Sourav Srimal

Global Head of Operations

BDC Filing season is almost over. This report will analyze BDCs that have filed in the last 3 weeks. Last week’s analysis is available here.

Aggregate Fair Value reported by BDCs that have filed in Q1 2019 is 104 Billion USD. BDCs have reported 36 Billion USD AUM in this week.

Read More

Topics:

BDC Index,

BDC,

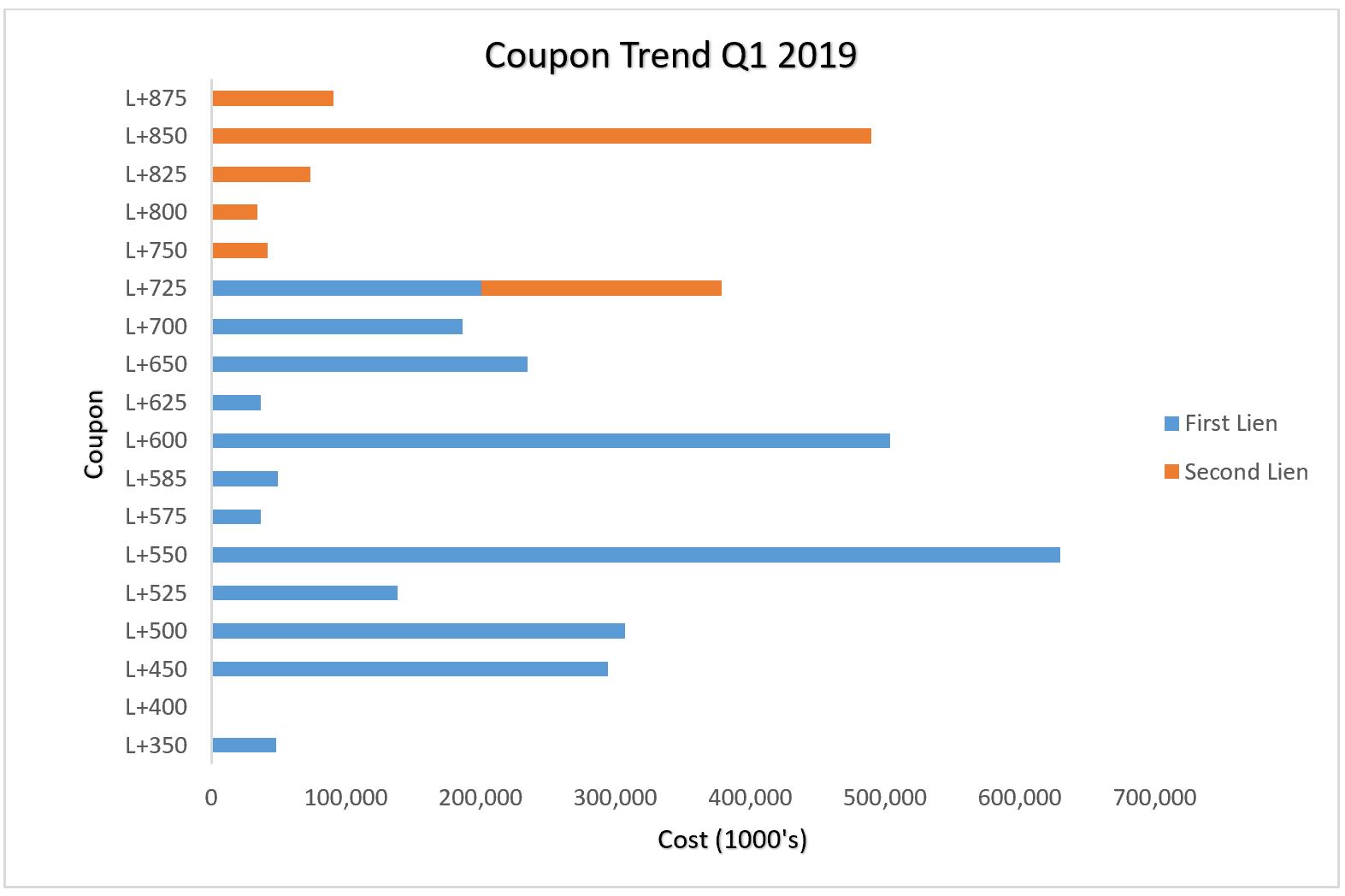

First Lien,

business development company,

Non-accruals,

New Issues,

Second Lien,

BDC Filings,

fair value

BDC Filing season is in full swing. This report will analyze BDCs that have filed in the last 2 weeks. Last week’s analysis is available here.

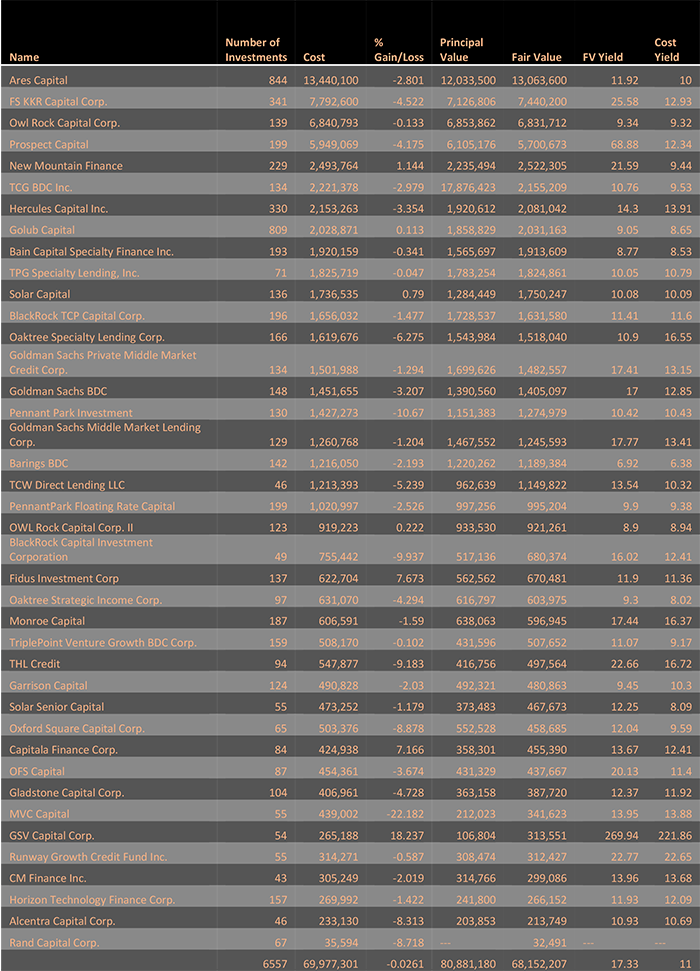

Aggregate Fair Value reported by BDCs that have filed in Q1 2019 is 68.1 Billion USD which is approximately 70% of aggregate AUM of all BDCs. BDCs have reported 48.8 Billion USD AUM in this week alone.

Read More

Topics:

Analytics,

BDC,

AUM,

market analytics,

business development company,

Non-accruals,

BDC Filings,

fair value,

market update,

top 5,

adds & exits

BDC Filing season is in full swing. This report will analyze nine BDCs that have filed this week. Aggregate Fair Value reported by these BDCs is 19.3 Billion USD which is approximately 20% of aggregate AUM of all BDCs.

Read More

Topics:

Analytics,

BDC,

AUM,

market analytics,

business development company,

Non-accruals,

BDC Filings,

fair value,

market update,

top 5,

adds & exits

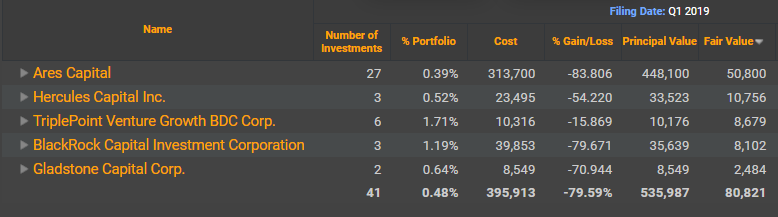

Top 5 Portfolio companies by Fair Value held by BDC’s account for 25 percent of aggregate BDC’s assets under management. Please click below to download List of Top 5 Portfolio Companies by Fair Value held by all BDCs.

Read More

Topics:

BDC,

business development company,

fair value,

portfolio

BDC filings are around the corner. See our Q2 2018 BDC earnings calendar below. Outsourcing your data collection efforts to AdvantageData provides your team with access to standardized #BDC data within 8 hours of filings. BCD Advantage empowers your team with the aggregated data they need. Leveraging filing information has never been easier.

BDC Advantage was developed in partnership with a group of BDCs seeking to outsource BDC data aggregation, direct lending analytics and loan pricing across the thousands of US middle market companies currently held as portfolio companies. AdvantageData provides unmatched insight into the BDC space by leveraging tools perfected through over 20 years of serving the sell-side but using data specific to the BDC and private credit space. See why BDCs, direct lenders, BDC analysts and investors all use AdvantageData.

Read More

Topics:

Loans,

BDC,

earnings,

BDC Filings,

Fixed Income

.png)