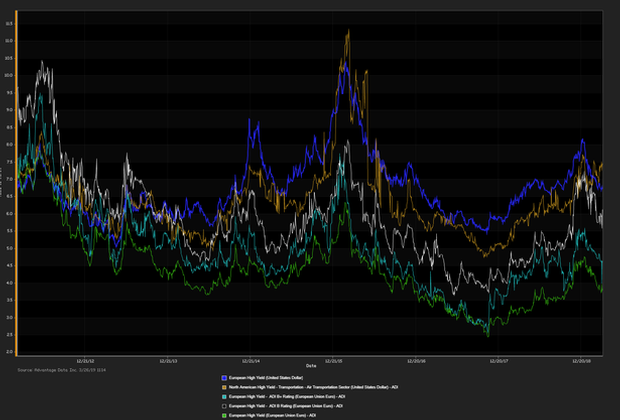

INVESTMENT-GRADE BONDS EDGED OUT its high-yield counterparts in net prices linked to actual trades

. Equities continue to fight for guidance

as investors keep a keen eye on the U.S. and China trade dispute. The

10-year

Gilt declined 5.6 basis points.

FTSE 100 -1.61%,

German DAX -1.80%,

CAC 40 +1.7%,

STOXX Europe 600

-1.47%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN SHARES SLIPPED UPON A SPARK

in geopolitical risk as the U.S. affirmed a rise in tariffs on China claiming a

slowdown in trade talks. Automakers BMW, Daimler, and Volkswagen took a

significant hit losing between 2 and 3 percent following

the escalation of trade tensions.

German DAX -1.38%,

CAC 40 -1.43%,

STOXX Europe 600

-1.09%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

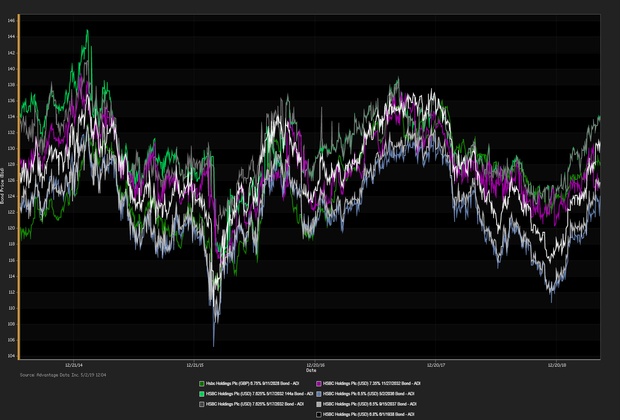

BRITAIN’S SERVICES SECTOR EXPANDED IN APRIL despite weak demand and

ongoing uncertaintyaround Brexit; the

PMI index rose to 50.4 from last month’s two year low of 48.9. European equities bounce back supported by

solid bank earnings,

Societ General soared 4 percent

as the bank’s capital ratio held steady at 11.7

offsetting a 26 percent nosedive in net profit. The

10-year

Gilt rose 1.9 basis points.

FTSE 100 +0.48%,

German DAX +0.40%,

CAC 40 +0.12%,

STOXX Europe 600

+0.38%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

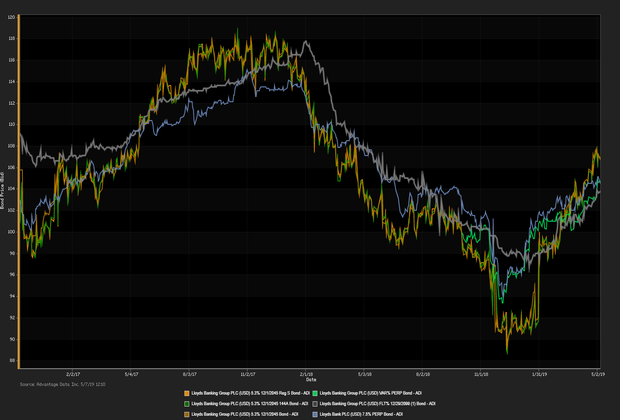

LLOYDS BANK REPORTED STRONG FIRST QUARTER EARNINGS

but

shares fell

due to a decline in home loans and borrowing from businesses as

confidence softens. European equities settled lower after the

U.S. Fed’s dovish tone yesterday

announcing “

transitory factors”

caused subdued inflation. The

10-year

Gilt rose 0.3 basis points.

FTSE 100 -0.38%,

German DAX +0.17%,

CAC 40 -0.64%,

STOXX Europe 600

-0.46%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN EQUITIES SETTLED MIXED with light trading volumes as European markets are observing Labour Day. The European Central Bank fears

Deutsche Bank is at risk of failing U.S. stress tests. The bank has struggled to

appease investors after unproductive merger

talks

with Commerzbank. The

10-year

Gilt lost 2.3 basis points.

FTSE 100 -0.35%,

German DAX +0.13%,

CAC 40 +0.10%,

STOXX Europe 600

-0.05%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROZONE ECONOMY EXPANDED in the first quarter of 2019 shaking off a rough finish to 2018

easing fears of a recession. GDP rose 1.2 percent year-over-year with preliminary estimates of 0.4 percent, analysts expect the

GDP to waver around 0.3 percent for the remainder of the year. The

10-year

Gilt rose 4.2 basis points.

FTSE 100 -0.53%,

German DAX -0.15%,

CAC 40 -0.34%,

STOXX Europe 600-0.23%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN EQUITIES WHIPSAW on data revealing economic sentiment

declined for the tenth straight month. The euro edged higher against the dollar

meanwhile lost against the British pound. The

10-yearGilt settled 1.3 basis points higher.

FTSE 100 +0.19%,

German DAX +0.09%,

CAC 40 +0.14%,

STOXX Europe 600

+0.07%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

NORTHERN IRELAND AND UK ANNOUNCED A FIVE-WEEK PROCESSS aimed at

restoring

the Northern Ireland

Executive

and

Assembly. The main political parties in Northern Ireland, the

UK and Irish governments will all be involvedto

re-establish

full operation of the democratic institutions. This follows statements from

Varadkar

that a no-deal scenario would put

Ireland in a difficult situation. Senior Conservative Party members are

calling on May to limit the Irish backstop

to one year or remove it completely.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

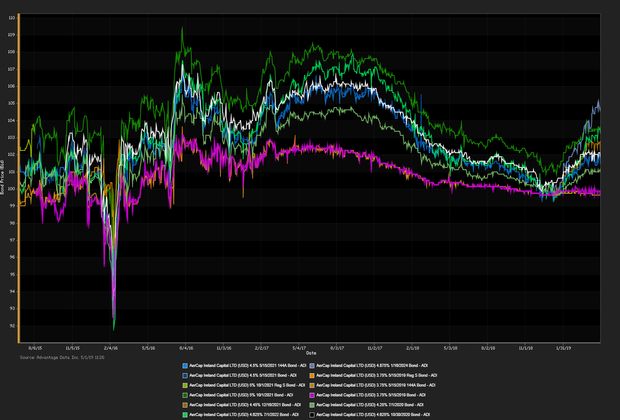

EUROPEAN EQUITIES EDGED LOWER ON THURSDAY following

mixed earnings

and weak economic data.

Commerzbank in Germany

fell 3 percent after

Deutche bank decided to discontinue

early talks regarding a merger or acquisition.

Barclays

sank 4 percent after reporting

disappointing earnings revealing

first-quarter profit declined 10 percent

year-over-year. The

10-year

Gilt settled 2.1 basis points lower.

FTSE 100 -0.73%,

German DAX -0.38%,

CAC 40 -0.47%,

STOXX Europe 600

-0.35%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

GERMAN BUSINESS CONFIDENCE PLUMMETS to the lowest level in three years implying the European economy is experiencing a further slowdown. The business index dipped to 103.3 despite an estimate of 103.6, "Companies are less satisfied with their current business situation”. France’s manufacturing confidence dropped for the first time in five months hitting a two-and-a-half year low. Equities pulled back from eight-month highs as investors are concerned with China slowing the stimulus. The 10-year Gilt sank 4.5 basis points. FTSE 100 -0.63%, German DAX +0.52%, CAC 40 -0.36%, STOXX Europe 600 -0.08%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

.png)