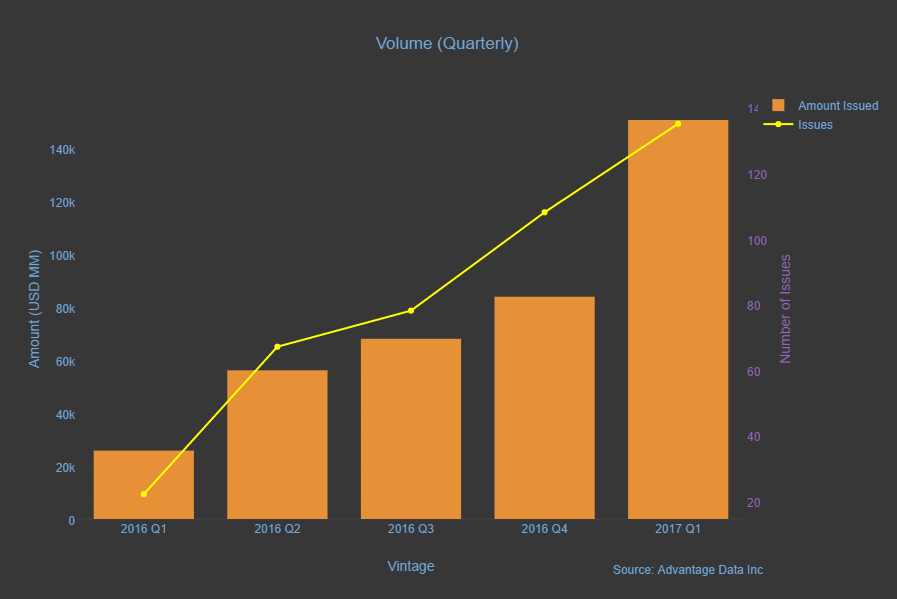

According to analysis on the loans tracked by AdvantageData, USD leveraged loan volume rated Ba3-Ba1 and B3-B1 continued its upward trajectory over the last 15 months topping out at $150.6 billion in Q1/17. This was due predominantly to first lien refinancings more than doubling in Q1/17 to $111.7 billion.

Recent Posts

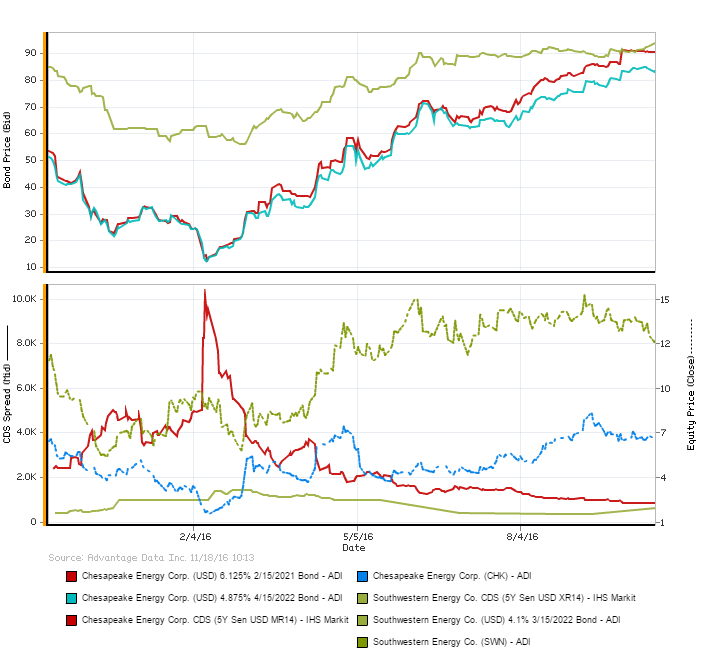

Divergence in Southwestern Energy and Chesapeake Energy bond and equity prices hit a high in Q1 2016 with the spike in Chesapeake 5 Year Senior USD MR14 CDS spread. Thereafter and through to present, equity prices remain divergent while bond prices converge.

Topics: credit default swaps, energy, CDS

Analysis: Q2 2016 vs. Q1 2016 Distressed BDC Investments

Looking at $80 billion of FV AUM for 76 BDCs at Q2 2016, with the exception of internally managed BDCs, we see reductions in distressed assets (90% of par or less) across the board, whether looking at size of BDC, externally managed BDCs or senior secured and non senior investments. Internally managed BDCs saw an increase in distressed assets as a percentage of portfolio of 0.2% vs. a decrease of 2.7% for all BDC's and a 3.1% decrease for externally managed BDC's.

Topics: BDC, Distressed Investments

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)