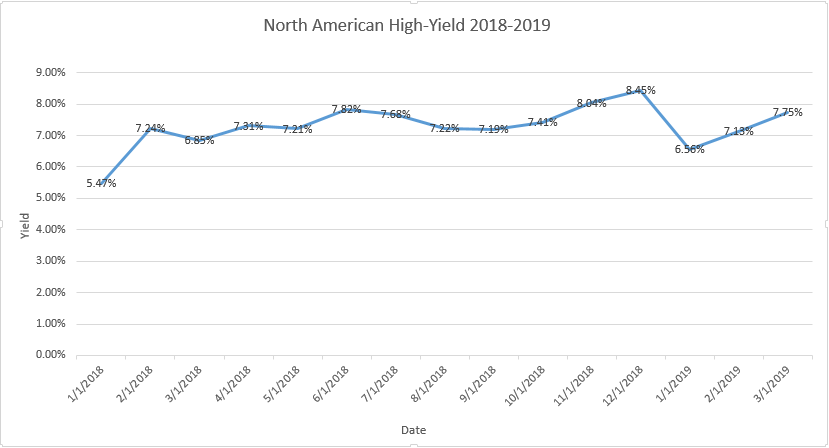

The new year has brought new growth to the High Yield space as average yield for North American High Yield new issues has steadily increased month over month.

Yields on the Rise for North American High Yield

The new year has brought new growth to the High Yield space as average yield for North American High Yield new issues has steadily increased month over month.

Topics: High Yield, bonds, junk bonds, bond market

North American Market Summary: High Yield Bond Research, December 17, 2018

U.S. TREASURY YIELDS SLID ON MONDAY APPROACHING three-month lows as investors fled to safe-haven assets. The 10-year benchmark settled near 2.857% losing 3.6 basis points while the inverted 2-year and 5-year Treasury yield gap narrowed to .3 basis points.

Topics: High Yield, bond market, market analytics, Finance, News, research

Industry Sectors in High Yield: A Yield Comparison

Back in 2015, Marty Fridson, Chief Investment Officer at Lehmann, Livian, Fridson Advisors LLC, spoke with Barron's on the topic of high yield industries most sensitive to rising interest rates.

Topics: High Yield, junk bonds, bond market, market analytics, YTW, Fixed Income, News, interest rate

BDC Common Stocks Market Recap: Week Ended September 14, 2018

Concession Speech

We are prepared to concede that the once semi-robust BDC common stock rally is in stall mode.

Topics: BDC, bond market, market analytics, business development company, Fixed Income, News

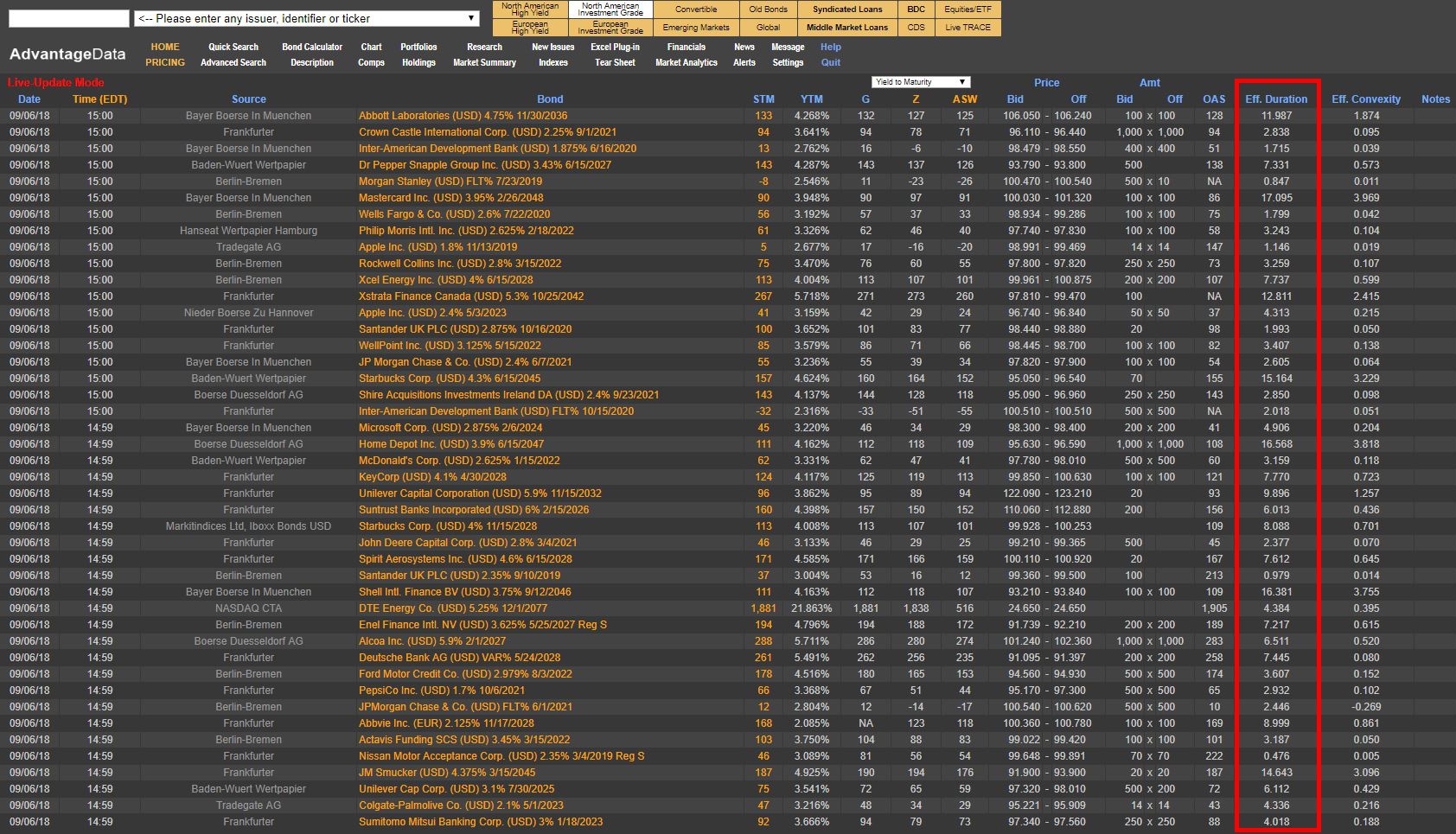

Duration Risk: The Relationship Between Bond Prices and Interest Rates

Duration risk has been a popular theme around buy-side firms as they look to incorporate low duration bonds into model portfolios to reduce interest rate sensitivity and increase liquidity. Typical bond indexes have an average duration of 5-7 years; this will create large outflow of assets in the upcoming quarters and increase popularity among individual securities.

Topics: Investment Grade, Analytics, bonds, Bonds Maturing, bond market, market analytics, Fixed Income, portfolio, interest rate, duration risk

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)