rose 2.3 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

INFLATION IS EXPECTED TO RISE MARKING A DECADE HIGH in Britain

sounding alarms

regarding the long term

sustainability of the economy. Long-run inflation

forecasts rose to 3.8 percent

swayed by an increase in energy prices.

European equities rally

on Friday as investors are optimistic on a trade deal between the US and Mexico despite a weak US jobs report,

FTSE 100 +1.06%,

German DAX +1.01%,

CAC 40

+1.90%,

STOXX Europe

600

+1.03%. The

10-year

Gilt lost 0.1 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

.png)