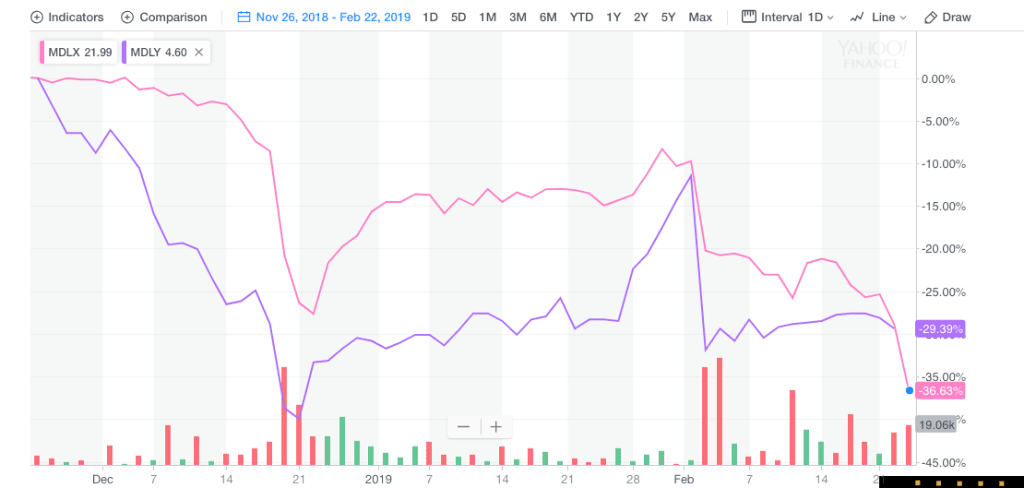

A very busy week ahead for BDC investors including fast moving prices; eleven new earnings releases and the vote on whether Medley Capital will merge into Sierra Income. We pledge to keep readers updated as a critical week unfolds.

Markets: Given that last week the BDC sector – as measured by the Wells Fargo BDC Index and the price of the UBS Exchange Traded Note with the ticker BDCS – dropped every day, the direction of the market will be a critical factor. Last week’s pullback occurred while the broader markets continued to rise and other forms of non investment grade credit remained strong, begging the question as to whether this was just a short term pause in a continuing rally or a turning point, and prices will be down from here. As we’ll discuss in greater detail below, BDC earnings season is still in process, and individual fund results may influence sector performance. By mid-month, though, all the latest quarterly updates will be in and investors will have positioned themselves. We’ll be keeping track not only of BDCS and the Wells Fargo BDC Index but of the trends amidst the 45 different public BDCs we track. Last week, 42 dropped in price and 20 are now trading at a price below that of 4 weeks ago in the very midst of the rally. If that proportion of underwater stocks rises, or we see an uptick in BDCs trading within 5% or even 10% of their 52 week lows (the current numbers are zero and one respectively) we’ll be worried that the rally that began December 24, 2018 has run its course. On the other hand, if BDCS breaks through the August 30, 2018 high of $21.03, we’ll know that this rally lives and has broken through a critical threshold. For reference, as of Friday, BDCS was at $19.73.

.png)