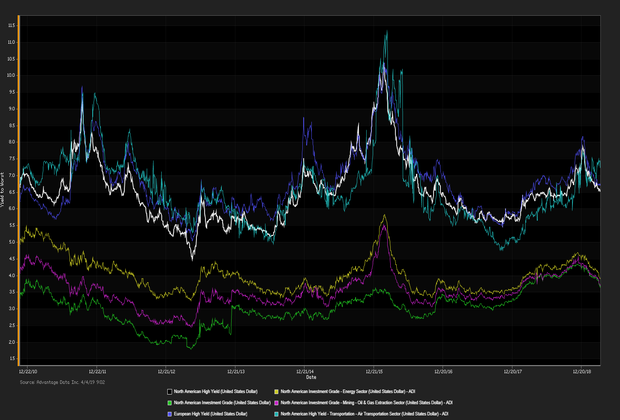

JUNK BONDS RETAIN A SLIGHT EDGE OVER INVESTMENT-GRADE DEBT in net prices linked to actual trades despite lackluster bank earnings. Goldman Sachs sank 3.41 percent upon releasing weaker than expected revenue for the first quarter, meanwhile, Citigroup reported a rise in profit by 2 percent from a year ago lifted by an expansion in U.S. consumer banking. “Both our consumer and institutional businesses performed well and we saw good momentum in those areas where we have been investing,” stated Chief Executive Mike Corbat. 10-year Treasury note slipped 1.9 basis points. S&P -0.07%, DOW-0.11%, NASDAQ -0.07%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

RISK-ON SENTIMENT INTENSIFIED FOLLOWING A SLEW OF POSITIVE EARNINGS as the Dow Jones Industrial Average spiked 230 points. J.P. Morgan and Disney were among the companies that reported on Friday, J.P. Morgan announced the “impact of higher rates” elevated earnings, JPM closed 4.5 percent higher. Disney surged 11 percent after revealing a rival streaming service to Netflix. Economic concerns have dissipated, “Strength in [JPMorgan’s] consumer franchise shows that despite the uncertainty in the fourth quarter of last year, consumers continue to spend and give strength to the overall U.S. economy”. 10-year Treasury note rose 6.4 basis points. S&P +0.64%, DOW +0.96%, NASDAQ +0.44%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

TREASURY YIELDS ROSE ON THURSDAY upon the release of positive economic data on the labor market calming fears of a slowing economy, 10-year Treasury note increased 3.4 basis points. Equities settled lower as investors anticipate a lackluster quarterly earnings season set to kick off this Friday. Chief equity strategist Terry Sandven at U.S. Bank Wealth Management sees opportunity, “Expectations for first-quarter results have been ratcheted down on the heels of sluggish global growth, so the bar is low and it could set the stage for upside surprises”. S&P -0.11%, DOW -0.19%, NASDAQ -0.31%

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: High Yield, Investment Grade, Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, Syndicated Bonds, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, News, Syndicated Bonds, research, EU, market update, European

INVESTMENT-GRADE DEBT ROSE AGAINST JUNK BONDS in net prices linked to actual trades. Fed meeting minutes from March released on Wednesday indicated a holding pattern will continue, “A majority of participants expected that the evolution of the economic outlook and risks to the outlook would likely warrant leaving the target range unchanged for the remainder of the year”. 10-year Treasury note declined 3.1 basis points. S&P +0.27%, DOW -0.06%, NASDAQ -0.61%

Topics: Investment Grade, Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, News, Syndicated Bonds, research, market update

Topics: Investment Grade, Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, News, Syndicated Bonds, research, market update

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)