The leveraged loan market last week continued to build on trends that became evident two weeks prior, with more issuers winning aggressive terms and pricing, and an environment firming for the renewal of opportunistic business.

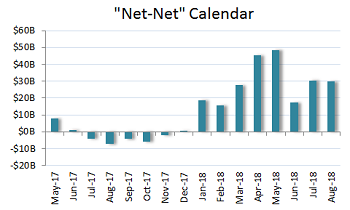

Significantly, while last week’s gross launched volume was roughly in line with the prior week’s tally, at $11 billion, opportunistic volume accounted for $4.3 billion, all of it involving repricing. Moreover, net launched volume ebbed to just $4 billion, exacerbating fears that accounts won’t have much new paper in which to invest after the big September rush slows.

.png)