U.S. STOCKS DECLINED AGAIN WEDNESDAY as trade worries continued and more investors moved into government bonds. The Treasury yield curve has reached its deepest inversion since 2007, with the 3-month yield topping the 10-year by almost 10 basis points. Amidst the yield curve predicting economic downturn, all three major indices fell today. S&P -0.69%, DOW -0.87%, NASDAQ -0.79%.

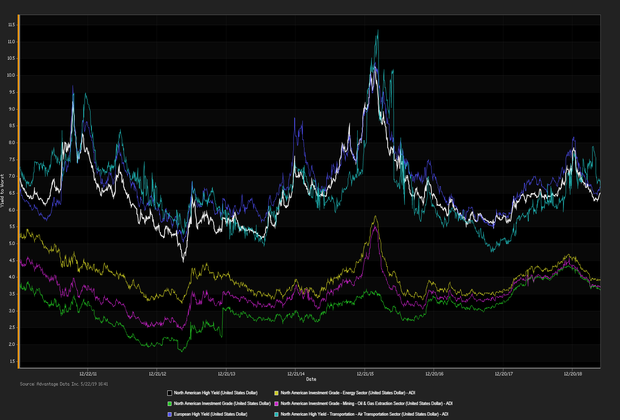

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

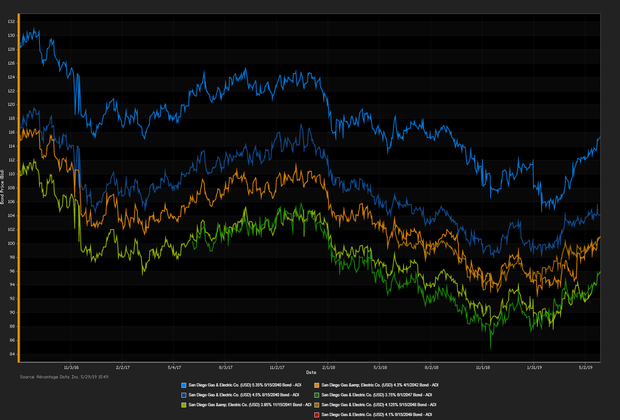

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

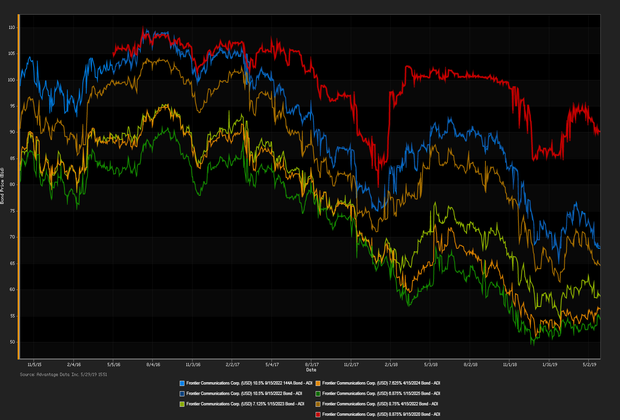

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

INVESTMENT GRADE BONDS ROSE AGAINST HIGH YIELDING DEBT in net prices linked to actual trades. The 10-year note lost 6.4 basis points settling at its lowest since October 2017. Equities settled lower and gave up gains following the threat of a trade war escalation with China. S&P -0.85%, DOW-0.93%, NASDAQ -0.39%.

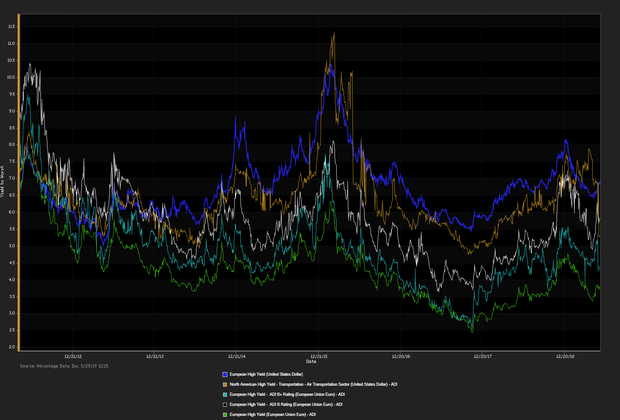

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

RISK-OFF SENTIMENT PREVAILED as investment grade debt rose against junk bonds in net prices linked to actual trades. Jobless claims fell to a seasonally adjusted 211,000 claims surpassing expectations; managers continue to struggle with employee retention and sourcing skilled labor. In other economic news, new home sales declined across the country in all regions except the Northeast sinking 6.9 percent. The 10-year note plunged 7 basis points settling near 18-month lows. S&P -1.19%,DOW -1.11%, NASDAQ -1.58%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

U.S. STOCKS DECLINED WEDNESDAY after the Federal Reserve indicated it will hold off on an interest rate change. Voting member of the Fed James Bullard stated, “Rates are at a good place in the U.S. right now, if anything we are a little restrictive I would say”. The Fed was in agreement that the current policy can stay, but was split on whether it would change if the economy continues on its expected path. Combined with persisting tariff tensions, all three major indices fell today. S&P -0.28%, DOW -0.39%, NASDAQ -0.45%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)