WEAK TRADE DATA CASTING DOUBT ON GERMANY’S ECONOMIC

STRENGTH

. German exports and imports declined more than expected in February dropping by an aggregate of 1.3 percent

in February. German exporters are suffering from a

slowing world economy, trade disputes and Brexit angst.

The trade surplus edged up to

18.7 billion euros

from a

revised 18.6 billion euros the previous month. German industrial orders fell by the biggest margin in more than two years.

Brexit deadline is looming and a “no-deal Brexit makes no sense and is the worst possible solution,”

stated European Agriculture Commissioner, Phil Hogan. The

UK 10-year Gilt

declined one-tenth of a basis point.

FTSE 100 +0.07%,

STOXX Europe 600 -0.19%,

CAC 40 +0.38%,

German DAX -0.39%.

Read More

Topics:

Analytics,

bonds,

bond market,

market analytics,

News,

research,

EU,

market update,

European

U.S. EMPLOYMENT ACCELERATED IN MARCH growing by 196,000 jobs rebounding from a 17-month low in February. “This was a Goldilocks report, with a rebound in job growth to calm fears of an imminent recession, and wage growth that was solid enough without triggering inflationary concerns,”said Curt Long, chief economist at the National Association of Federally-Insured Credit Unions. 10-year Treasury note shed 2.2 basis points. Equities rise to six month highs amid strong economic data, S&P+0.44%, DOW +0.18%, NASDAQ +0.58%

Read More

Topics:

High Yield,

Investment Grade,

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

News,

research,

market update

U.

S.

EMPLOYMENT ACCELERATED IN MARCH

growing by 196,000 jobs rebounding

from a 17-month low

in February.

“This was a Goldilocks report, with a rebound in job growth to

calm fears of an imminent recession, and wage growth that was solid enough without

triggering inflationary concerns,”said Curt Long, chief economist at the National Association of Federally-Insured Credit Unions.

10-year Trea

sury note shed 2.2 basis points. Equities rise to

six month highs

amid strong economic data,

S&P+0.44%,

DOW

+0.18%,

NASDAQ

+0.58%

Read More

Topics:

High Yield,

Investment Grade,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

News,

research,

market update

EUROPEAN EQUITIES GAINED following the release of a

positive U.S. jobs

report signaling the U.S. economy remains strong despite

global economies faltering. In the European front, German industrial output increased 0.7 percent in February aided by a

flood of construction

activity, however,

“The industrial sector is expected to remain subdued given the weak development in orders and the gloomier business climate” The

UK 10-year

Gilt

rose 3.3 basis points.

FTSE 100 +0.78%,

STOXX

Europe 600

+0.19%,

CAC 40

+0.38%,

German DAX

+0.21%.

Read More

Topics:

Analytics,

bonds,

bond market,

market analytics,

News,

research,

EU,

market update,

European

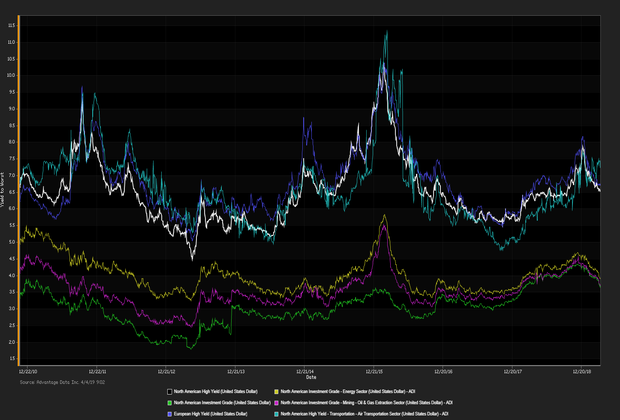

JUNK BONDS REGAINED FAVOR as a risk-on sentiment prevailed against investment grade debt. U.S. mortgage applications surge to levels not seen since October 2016 aided by a wave of homeowners refinancing. Plummeting interest rates also led to the uptick in refinancing activity which increased 47.4 percent from the previous week. The 10-year Treasury note gained 4.7 basis points. S&P +0.2%, DOW-0.03%, NASDAQ +0.56%

Read More

Topics:

Investment Grade,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

News,

research,

market update

JUNK BONDS REGAINED FAVOR as a risk-on sentiment

prevailed

against investment grade debt. U.S.

mortgage applications surge

to levels not seen since October 2016 aided by a wave of homeowners refinancing. Plummeting interest rates also led to the

uptick in refinancing

activity which increased 47.4 percent from the previous week. The

10-year Trea

sury note gained 4.7 basis points.

S&P

+0.2%,

DOW-0.03%,

NASDAQ

+0.56%

Read More

Topics:

High Yield,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

News,

research,

market update

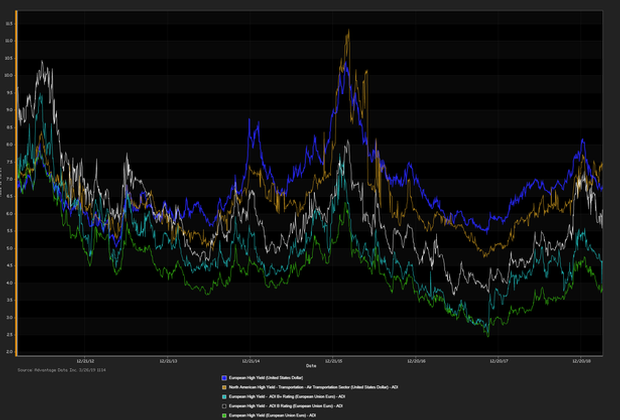

UK HEADED FOR A DOWNTURN AS BREXIT WORRIES

NEGATIVELY

IMPACT SERVICES SECTOR. The PMI, a barometer of the economy’s health

tumbled to 48.9 in March from 51.3 in February, inducing the sterling to dip to $1.3156.

“A stalling of the economy in the first quarter will create further

stress on the second quarter unless demand revives suddenly, which seems highly improbable with

Brexit looming,” mentioned IHS Markit. “In a no-deal scenario, both the EU and the UK would face a challenge of protecting their single markets,” mentioned

European Commissioner, Pierre Moscovici. The UK 10-year Gilt

increased

seven basis points.

FTSE 100, +0.23%,

STOXX Europe 600 +0.

91%,

CAC 40 +0.76%,

German DAX +1.68%.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

News,

research,

EU,

market update,

European

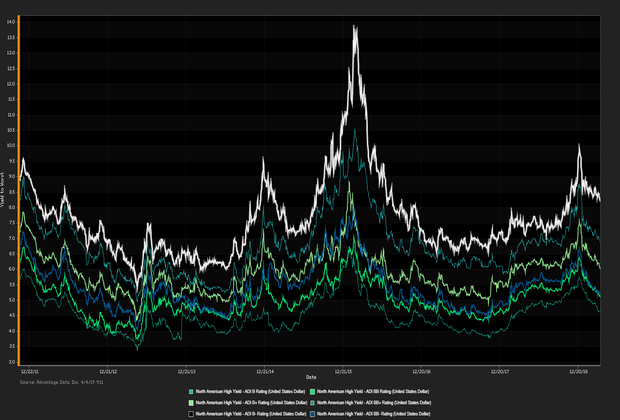

INVESTMENT-GRADE DEBT EDGED OUT JUNK BONDS in net prices linked to actual trades. U.S. Treasury yields slipped as investors turned bearish following Brexit reigniting fears of uncertainty. The U.K. Prime Minister Theresa May will “request a further postponement of Brexit” seeking to break the standoff in Parliament. Equities on Tuesday wavered upon investors fleeing to safe-haven assets. The 10-year Treasury note declined 3.6 basis points. S&P +0.06%, DOW -0.27%, NASDAQ +0.31%

Read More

Topics:

Investment Grade,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

News,

research,

market update

INVESTMENT-GRADE DEBT EDGED OUT JUNK BONDS in net prices linked to actual trades. U.S. Treasury yields slipped as investors turned bearish following Brexit

reigniting fears of uncertainty. The U.K. Prime Minister Theresa May will

“request a further postponement of Brexit”

seeking to break the standoff in Parliament.

Equities on Tuesday wavered

upon investors fleeing to safe-haven assets. The

10-year Trea

sury note declined 3.6 basis points.

S&P

+0.06%,

DOW

-0.27%,

NASDAQ

+0.31%

Read More

Topics:

High Yield,

Analytics,

bonds,

junk bonds,

bond market,

market analytics,

News,

research,

market update

BANK OF ENGLAND TO EXTEND BREXIT LIQUIDITY AUCTIONS

UNTIL END OF JUNE, providing smooth

market conditions given Britain leaves the European Union. “

The bank will continue to monitor growth

and market liquidity on a daily basis, and stands ready to take additional action if necessary.” The EU has placed a series of

contingency measures

to deal with a no-deal Brexit; including a

temporaryrecognition of Britain-based clearing houses which processes multi-trillion euro

derivatives transactions. The

euro fell below $1.12 as U.S. economic data outperforms expectations. The pound fell half a percent after lawmakers rejected four

Brexit proposals. The UK 10-year Gilt declined

four basis points.

FTSE 100, +1.08%,

STOXX Europe 600 +1.

68%,

CAC 40 +0.41%,

German DAX +0.77%.

Read More

Topics:

Analytics,

bonds,

bond market,

market analytics,

News,

research,

EU,

market update,

European

.png)