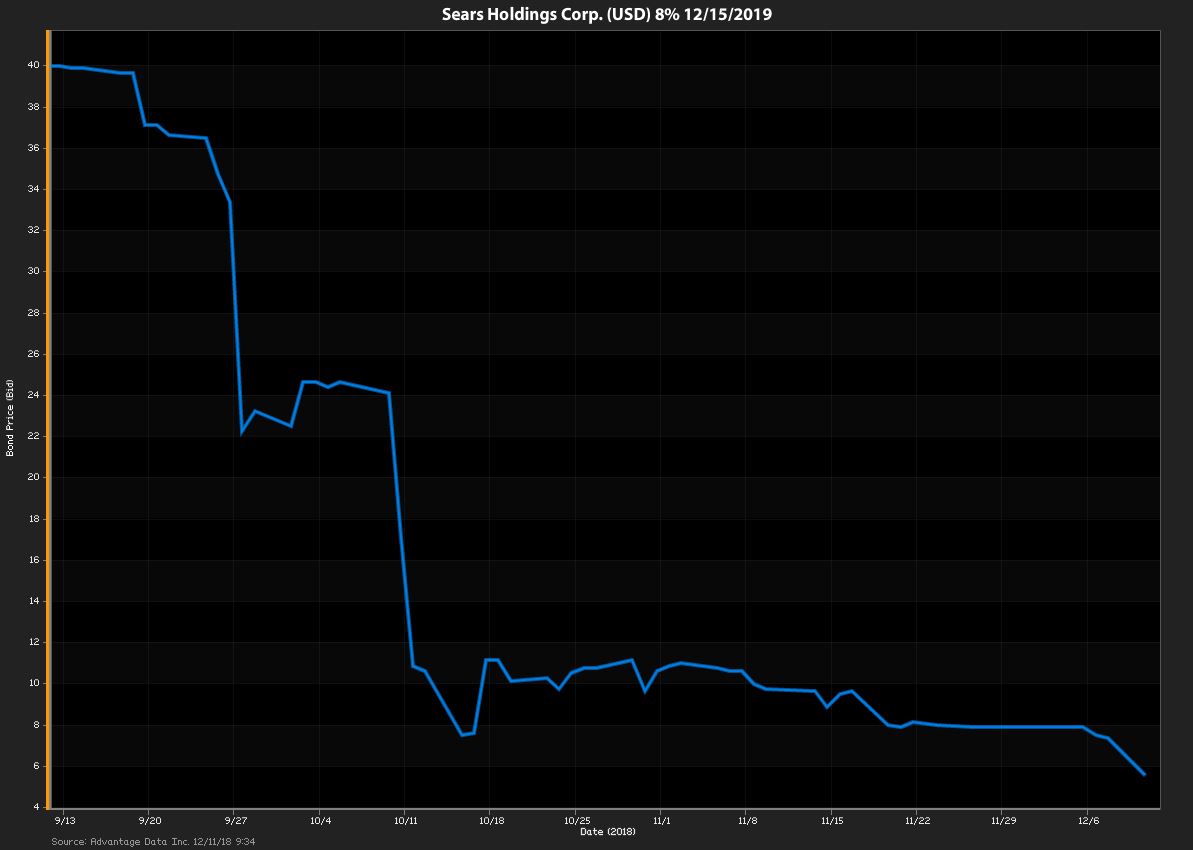

Sears CEO, Edward Lampert stands to lose a fortune if SEARS Holdings Corp. goes under. Analysts increasingly predict that will indeed be the case.

Sears CEO Places Hail Mary Bid to Save Company, And His Wallet

Topics: High Yield, bonds, Losers, Restructuring, sears, Fixed Income, News, bankruptcy

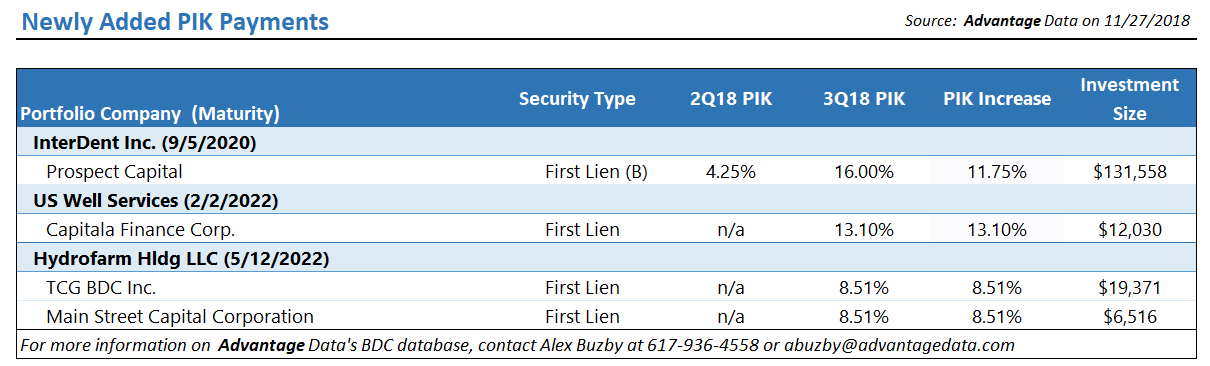

One Step Ahead: Identifying Distress In The Middle Market

Analyzing PIK and Coupon Spread changes can be a great way to identify middle market companies that are beginning to feel pressure from lenders. Whether you're sourcing investments, consulting distressed borrowers or analyzing BDCs, utilizing alternative signs of distress as leading indicators is a great way to get ahead of the market - Download the data sample below!

Topics: Middle Market, BDC, Spreads, First Lien, Distressed Investments, debt, business development company, Distress, Distressed Debt, Finance, Restructuring, Fixed Income, download

Many reports are claiming the death of Sears, but is it really dead or just dead as we knew it?

Sears started life in 1892 as a mail-order catalog that sold watches and jewelry. In 1894 the Sears, Roebuck and Company catalog had grown to 322 pages and included sewing machines, bicycles, sporting goods, automobiles and other new items. In the following years the catalog would eclipse 500 pages and adding dolls, stoves and groceries.

Topics: Loans, bonds, Distressed Debt, Restructuring, sears, News, default, bankruptcy

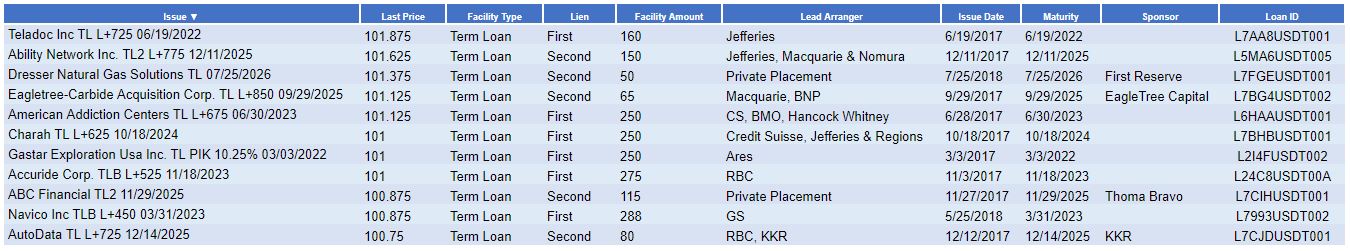

The Middle Market Loan Advantage: A Look Behind The Curtain

[Transcribed from video]

Introducing the Middle Market Loan Advantage. The newest edition to AdvantageData’s suite of credit data products. The Middle Market Loan Advantage complements our syndicated loan and BDC Advantage modules. With [~4500**] middle market loans, the Middle Market Loan Advantage shines a bright light on this opaque market.

How do we do it? AdvantageData aggregates information from news sources, trading desks, buy and sell-side filings, and more.

Topics: Loans, Middle Market, Analytics, BDC, business development company, Valuation, Restructuring, Direct Lending, Investment Banks, Syndicated Bonds

The Middle Market Loans Advantage: The Tools and Data to Source Your Next Deal

An effective deal sourcing process is crucial to successful investing. Deal sourcing involves generating leads and managing relationships with intermediaries. Strategies for deal sourcing vary among firms. Some firms prefer to employ specialist teams while others prefer using in-house resources.

Regardless of a firm’s strategy, access to the proper tools and the right data are essential for effective deal sourcing. In March, Mergers & Acquisitions published an article that illustrated this concept with Michael Lewis’ book, Moneyball: The Art of Winning an Unfair Game. The book details how the Oakland Athletics baseball team successfully used statistics and analytics to their advantage. The same can be done in the world of deal sourcing.

Topics: Middle Market, Analytics, market analytics, Distressed Debt, Finance, Restructuring, Fixed Income

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)