Below is a weekly snapshot of the 'Total Returns By Industry' report (High Yield Bonds).

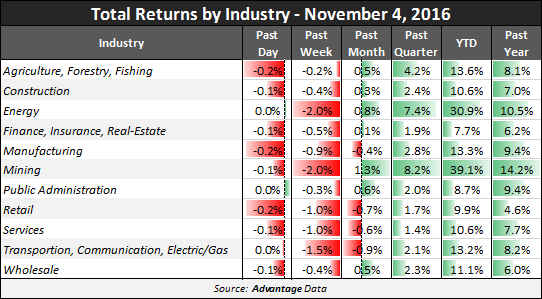

Total Returns by Industry: High Yield as of November 4, 2016

Topics: High Yield, Total Returns by Industry, Analytics

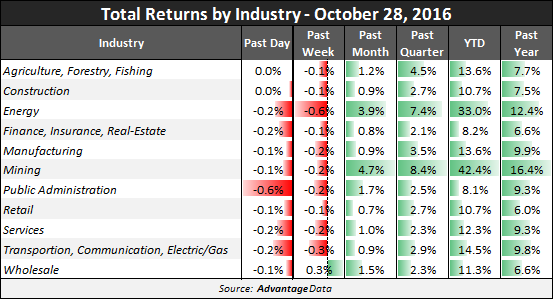

Total Returns by Industry: High Yield as of October 28, 2016

Topics: High Yield, Total Returns by Industry, Analytics

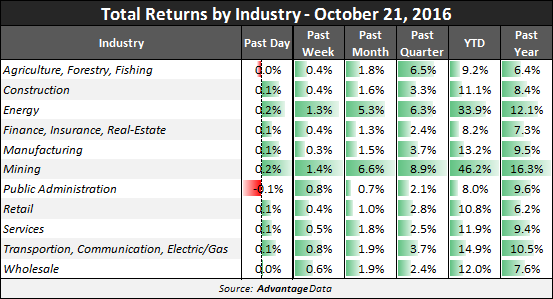

Total Returns by Industry: High Yield as of October 21, 2016

AdvantageData has the world’s most sophisticated corporate bond database. Buy-side and sell-side shops around the world rely on most powerful and up-to-date Market Analytics produced by AdvantageData’s proprietary database.

Topics: High Yield, Total Returns by Industry, Analytics

Total Returns by Industry: High Yield as of October 14, 2016

AdvantageData has the world’s most sophisticated corporate bond database. Buy-side and Sell-side shops around the world rely on most powerful and up-to-date Market Analytics produced by AdvantageData’s proprietary database. Below is a snapshot of the 'Total Returns By Industry' report (High Yield Bonds).

Topics: High Yield, Total Returns by Industry, Analytics

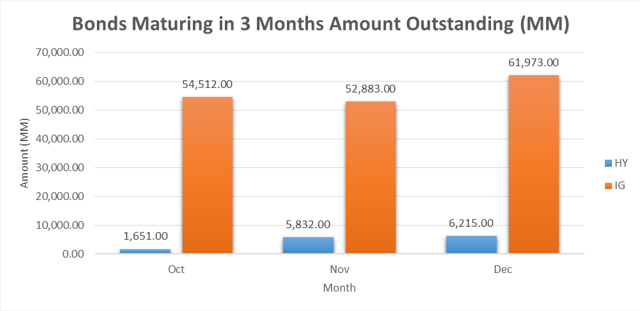

Analysis: High Yield & Investment Grade Bonds Maturing in 3 Months

In the coming months, October – December, Investment Grade & High Yield bonds amounting to 183.1 Billion are maturing. Of the two asset classes, Investment Grade has the lion’s share of debt maturing in the next 3 months compared to High Yield.

Topics: High Yield, Investment Grade, Bonds Maturing, Distressed Investments

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)