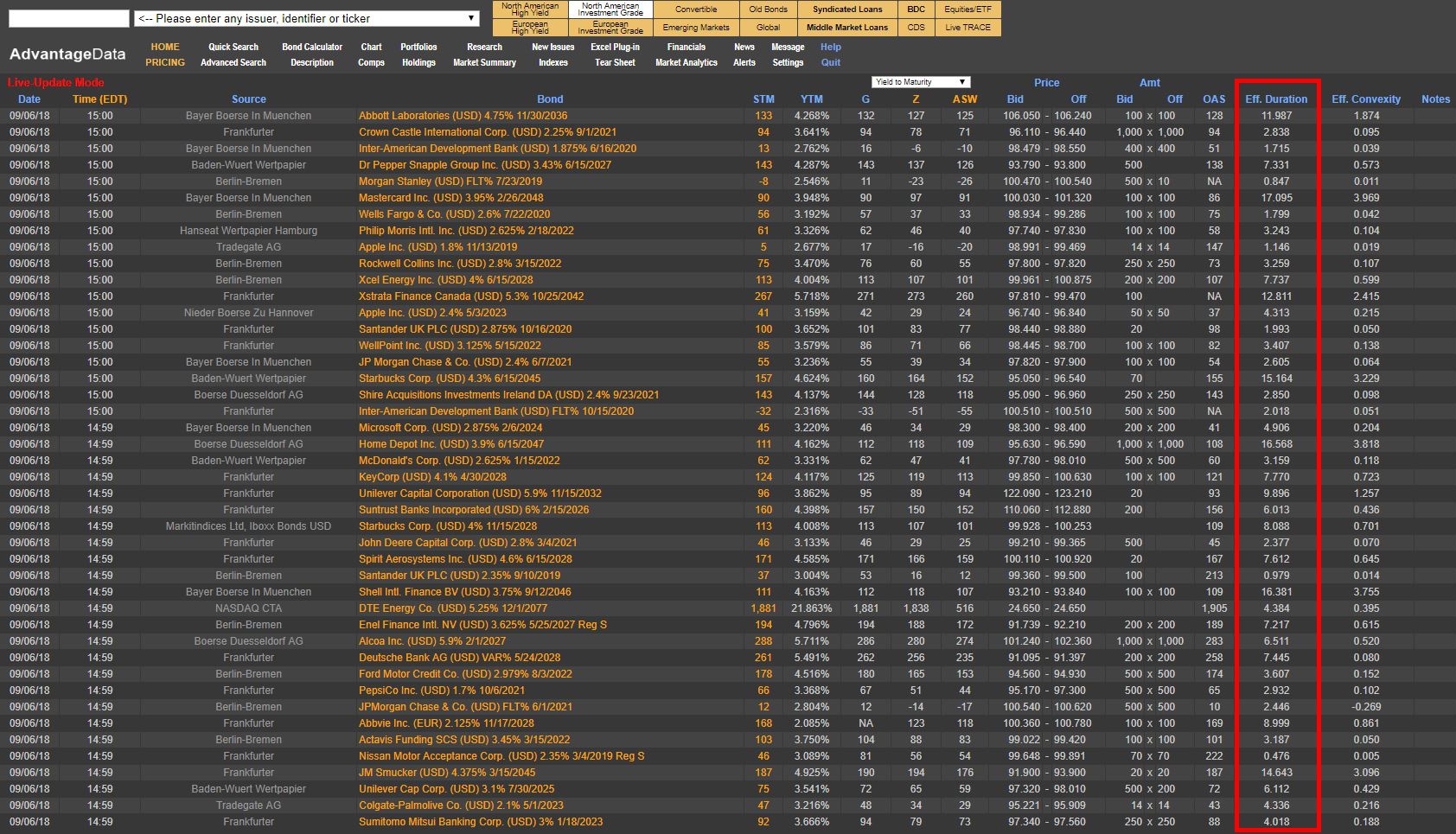

Duration risk has been a popular theme around buy-side firms as they look to incorporate low duration bonds into model portfolios to reduce interest rate sensitivity and increase liquidity. Typical bond indexes have an average duration of 5-7 years; this will create large outflow of assets in the upcoming quarters and increase popularity among individual securities.

Duration Risk: The Relationship Between Bond Prices and Interest Rates

Topics: Investment Grade, Analytics, bonds, Bonds Maturing, bond market, market analytics, Fixed Income, portfolio, interest rate, duration risk

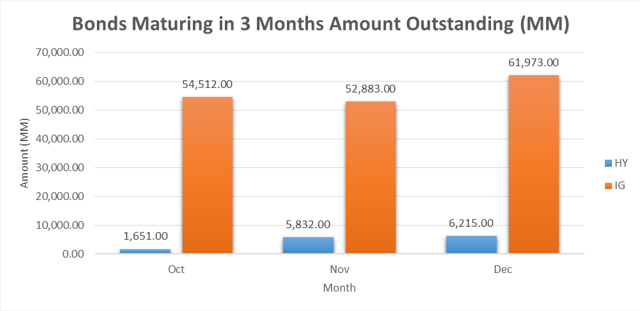

Analysis: High Yield & Investment Grade Bonds Maturing in 3 Months

In the coming months, October – December, Investment Grade & High Yield bonds amounting to 183.1 Billion are maturing. Of the two asset classes, Investment Grade has the lion’s share of debt maturing in the next 3 months compared to High Yield.

Topics: High Yield, Investment Grade, Bonds Maturing, Distressed Investments

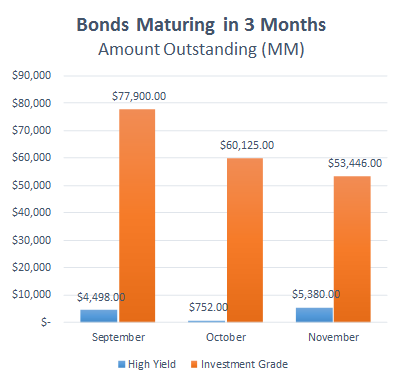

Analysis: High Yield & Investment Grade Bonds Maturing in 3 Months

In the months of September – November, Investment Grade & High Yield bonds amounting to $202.1 billion are maturing. Of the two asset classes, Investment Grade bonds has the lion’s share of debt maturing in the next 3 months compared to High Yield.

Topics: High Yield, Investment Grade, Bonds Maturing

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)