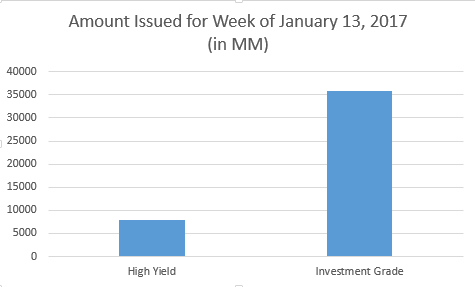

The amount issued in North American investment grade debt was more than quadruple the amount of that issued in high yield this week, with investment grade debt totaling $35.25 billion and high yield debt totaling $7.97 billion. Broadcom Corporation (NasdaqGS:AVGO) led investment grade deals with four new issues of senior unsecured notes totaling $13.55 billion to replace an old credit facility. This represented 38.4% of total investment grade debt issued this week. General Motors (NYSE:GM) led high yield deals with three new issues of senior unsecured notes totaling $2.5 billion, about 31.4% of total high yield debt issued this week.

Topics: High Yield, Investment Grade, New Issues, General Motors

European high yield debt held a slight edge over investment grade names, even as the pan-European Stoxx 600 equities index stayed mired in the shallow red.

Topics: High Yield, Investment Grade, debt

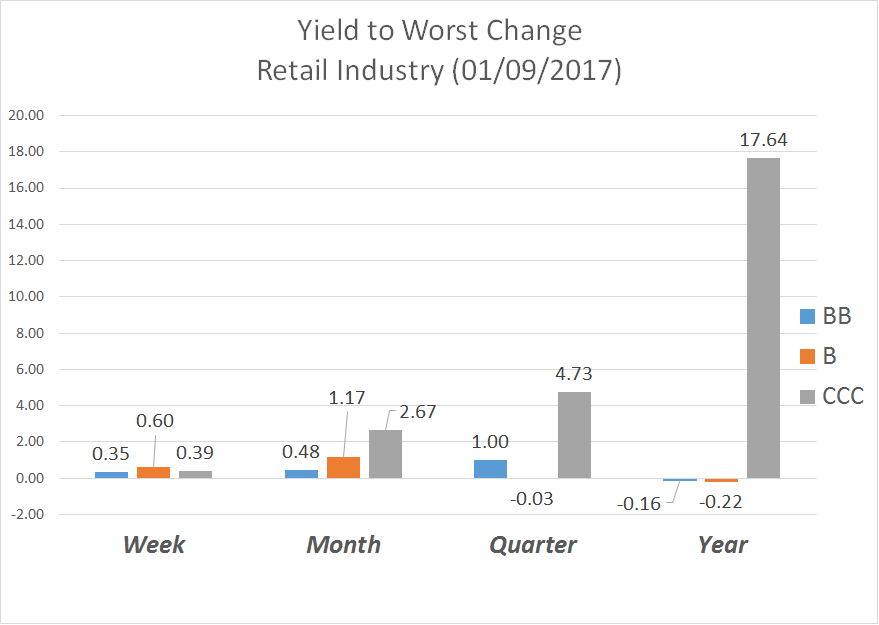

Shrinking historical “Yield to Worst” change shows that investor’s appetite for risk appears to be growing in the retail industry. This steady trend conforms with the post election rally that has taken place. The retail industry has been bolstered by a nice bump from a holiday season rush. While brick-and-mortar stores appear to be under acute pressure, many big retailers adapted and have established a strong online presence.

Topics: High Yield, retail, YTW

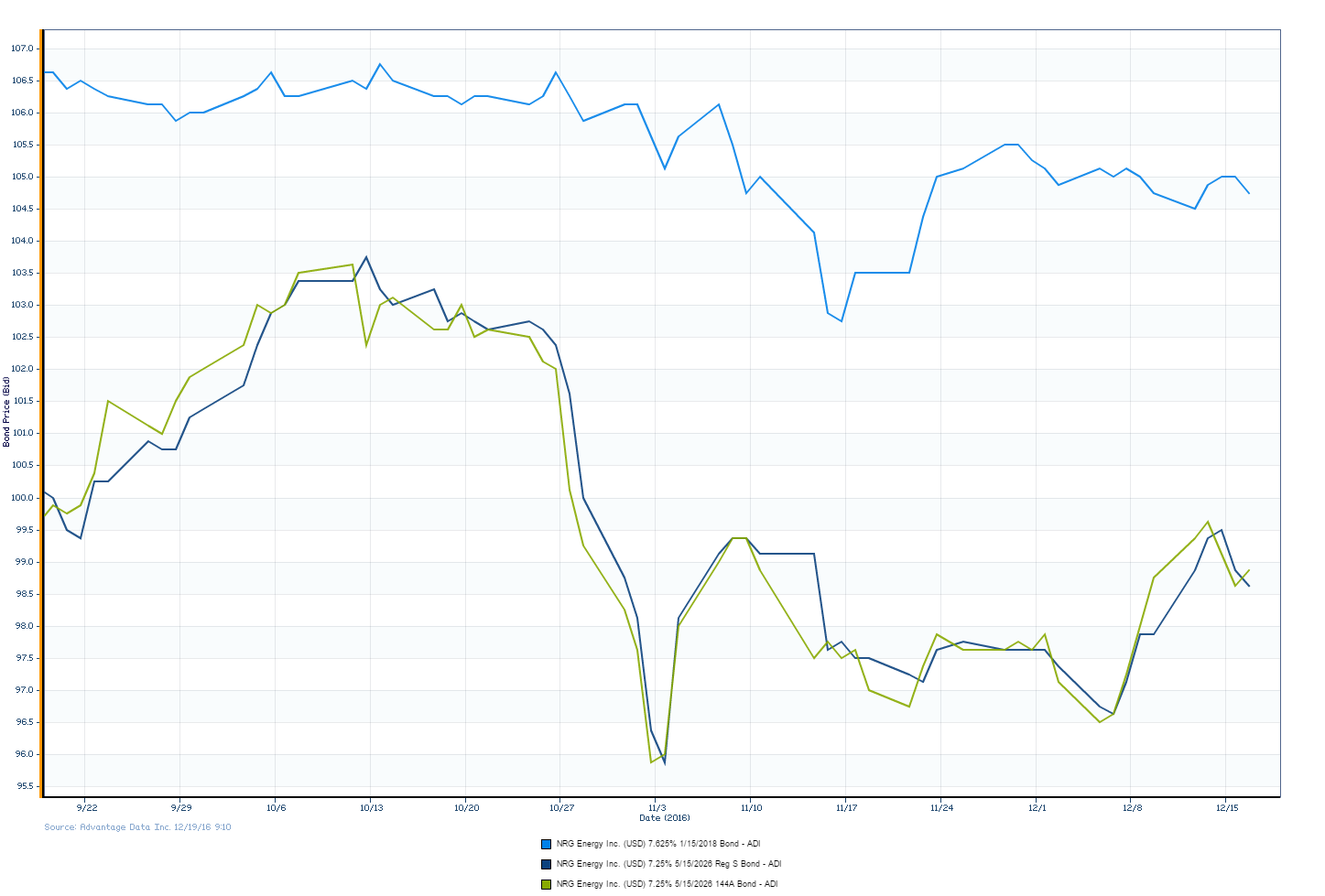

NRG Energy Completes Milestone in Fleet Optimization Strategy

NRG Energy, Inc. (NYSE: NRG) announced today that it has completed the conversion of four powerplants from coal to natural gas as the primary fuel. This comes as an important milestone for the energy company's fleet optimization strategy, as it tries to meet current enviromental standards and NRG's wider decarbonation efforts.

Following the announcement, NRG finds it's debt among the ADI top intraday high yield gainers in the Electric, Gas, & Sanitary Services Sector.

Topics: High Yield, Electric, natural gas

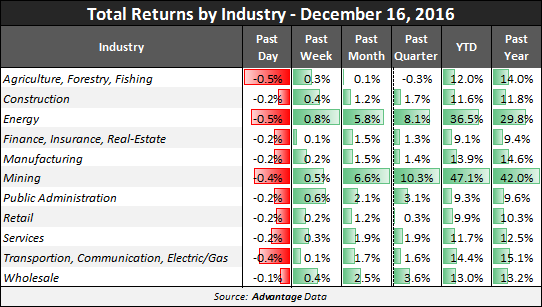

Total Returns by Industry: High Yield as of December 16, 2016

Topics: High Yield, Total Returns by Industry, Analytics

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)