Harvest Partners went with Owl Rock Capital, Crescent Capital and Antares Capital last month for $945 million in unitranche financing in connection with the private equity firm’s minority growth investment in Integrity Marketing Group, a national life and health insurance broker.

Harvest Partners hit direct lending market for $945M unitranche loan at L+575 to support Integrity Marketing deal: Owl Rock, Crescent, Antares

Topics: Middle Market, BDC, debt, business development company, Non-accruals, portfolio, Direct Lending, underperformers, Direct Lending Deals

BDC Common Stocks Market Recap: Week Ended September 13, 2019

BDC COMMON STOCKS

Surprising

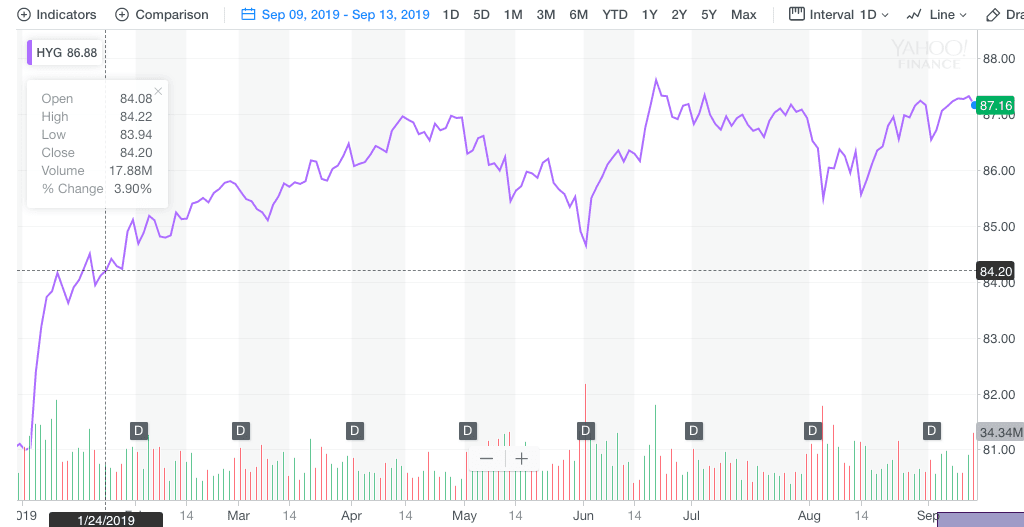

Notwithstanding the absence of any BDC sector news, prices continued to rise for a fourth week in a row.

As of September 13, 2019 the UBS Exchange Traded Note with contains most of the 46 public BDCs we track – and which has the ticker BDCS – closed at $20.08.

That was 1.75% higher than the week before.

Likewise, that other barometer of BDC price performance – the Wells Fargo BDC Index – reached 2,793.76.

BDCS is not at a record level, but the Wells Fargo measurement – which provides a “total return” – was again at a new year-to-date high for a second week in a row.

Topics: Loans, Analytics, BDC, market analytics, business development company, News, bdc reporter, research

With leveraged loan market back online, LBOs for CoAdvantage, Del Frisco’s, Waystar, OEConnection to take out BDC-held debt

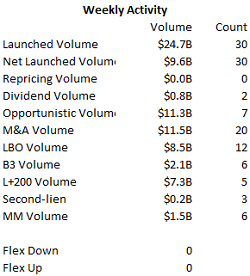

Both the leveraged loan and high-yield bond markets wasted no time getting back to business despite August’s tenuous market conditions, with issuers stepping forward last week with a mix of opportunistic and M&A-related transactions. Foreshadowing what is expected to be a busy September, the high-yield market saw its first drive-by execution on the Tuesday after Labor Day in seven years as issuers rushed to capitalize on the plunge in U.S. Treasury yields with heightened trade tension last month, even as it reversed course last week with one of the biggest one-day yield gains in three years.

Topics: High Yield, Analytics, BDC, market analytics, business development company, LevFin Insights, News, research

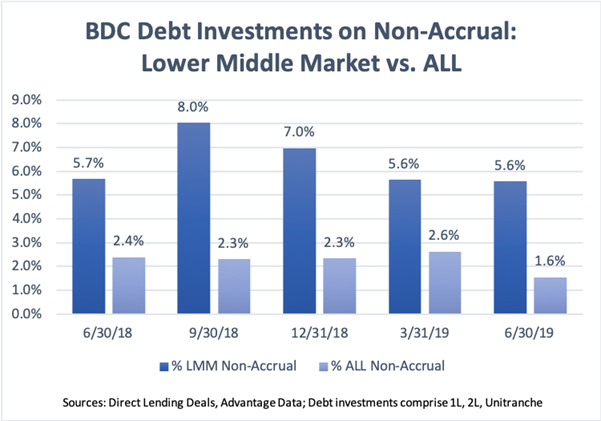

Non-Accruals PART II: What about lower middle market defaults? Higher, but even harder to assess

Last week’s look at BDC non-accruals showed an overall rate that still ran below historical norms, but what about the lower middle market? All BDCs invest in these names —that’s the nature of the business— but some drill down more than others.

Topics: BDC, debt, business development company, Non-accruals, portfolio, Direct Lending, underperformers, Direct Lending Deals

BDC Common Stocks Market Recap: Week Ended September 6, 2019

Becalmed

Topics: Loans, Analytics, BDC, market analytics, business development company, News, bdc reporter, research

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)