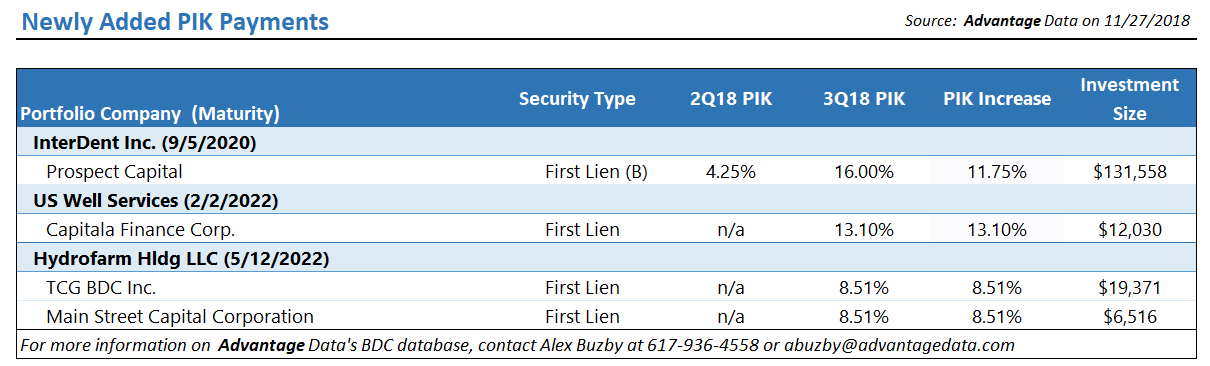

Analyzing PIK and Coupon Spread changes can be a great way to identify middle market companies that are beginning to feel pressure from lenders. Whether you're sourcing investments, consulting distressed borrowers or analyzing BDCs, utilizing alternative signs of distress as leading indicators is a great way to get ahead of the market - Download the data sample below!

One Step Ahead: Identifying Distress In The Middle Market

Topics: Middle Market, BDC, Spreads, First Lien, Distressed Investments, debt, business development company, Distress, Distressed Debt, Finance, Restructuring, Fixed Income, download

Many reports are claiming the death of Sears, but is it really dead or just dead as we knew it?

Sears started life in 1892 as a mail-order catalog that sold watches and jewelry. In 1894 the Sears, Roebuck and Company catalog had grown to 322 pages and included sewing machines, bicycles, sporting goods, automobiles and other new items. In the following years the catalog would eclipse 500 pages and adding dolls, stoves and groceries.

Topics: Loans, bonds, Distressed Debt, Restructuring, sears, News, default, bankruptcy

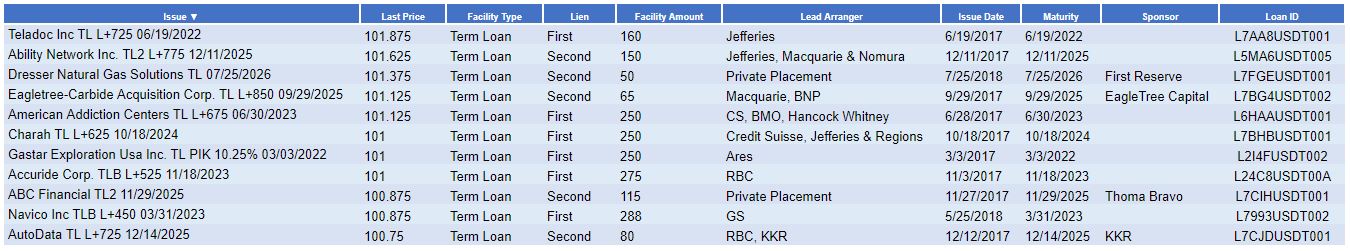

The Middle Market Loans Advantage: The Tools and Data to Source Your Next Deal

An effective deal sourcing process is crucial to successful investing. Deal sourcing involves generating leads and managing relationships with intermediaries. Strategies for deal sourcing vary among firms. Some firms prefer to employ specialist teams while others prefer using in-house resources.

Regardless of a firm’s strategy, access to the proper tools and the right data are essential for effective deal sourcing. In March, Mergers & Acquisitions published an article that illustrated this concept with Michael Lewis’ book, Moneyball: The Art of Winning an Unfair Game. The book details how the Oakland Athletics baseball team successfully used statistics and analytics to their advantage. The same can be done in the world of deal sourcing.

Topics: Middle Market, Analytics, market analytics, Distressed Debt, Finance, Restructuring, Fixed Income

A quarter over quarter coupon spread increase can be an early warning sign for investors and restructuring advisors that the issuer may be facing financial troubles.

What do we mean by “coupon spread increase”? First, the coupon is simply the annual interest payment paid by the issuer relative to the loan or bond's face or par value. Coupon spreads compare the interest rate differential between two loans or bonds. Say the coupon rate is 5% in the first quarter of the year, and then changes to 7% the next quarter. This would cause a coupon spread increase between it and the coupon of a comparable loan or bond. [source]

An increased coupon spread from one quarter to another is an indicator that something happened – it does not mean there is imminent risk of default. If a company does not meet its obligation to its lenders, it may be required to take some sort of action to make good on its promises of repayment or otherwise remain in good faith. One such action could be an increase of the coupon payment.

Topics: Loans, BDC, Distressed Debt, Restructuring, download

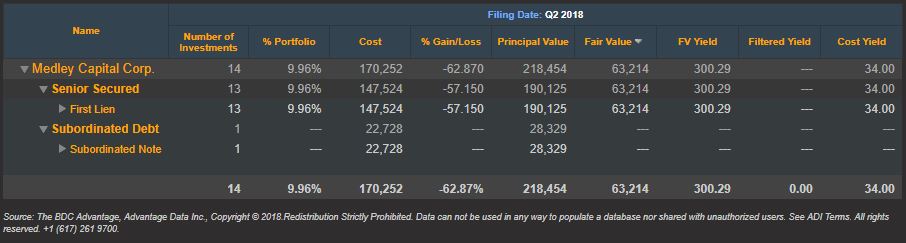

Q2 2018 BDC Non-Accruals: Medley Capital Corp No Longer Worst Performer

Last month we shared a list of the top 10 BDC non-accruals based on first quarter 2018 SEC filings. Now that we are mid-way through August and second quarter filings are readily available, let’s take a fresh look at the first quarter’s worst performer.

Topics: BDC, First Lien, Non-accruals, Distressed Debt, Restructuring, Second Lien, Loan Default Rate, BDC Filings, Default Rate, Fixed Income, fair value, portfolio, download, News

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)