Recent Posts

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Investment Grade Bond Research - October 22, 2019

US STOCKS FELL SLIGHTLY TODAY amid European headlines regarding Brexit. Additionally, McDonald’s missed earnings expectations in a mixed third quarter and saw shares dip 5%. The 10-year Treasury note declined 3.7 bps. S&P -0.36%, DOW -0.15%, NASDAQ -0.72%

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Investment Grade Bond Research - August 20, 2019

US STOCKS FELL TODAY as investors continue to weigh concerns over the strength of the economy. Today’s drop comes after three straight days of growth. The 10-year Treasury note fell 5.6 basis points to 1.553%. S&P -0.79%, DOW -0.66%, NASDAQ -0.68%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

US STOCKS FELL THEN ROSE TODAY, as investors fled into the safety of bonds. The falling bond yields resulted in stocks ending the day near level with this morning. Similarly, the 10-Year Treasury note dropped to as low as 1.598%, but is currently up 2.6 basis points at 1.734%. S&P +0.08%, DOW -0.09%, NASDAQ +0.38%

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

THE US ADDED 164,000 JOBS IN JULY according to the Department of Labor, just below the expected figure of 165,000. The unemployment rate remained unchanged at 3.7%. Despite the report of steady job growth, stocks fell again today as investors continue to focus on trade threats. The 10-Year Treasury note fell to 1.846%, its lowest yield in nearly 3 years. S&P -0.73%, DOW -0.37%, NASDAQ -1.32%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

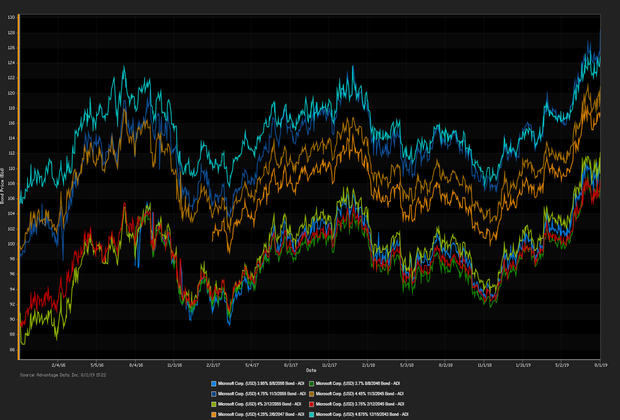

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)