An effective deal sourcing process is crucial to successful investing. Deal sourcing involves generating leads and managing relationships with intermediaries. Strategies for deal sourcing vary among firms. Some firms prefer to employ specialist teams while others prefer using in-house resources.

Regardless of a firm’s strategy, access to the proper tools and the right data are essential for effective deal sourcing. In March, Mergers & Acquisitions published an article that illustrated this concept with Michael Lewis’ book, Moneyball: The Art of Winning an Unfair Game. The book details how the Oakland Athletics baseball team successfully used statistics and analytics to their advantage. The same can be done in the world of deal sourcing.

In today's middle market, the focus is always on the next deal. Maintaining and increasing deal flow in this competitive environment is difficult, but using data to find new targets is an easy win for middle market lenders. AdvantageData provides the tools to source and analyze opportunities in the credit market. Download our Restructuring Deal Sourcing PDF to learn more.

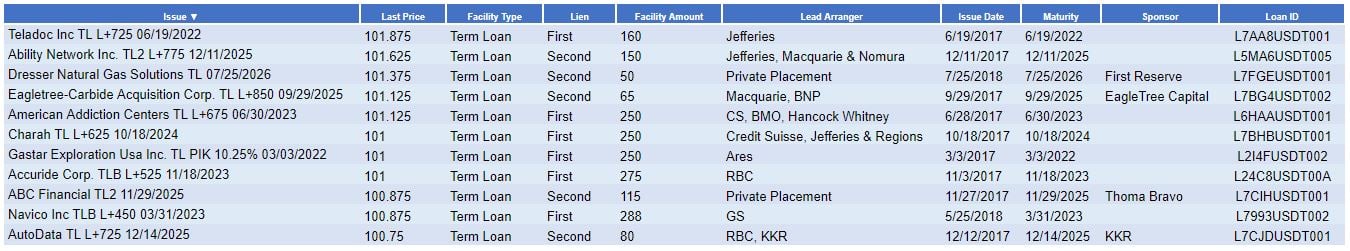

With ADI, users can find deals ready for refi or add-ons quickly and easy. Find loans with upcoming calls or maturities all within your specific investment mandates. Below a small example of loans with calls falling off soon that are valued above par. AdvantageData has hundreds of these deals with calls upcoming just in the next few months.

Do you want access to hundreds of potential middle market deals? Sign up for a demo and get free access to the AdvantageData workstation today. Let us show you how ADI can source your next middle market deal.

Do you want access to hundreds of potential middle market deals? Sign up for a demo and get free access to the AdvantageData workstation today. Let us show you how ADI can source your next middle market deal.

ADI is a powerful business intelligence and prospecting tool for the credit space. Quickly screen for details around pricing, leverage and other lender data for Middle Market companies; easily create precedent debt transaction comps, screen for distressed and maturing refi opportunities for further business development, and more.

.png)