On Monday, President Trump criticized the Fed for even considering raising rates, yet on Wednesday the Federal Open Market Committee announced its decision to raise the Fed Funds rate ¼ of a percent from 2.25% to 2.5% -- the fourth such increase in 2018.

Fed announces fourth rate hike of 2018, markets react

Topics: High Yield, Analytics, bonds, junk bonds, market analytics, New Issues, Finance, Equity, Fixed Income, News

LBOs to take out Elo Touch, Latham Pool debt held by BDVC, FSIC, GARS

Arrangers pressed forward with some of the final new-issue loans of 2018 last week, but it’s an open question as to how much enthusiasm remains among buysiders that have been buffeted by volatility in recent weeks. The recent downdraft has repriced the primary market, and issuers are seeking to address the issue with yield—and not just on dicier transactions.Meanwhile, high-yield’s heartbeat barely registered with a single $350 million print and a murky outlook on further deal flow as the loan market continued to dominate the waning supply in the final weeks of 2018.

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Fixed Income, LevFin Insights, News

BDC Preview: Week Of December 3 – December 7, 2018

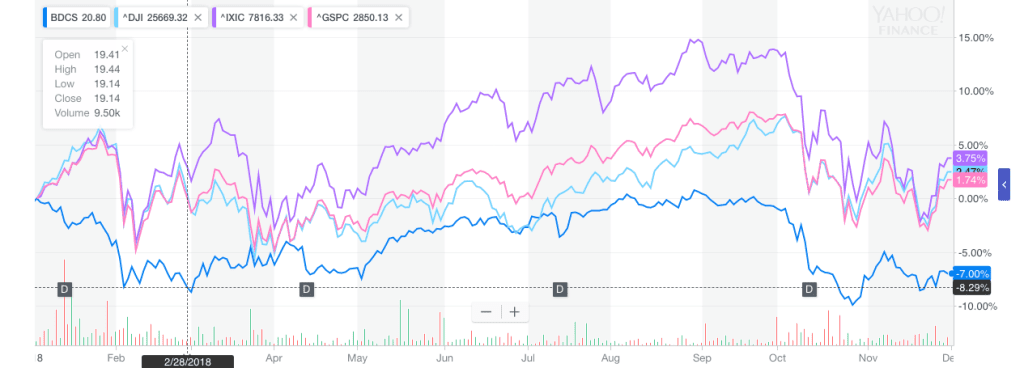

Back In Sync: As we expected, in the week ended November 30, 2018 the BDC common stock and the broader indices adjusted to get more in sync. The major markets raced ahead, while the BDC sector – which had performed better the week before – followed behind, up 0.62% in price terms. As this 2018 year-to-date chart comparing BDCS to the Dow Jones, NASDAQ and the S&P 500 shows all four have followed a similar shape even if there are short term divergences. If you adjust for the fact that the BDC sector pays out much higher distributions, even the total return is highly similar.

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Fixed Income, News, bdc reporter

BDC Preview: Week Of November 26 – November 30, 2018

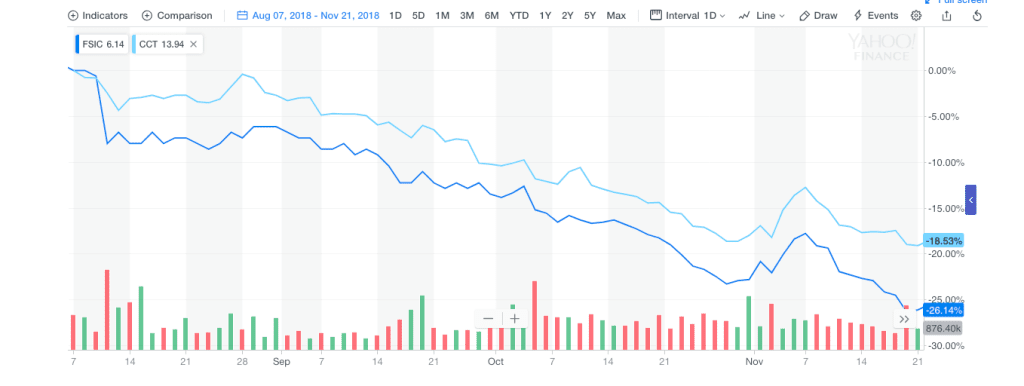

Market Mayhem: As we discussed at length already in our premium BDC Common Stocks Market Recap, last week was surprising as the BDC sector – and many individual BDCs – fared much better than the main indices and all the main categories from investment grade to “junk”. However, we’d be very surprised if the BDC sector can continue to remain uncorrelated with the broader markets for very much longer. As this chart below shows – comparing the price progress of the Exchange Traded Fund SPY, which is based on the S&P 500, and the exchange traded note with the ticker BDCS,which reflect the BDC sector – the two have moved pretty much in tandem since the decline began in the markets on September 20.

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Finance, Fixed Income, News, bdc reporter

Repricings at Avantor and MRO to reduce yield on credits held by CCT, BDVC, OCSI, BBDC, CION and Flat Rock

Editor’s note: Due to the Thanksgiving holiday, LFI BDC Portfolio News will not publish on Monday, Nov. 26. The report will resume publication on Monday, Dec. 3.

Download: LFI BDC Portfolio News 11-19-18

The tone in the broader leveraged loan market deteriorated as last week progressed, complicated by a handful of high-profile earnings misses that came in as the traditional 45-day reporting period trailed off and the jumbo LifePoint Health deal that quickly faded in the secondary loan and bond markets despite a host of investor-friendly revisions. In many cases, price talk and structure are deeply in flux, and investors are increasingly skittish amid poor secondary performance as the list of recently issued loans bid below their OIDs grows.

Topics: Middle Market, Analytics, BDC, market analytics, business development company, Fixed Income, LevFin Insights, News

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)