BDC COMMON STOCKS

Surprised

Halloween is still a month away but the broader markets were spooked this week by a series of negative economic reports.

That caused all the major indices to drop in unison for several days.

Appropriately enough, a positive payroll report (unemployment at its lowest level in 50 years !) brought investors back in.

At the end of the 5 business day period the S&P was barely down: (0.33%).

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

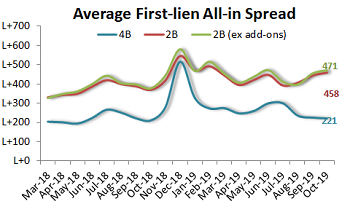

Market signals cautious tone as it enters 4Q; little activity in credits held by BDCs

Global market volatility on the heels of an active September in loans and the biggest high-yield calendar in two years has injected a further air of caution into new issues heading into the final three months of 2019, particularly with respect to the mid-to-lower single-B segment of the market.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

BDC COMMON STOCKS

Finished

Nothing lasts for ever – including BDC common stocks winning streaks – which ended this week in the red after 5 consecutive weeks in the black.

The UBS Exchange Traded Note with the ticker BDCS – which includes most of the sector’s public companies and which we use to measure price changes – was down (0.44%), closing at $20.16.

Likewise, the related Wells Fargo BDC Index – which provides a “Total Return” picture was off (1.01%).

31 individual BDCs dropped in price in the week while 15 were up or unchanged.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

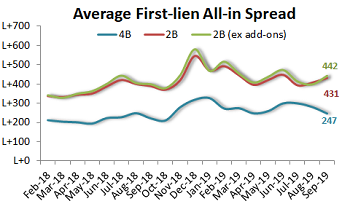

DuBois Chemicals LBO to take out debt held by Audax, GSBD; ION Corporates to refi Wall Street Systems debt held by AINV

The crush of September loan and bond launches finally brought matters to a head in a week that offered the good, the bad and the just plain ugly. In particular, Friday brought deadlines for issuers working high-profile deals, especially those with concurrent bond executions, including LBO deals for Inmarsat, Shutterfly and Sotheby’s. Like a lot of current business, these deals are coming down to the wire — or heading into overtime — as accounts have been loath to commit early as they grapple with the full calendar of as many as 45 transactions on the go all at once.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

BDC COMMON STOCKS

On A Run

For the fifth week in a row, the BDC sector ended up in price on the week. The upward push appeared to have taken on a life of its own.

In prior weeks, the hike in BDC prices seemed to be tied to the upward direction of the broader markets. This week, however, BDCS – the UBS Exchange Traded Note which includes most BDC stocks and which we use as our gauge of price change – was up 0.9% while the S&P 500 was down (o.5%).

Since Friday August 16, the last time the BDC sector was down for the week till this last Friday, BDCS is up 2.6% and the S&P 500 2.3%. We don’t know what’s more intriguing: that the two indices are so close or that BDCS is (slightly) ahead of the S&P. (That’s not traditionally the case: YTD the gap is 5% in favor of the latter and over 5 years 69%! Of course, distributions are much higher for BDCs than the S&P 500).

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

.png)