Recent Posts

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

TODAY MARKED THE END OF A STRONG WEEK for US stocks, after news of a potential federal interest rate cut boosted investors’ sentiment. Federal Reserve chairman Jerome Powell hasn’t set any parameters on the cut, but analysts are predicting it will be more than 25 basis points. The next monetary policy committee meeting will be held on July 31st. 10-Year Treasury note yields rose 3.5 basis pointstoday, after dipping below 2% yesterday. S&P -0.13%, DOW -0.13%, NASDAQ -0.24%.

| Key Gainers and Losers | Volume Leaders | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Tyson Foods Inc. 5.1% 9/28/2048 Comcast Corp. 4.7% 10/15/2048 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | New Issues [Continued] |

|---|---|

| 1. Spirit Realty LP (USD) 4% 7/15/2029 (06/20/2019): 400MM Senior Unsecured Notes, Price at Issuance 99.924, Yielding 4.01%. 2. HCP Inc. (USD) 3.25% 7/15/2026 (06/20/2019): 650MM Senior Unsecured Notes, Price at Issuance 99.906, Yielding 3.26%. |

|

Additional Commentary

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Hertz Corp. (5Y Sen USD CR14) Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

San Miguel Corp. (5Y Sen USD CR14) Atmos Energy Corp. (5Y Sen USD MR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:

Deals recently freed for secondary trading, notable secondary activity:

- Vidrala SA, Hilton Worldwide Finance LLC, US Renal Care Inc., Perforce Software Inc.

- TED spread held below 22 bp (basis points), as of 06/21/19

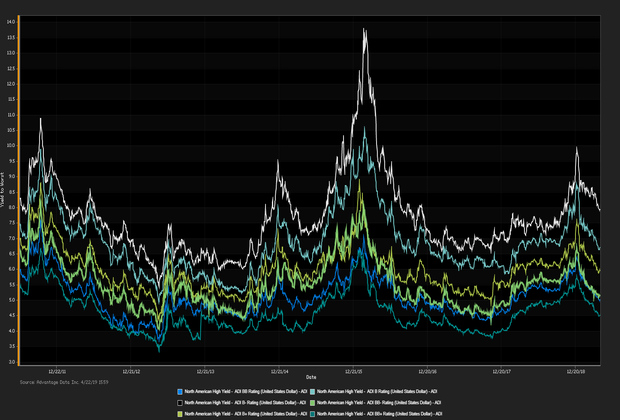

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

U.S. STOCKS DECLINED AGAIN WEDNESDAY as trade worries continued and more investors moved into government bonds. The Treasury yield curve has reached its deepest inversion since 2007, with the 3-month yield topping the 10-year by almost 10 basis points. Amidst the yield curve predicting economic downturn, all three major indices fell today. S&P -0.69%, DOW -0.87%, NASDAQ -0.79%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

U.S. STOCKS DECLINED WEDNESDAY after the Federal Reserve indicated it will hold off on an interest rate change. Voting member of the Fed James Bullard stated, “Rates are at a good place in the U.S. right now, if anything we are a little restrictive I would say”. The Fed was in agreement that the current policy can stay, but was split on whether it would change if the economy continues on its expected path. Combined with persisting tariff tensions, all three major indices fell today. S&P -0.28%, DOW -0.39%, NASDAQ -0.45%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

THE NASDAQ FELL SHARPLY MONDAY morning as U.S. tech companies cut off supplies to Chinese electronics manufacturer, Huawei Technologies. In compliance with a decision from the White House, chipmakers have halted business with Huawei until further notice. Amid the escalating trade tensions, all three major indices suffered losses, with the NASDAQ dropping 113 points. S&P -0.67%, Dow -0.33%, NASDAQ -1.46%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

U.S. STOCKS RECOVERED EARLY LOSSES on Friday as positive economic data weighs against trade concerns. News that China is hesitant to resume trade talks with the U.S. reinforced investors' concerns that tensions will persist. However, news that consumer sentiment is at a 15-year high bolstered stocks and stabilized U.S. treasury yields, with the 10-Year Note at 2.39%. S&P -0.58%, Dow -0.38%, NASDAQ -1.04%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)