BDC Filing season is almost over. This report will analyze BDCs that have filed in the last 3 weeks. Last week’s analysis is available here.

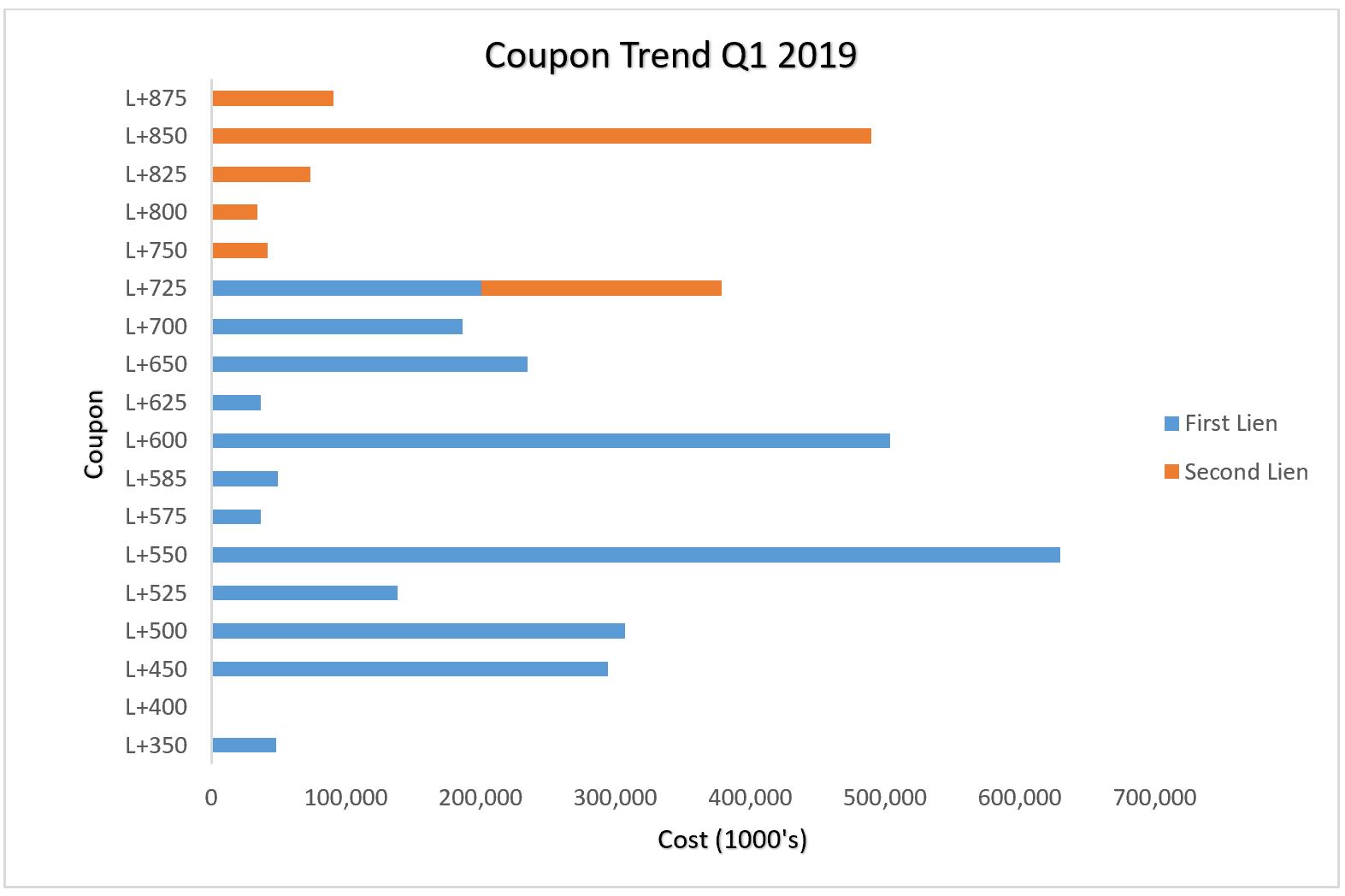

Aggregate Fair Value reported by BDCs that have filed in Q1 2019 is 104 Billion USD. BDCs have reported 36 Billion USD AUM in this week.

Read More

Topics:

BDC Index,

BDC,

First Lien,

business development company,

Non-accruals,

New Issues,

Second Lien,

BDC Filings,

fair value

On Monday, President Trump criticized the Fed for even considering raising rates, yet on Wednesday the Federal Open Market Committee announced its decision to raise the Fed Funds rate ¼ of a percent from 2.25% to 2.5% -- the fourth such increase in 2018.

Read More

Topics:

High Yield,

Analytics,

bonds,

junk bonds,

market analytics,

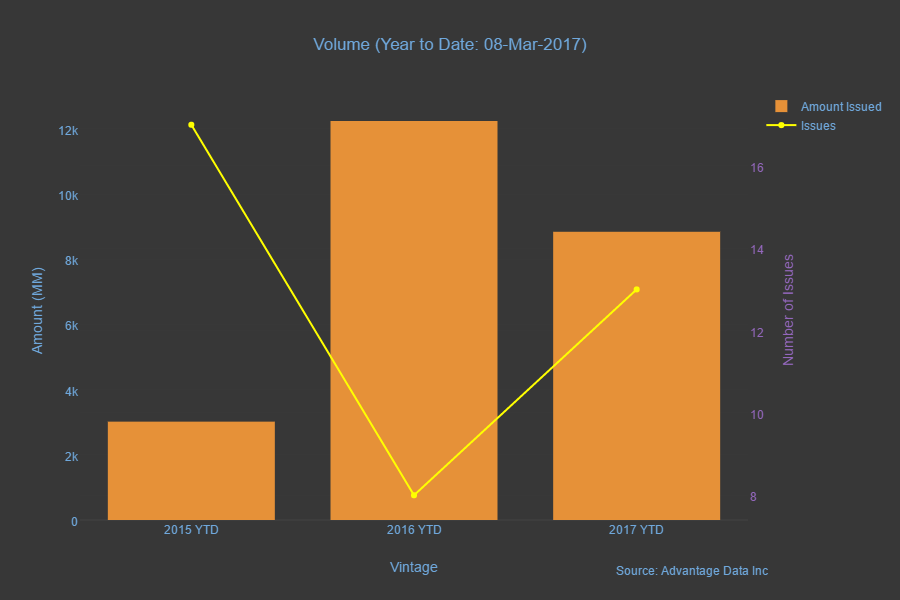

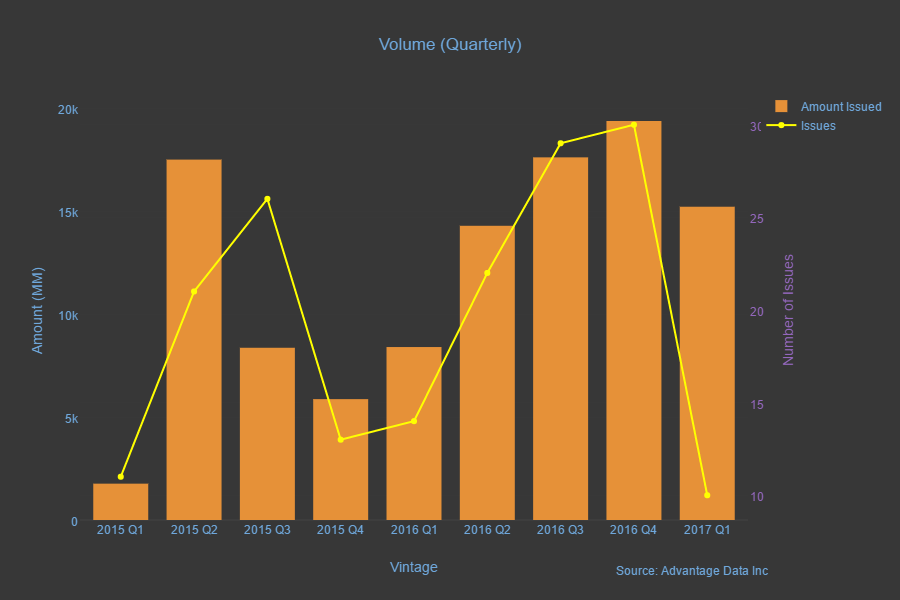

New Issues,

Finance,

Equity,

Fixed Income,

News

RISK-OFF SENTIMENT NOTCHED LOWER

among investors in European corporate debt. Relative to yesterday's levels of risk aversion, trades in corporate bonds reflected a

very slight favor for junk bonds in price gains linked to actual trades. Nonetheless

geopolitical overhang amid N. Korean nuclear warhead posturing

kept a lid on gains in risk assets. So too did

pressure on the European insurance sector ahead of projected damage by intense hurricane

Irma, headed for Puerto Rico and Florida. The

Stoxx 600 index vacillated in the shallow red amid data showing a dip in Germany's manufactured-goods orders, although shares of

Deutsche Bank AG

and

Micro Focus International PLC

posted notable gains.

Read More

Topics:

bonds,

CDS,

New Issues

Hub holdings, LLC announced that it will increase its senior secured term loan by $375 million to refinance current oustanding debt. The proceeds will be mainly used to make payments on $300 million of second-lien secured notes and around $60 million of revolving credit. Following the announcement, Moody's announced that it would affirm the B3 corporate family rating and change the outlook on the debt from negative to stable. This outlook is based on the company's EBITDA growth and the feeling that they will be able to continue to reduce their leverage in 2017.

Read More

Topics:

Loans,

New Issues,

Second Lien

Level 3 Financing, Inc. , a wholly owned subsidiary of Level 3 Communications, Inc. (NYSE: LVLT), announced last week that it successfully refinanced its outstanding Term Loans through the issuance of a new TLB L+225/2024. The company anticipates approximately $35 million of cash interest expense savings on an annualized basis through this $4.61 billion senior secured agreement. At the day of issuance, ADI loan pricing services quoted an end of day bid for the loan at 99 3/4. Since then, the loan has traded up to a bid of 100 5/8 in the week and half since its first quote.

Read More

Topics:

Loans,

First Lien,

New Issues

.png)