Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

MANUFACTURING IN MAY EXPANDED AT ITS SLOWEST RATE in over two years slipping to 52.1 from 52.8 from April. The sentiment downturn is linked to recent trade threats made by the White House and indications pointing to a slowing global economy. The sector is also being hindered by responses from countries following increased tariffs from the US. The 10-year note further fell 5.6 basis points. S&P-0.61%, DOW -0.30%, NASDAQ -1.97%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

SAFE-HAVEN ASSETS SOARED WHILE EQUITIES TUMBLED ON FRIDAY following the White House announcing tariffs on Mexican goods. The 10-year note plummeted 8.2 basis points, shedding 18 basis points this past week slipping to 20-month lows. JPMorgan predicts there will be two interest rate cuts by the end of the year given the new tariff threats. S&P -1.32%, DOW +1.41, NASDAQ -1.51%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

REVISED GDP DATA REVEALED THE ECONOMY GREW SLOWER THAN EXPECTED in the first quarter of 2019 due to reduced business investment and a decline in corporate profits. Consumer spending overall remained stagnant with one exception, spending on durable goods sank 4.6 percent. Pending home sales fell marking the 16th straight month of annual declines as the 30-year mortgage fixed rate mortgage dipped below 4 percent. The 10-year note dipped 5.5 basis points.S&P+0.21%,DOW+0.17%, NASDAQ+0.27%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

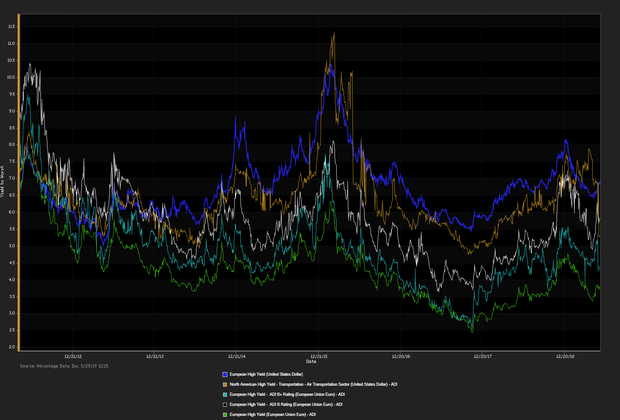

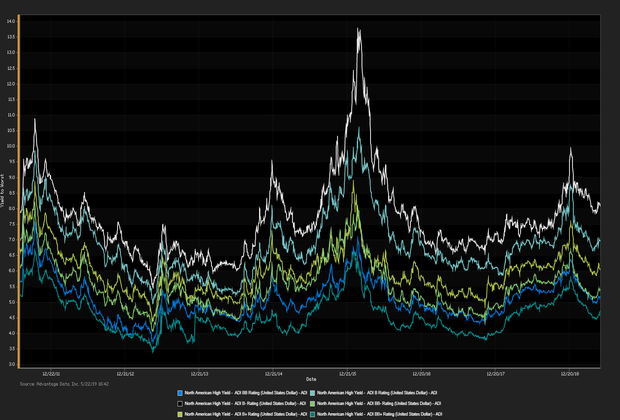

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)