JUNK BONDS HELD AN EDGE, narrowly outpacing investment-grade debt in net price gains linked to actual trades.

Risk-taking remained largely muted nonetheless, as the pan-European

Stoxx 600 vacillated to the shallow red amid

pressure in the European auto sector. Allegations of misconduct aimed at several European carmakers from

Volkswagen AG sent shares of

Daimler AG,

BMW AG, and

VW down between 1.5% and 2.5%, impacting trading in related junk bonds. A

floor on losses in commodities was maintained, however, as

crude oil prices oscillated higher amid pledges of lower output from Saudi Arabia and Nigeria.

Michael F. Brown

Recent Posts

0 Comments Click here to read/write comments

SENTIMENT BECAME MORE RISK-AVERSE, as European junk bonds lagged investment-grade debt in net price gains linked to actual trades. A

jump in the euro followed news today of

fresh setbacks in President Donald Trump's agenda amid fading hopes for passage of a new healthcare bill. Further conspiring to keep pressure on European risk assets were a sharp 15.7% pullback in

Ericsson AB shares, while

a bout of profit-taking impacted recent gains in the financials and materials groups.

0 Comments Click here to read/write comments

JUNK BONDS LAGGED INVESTMENT-GRADE NAMES in European trading, as global investors perceived a less hawkish Janet Yellen 'across the pond'. Indications from Federal Reserve Chair Yellen that

rate increases will maintain a gradual clip sent a spectrum of European equities higher, while global bond yields fell. A

rally in oil prices on a bigger-than-expected drop in U.S. crude-oil inventories bolstered the oil-and-energy group, while upbeat sales by

Burberry Group PLC sent luxury firms higher, lending additional sector cues to corporate-bond traders.

0 Comments Click here to read/write comments

'RISK-ON' BIAS PREDOMINATED - ALTHOUGH MODESTLY, keeping junk bonds with an overall margin over investment-grade debt, in net price gains linked to trades.

Statements from Mario Draghi viewed as hawkish made up an important element in the mix, as the

euro stepped higher. However pressure in the auto sector, sending

Fiat Chrysler NV shares off 1.2%, and a 2.3% pullback in

Deutsche Telekom AG, kept a lid on overall gains in risk assets.

0 Comments Click here to read/write comments

A DOWNSHIFT IN OIL PRICES WEIGHED on risk-taking, keeping European junk bonds under pressure. Although

Nymex oil at $43 kept a lid on gains in high-yield bonds, they maintained a modest edge over investment-grade debt. The oil prices took a

toll on energy and mining securities, as

Royal Dutch Shell PLC and

BP PLC shares both tanked between 1.5% and 2%. The European banking sector also felt pressure on the heels of charges of

Barclays Inc. misconduct linked to Qatar, sending the bank's shares down 1.9%.

0 Comments Click here to read/write comments

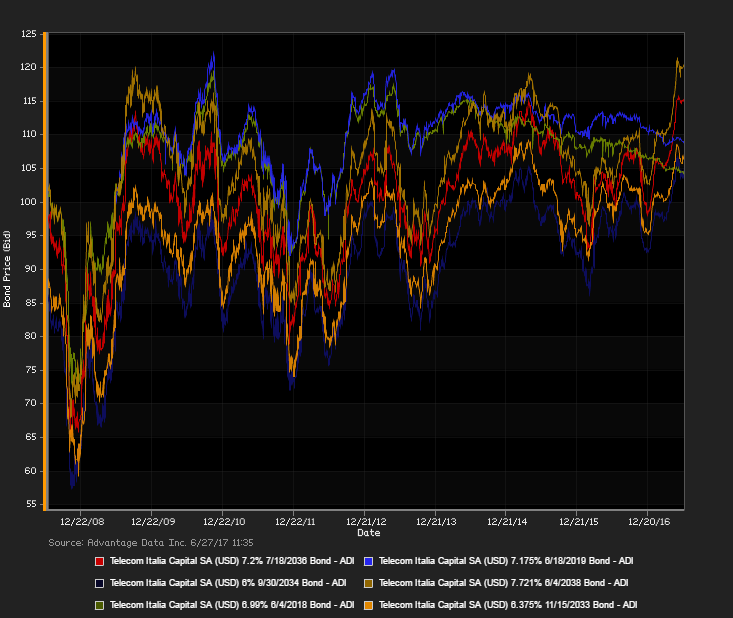

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)