Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

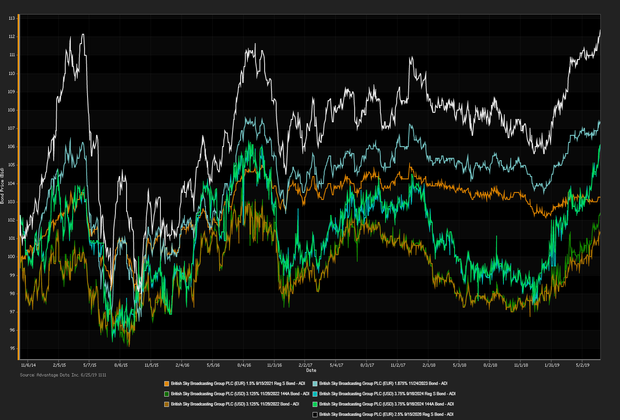

US TREASURY YIELDS SPIKE AS INVESTORS BECOME OPTIMISTIC a trade deal with China is likely to occur following the G20 summit in Japan. The trade spat is blamed for initiating a global growth slowdown and the Fed’s recent dovish tone suggesting aggressive rate cuts. The 10-year note spiked 5.7 basis points. S&P -0.01%, DOW +0.08, NASDAQ +0.41%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

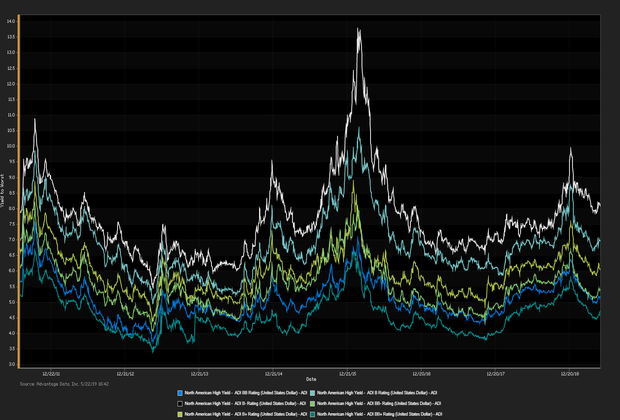

EQUITIES DRIFTED LOWER following an announcement from Federal Reserve President Jerome Powell stating “my colleagues and I are grappling with is whether these uncertainties will continue to weigh on the outlook and thus call for additional policy accommodation“. Currently Wall Street believes there is a 65.7 percent chance of a 25 basis point cut and a 35.4 percent chance of a 50 basis point cut. The 10-year note fell 2.8 basis points settling below 2 percent. S&P -0.95%, DOW -0.67, NASDAQ -1.51%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

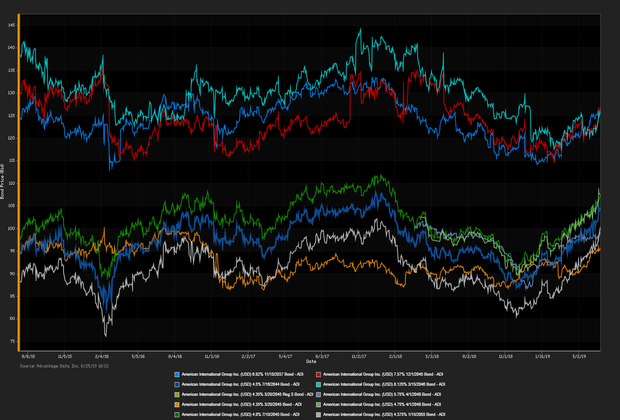

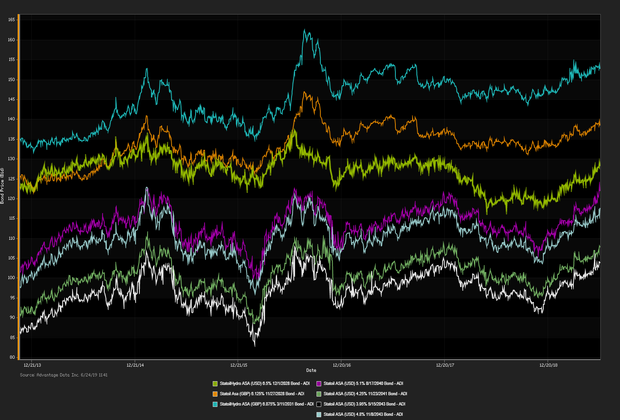

INVESTMENT-GRADE DEBT ROSE SIGNIFICANTLY AGAINST JUNK BONDS in net prices linked to actual trades. Gold prices breached six-year highs settling above $1,400 an ounce following the Fed’s dovish tone after last week’s meeting. The 10-year note fell 3.9 basis points. S&P -0.09%, DOW +0.12, NASDAQ -0.23%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)