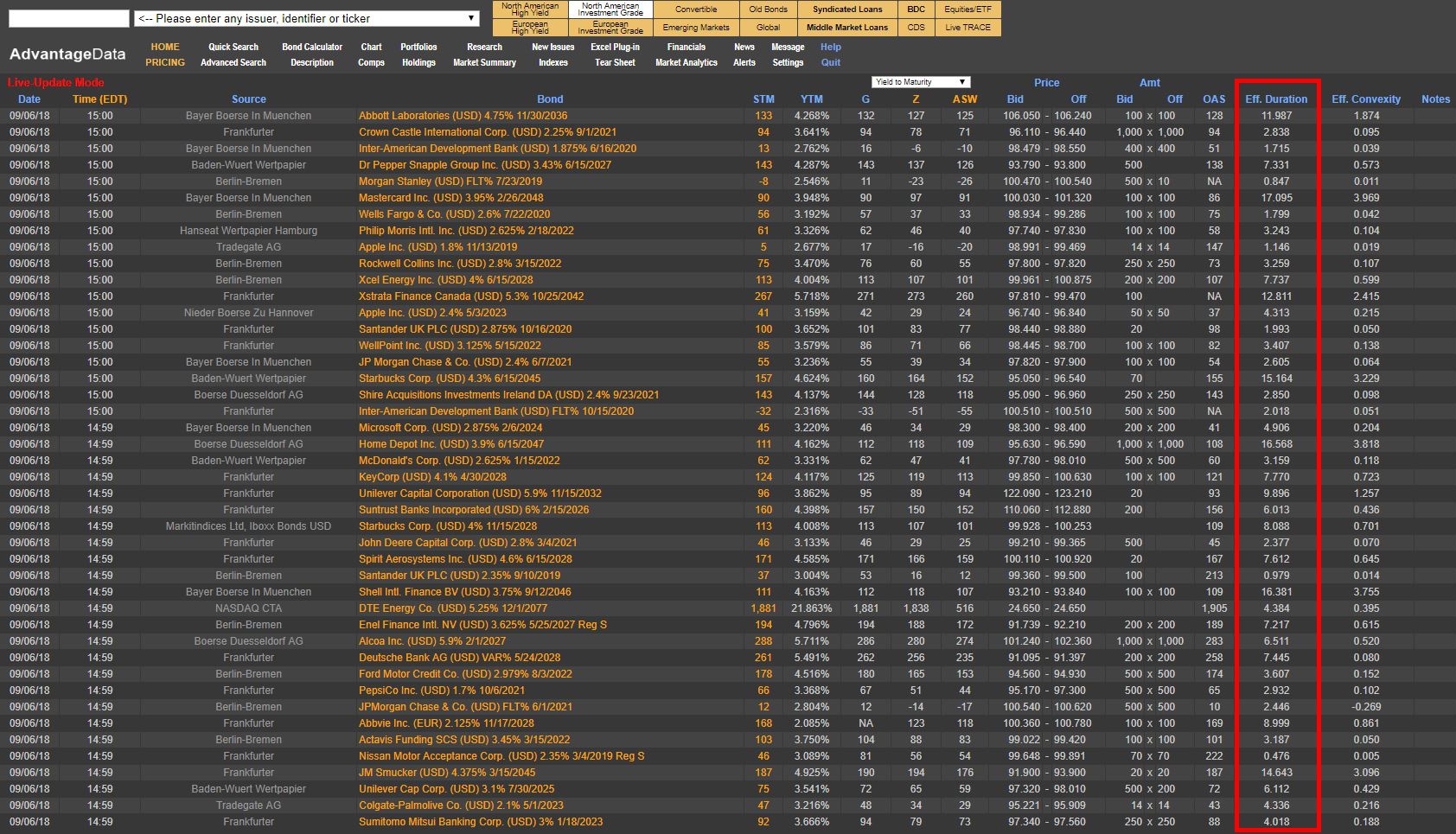

Duration risk has been a popular theme around buy-side firms as they look to incorporate low duration bonds into model portfolios to reduce interest rate sensitivity and increase liquidity. Typical bond indexes have an average duration of 5-7 years; this will create large outflow of assets in the upcoming quarters and increase popularity among individual securities.

Duration Risk: The Relationship Between Bond Prices and Interest Rates

Posted by

David Diggins on Sep 6, 2018 3:30:33 PM

0 Comments Click here to read/write comments

Topics: Investment Grade, Analytics, bonds, Bonds Maturing, bond market, market analytics, Fixed Income, portfolio, interest rate, duration risk

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)