Corey Mahoney

Recent Posts

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

US INVESTMENT GRADE DEBT ROSE AGAINST JUNK BONDS in net prices linked to actual trades after the European Central Bank President Mario Draghi announced the possibility of more stimulus if inflation stays low. US Treasury prices rallied for the second day as the Fed kicks off its two-day meeting. The 10-year note dipped 3.2 basis points. S&P +0.98%, DOW +1.36, NASDAQ +1.42%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

ATTENTION WILL FOCUS ON THE FED’S two-day meeting this week concluding with a monetary policy statement on Wednesday. A recent survey indicated 40 percent of economists polled expect the Fed to ease economic policy next month. Over the past 30 days, the 10-year note fell 45 basis points following tariff uncertainties and slowing economic data. The 10-year note held steady losing 0.4 basis points. Gold slips from 14-month highs, however, continues to see significant inflows as investors flee to the safe-haven asset. S&P +0.16%, DOW +0.15, NASDAQ +0.69%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

STOCKS INITIALLY FELL ON FRIDAY following weak industrial growth from China surprising investors reporting a 17-year low. “The China data certainly is far-reaching, impacting not only China but global markets as well.” Investors will keep a keen eye on the Feds meeting next week speculating on a rate cut. The 10-year note lost 0.1 basis points. Equities recovered in the afternoon from China's disappointing data, S&P +0.03%, DOW +0.14, NASDAQ -0.28%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

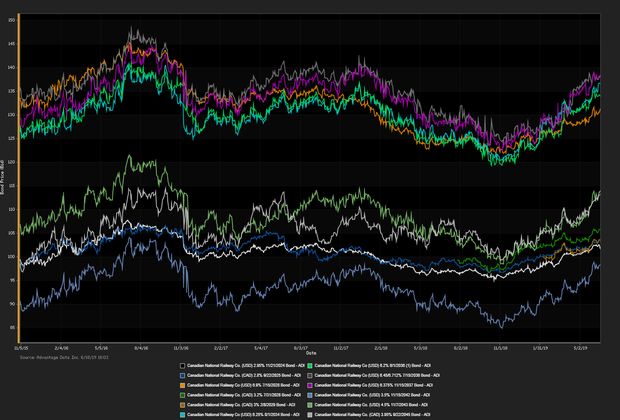

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)