North American Investment Grade debt was more than triple the amount of that issued in high yield this week, with investment grade debt totaling $24.85 billion and high yield debt totaling $8.26 billion. JPMorgan Chase & Co. (NYSE: JPM) and The Goldman Sachs Group Inc (NYSE: GS) led investment grade deals with JPMorgan having one issue of senior unsecured notes totalling $2.75 billion and Goldman Sachs with three new issues of senior unsecured notes totalling $5.0 billion. This represented 31.2% of total investment grade debt issued this week. Other stocks in the financial sector also had a big week as Capital One Financial Corporation (NYSE: COF) had two new issues of senior unsecured notes totaling $2.0 billion, BB&T Corporation (NYSE: BBT) with three new issues of senior unsecured notes totaling $2.6 billion, Royal Bank of Canada (NYSE: RY) with two new issues of senior unsecured notes totaling $1.75 billion, and SunTrust Banks Inc (NYSE: STI) with two new issues of senior unsecured notes totalling $1.3 billion. International Business Machines Corporation (NYSE: IBM) also had a busy week with four new issues of senior unsecured notes totalling $2.75 billion.

Topics: High Yield, Investment Grade, New Issues

Expansive tone continued to build regarding a spectrum of risk-assets, leading European junk debt to draw a fresh wave of bids along with equities. A strong showing by the banking sector was kindled by upbeat earnings from Santander SA, sending the Spanish bank's shares up 4.7%. The news carried along a range of other European banks as well, including France's Societe Generale SA and Germany's Deutsche Bank AG. A rally in Logitech International SA, posting share gains of over 15.5% as of 4PM London time and supporting the European tech group, provided additional sector cues to corporate-bond traders.

Topics: High Yield, Investment Grade, debt

North American Investment Grade debt was more than quadruple the amount of that issued in high yield this week, with investment grade debt totaling $36.55 billion and high yield debt totaling $8.649 billion. The International Bank for Reconstruction and Development (IBRD) led investment grade deals with a new issue of unsecured notes totaling $5 billion. This represented 13.7% of total investment grade debt issued this week. Financial sector stocks also had a big week with Morgan Stanley (NYSE: MS) having three new issues of senior unsecured notes totaling $7.0 billion, Bank of America (NYSE: BAC) with four new issues of senior unsecured notes totaling $6.75 billion, and Wells Fargo Securities (NYSE: WFC) with two new issues of senior unsecured notes totaling $5.0 billion.

Topics: High Yield, Investment Grade, New Issues

Defensive bias stepped higher, amid increasing attention by investors to statements by the U.K.'s Theresa May, and the U.S.' Donald Trump. Accordingly, investment-grade bonds easily outpaced junk debt on the European front, reflected in price gains linked to actual trades. High-yield bonds in the banking and retail sectors gave up some of last week's gains, while airline securities followed Lufthansa shares higher.

Topics: High Yield, Investment Grade, debt

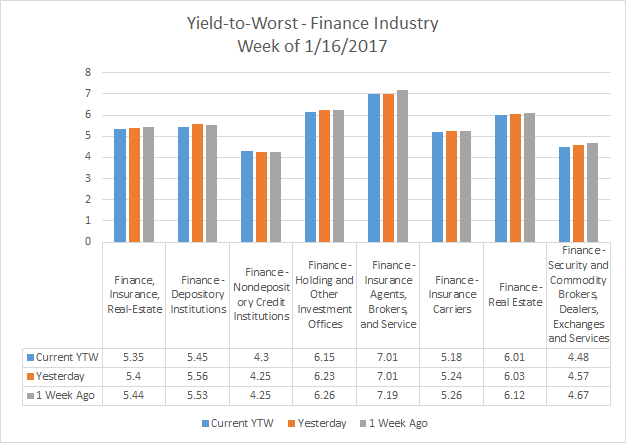

Finance Industry Analytics - Week of January 16, 2017

AdvantageData's (ADI) proprietary data shows low yield-to-worst statistics throughout the finance industry. With current yields being lower than yesterday’s and the previous week’s yields, investors are showing some signs of confidence for the financial sector. A better-than-expected earnings report by J.P. Morgan helped boost banking shares internationally, as discussed in Friday’s AdvantageData North American High Grade (HG) & High Yield (HY) summaries.

Topics: High Yield, YTW, Finance

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)