Macro economic factors — tariffs on Chinese goods, political unrest in Hong Kong and Brexit among them — have returned volatility to capital markets, however direct lending has plowed onward with few upsets.

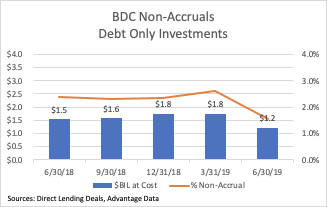

BDC portfolios show little pain in non-accruals for 2Q19, steady ahead

Topics: BDC, debt, business development company, Non-accruals, portfolio, Direct Lending, underperformers, Direct Lending Deals

BDC Common Stocks Market Recap: Week Ended August 30, 2019

BDC COMMON STOCKS

Denial

This was the week that the major markets decided not to worry so much about tariffs; global economic slowdown and the threat of war or military intervention just about everywhere.

As a result, the S&P 500 increased 2.79% and the other key indices moved up as well.

Topics: Loans, Analytics, BDC, market analytics, business development company, News, bdc reporter, research

BDC Common Stocks Market Recap: Week Ended August 23, 2019

BDC COMMON STOCKS

Peculiar

This was a curious week for the broader markets – and for the BDC sector – pulled in different directions.

At the beginning of the week, the major indices were bouncing back from global economic concerns; tariffs troubles, etc.

However, then there was the end of week hardening of the Chinese and U.S. stance and stock market prices went to heck, and bond prices rose.

Just to provide a sense of context, the S&P 500 dropped (1.44%) on the week.

(By the way and just as an FYI, the index is now down 4 weeks in a row).

On Friday alone the S&P dropped (2.6%).

Topics: Loans, Analytics, BDC, market analytics, business development company, News, bdc reporter, research

BDC Common Stocks Market Recap: Week Ended August 16, 2019

BDC COMMON STOCKS

Up And Down And Across

The week ended August 16, 2019 was a volatile one for the broader markets.

The Dow Jones – by way of example – had its worst day of the year on August 14, 2019.

Yet, when the dust settled by week’s end, the S&P 500 was down “only” (1.03%).

Still, that 3 weeks in a row to the downside, off (4.59%).

Topics: Loans, Analytics, BDC, market analytics, business development company, News, bdc reporter, research

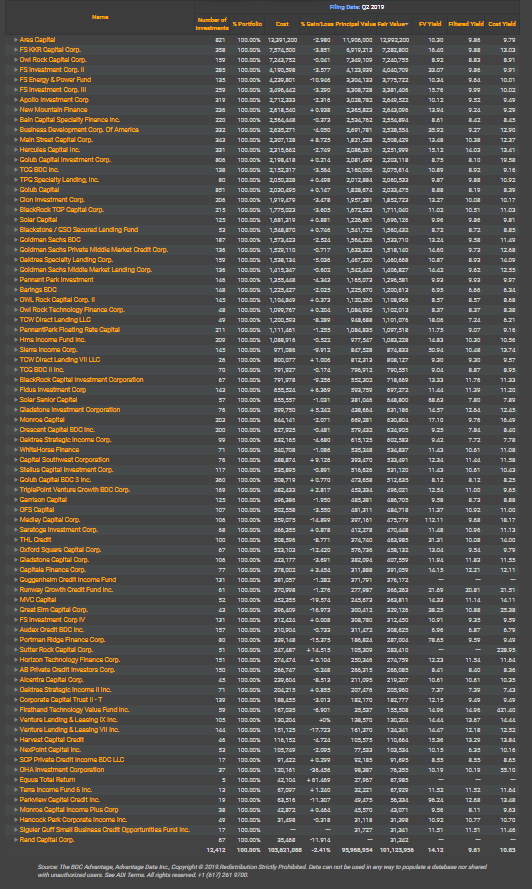

BDCs Filing season is in full swing. This report will utilize Advantage Data’s BDC workstation to analyze Q2 2019 filing data. As of Friday, August 16th, 2019 Aggregate Fair Value reported by BDCs that have filed in Q2 2019 is at 101.1 Billion USD (Fair Value) which is approximately 97% of aggregate AUM of all BDCs.

Topics: Analytics, BDC, AUM, market analytics, business development company, Non-accruals, BDC Filings, fair value, market update, top 5, adds & exits

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)