The press of constant developments across the BDC sector has greatly diminished with the end of earnings season. Where the BDC Reporter would wake to multiple new press releases, SEC filings, corporate presentations and analyst recommendations, we now have a blessedly short list of items to review and consider. In fact, we’re already done with the news flow on Wednesday May 25th and nobody is yet even at lunch on Wall Street. This is giving us the opportunity to write about a subject we’ve been meaning to discuss for several weeks. To keep readers awake and focused we’re going to break this into two parts. First, we’re going to review the drastic change in the popularity of leveraged lending in the middle market that has occurred in the past 8 years. In the second part, we’ll seek to explain why BDC investors should be worried in the short, medium and long term, and how they might be able to protect themselves.

The Big Picture: The Biggest Threat To The BDC Sector. Part One of a Two Part Series.

Topics: Middle Market, BDC

AdvantageData Wins 2017 Inside Market Data Award

The 15th annual Inside Market Data Awards and Inside Reference Data Awards took place last night and AdvantageData was proud to be in attendance.

Topics: Loans, Middle Market, BDC

Middle Market Insight: Nonbanks dive deep on leverage for best credits

The middle market is blowing away most preconceived notions of what can and can’t clear the market today. Leverage offers one measure of how accommodating the market is, and while the numbers don’t show it, the shadow market has set new outer limits for highly regarded, sponsored names.

Topics: Loans, Middle Market, BDC

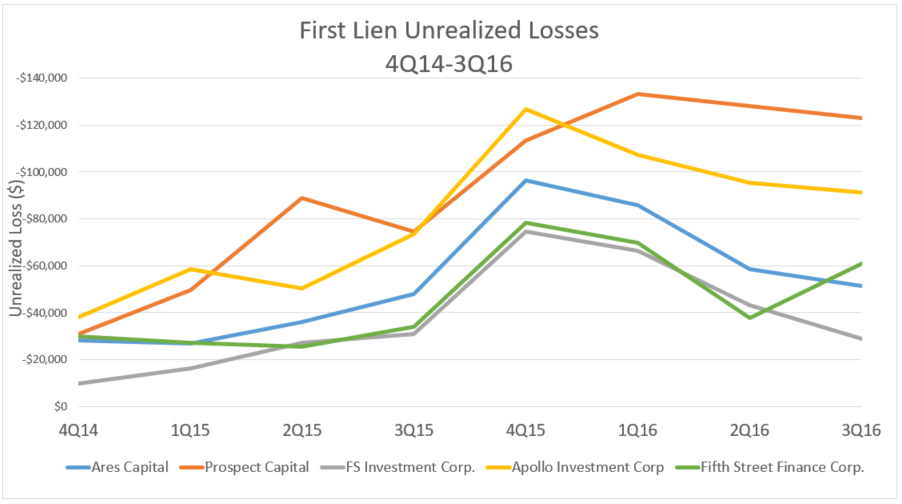

BDC Unrealized Losses and Percentage Loss - First Liens

Topics: Middle Market, BDC, First Lien

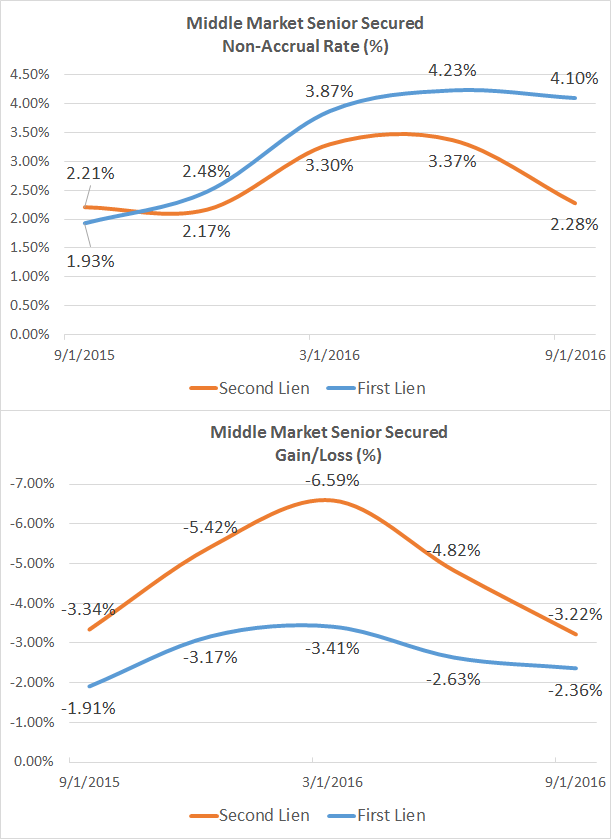

BDC First Lien Marks Rise While Non-Accruals Stay Relatively Flat

Interesting divergence between the first and second middle market liens on non-accrual vs. percentage loss over the 12 months from Q4 2015 through Q3 2016. In BDC portfolios, first lien non-accruals as a percentage of cost exceed second liens, while on a percentage loss basis second liens exceed first liens.

Topics: Middle Market, First Lien, Non-accruals

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)