CAUTIONARY STANCES ABOUNDED among traders in European corporate bonds as central-bank and political moves loomed, with the Fed and a key Dutch election imminent. An interest-rate hike from 'across the pond' in the U.S. is, by consensus, nearly certain. A key political outcome in the Netherlands also motivated caution, with far-right candidate Geert Wilders' popularity likely to presage voting strength for France's Marine Le Pen. As New York trading was in part hamstrung by a mid-March blizzard, gains in Europe's RWE AG and Ocado PLC lent sector cues to bond traders.

Michael F. Brown

Recent Posts

Topics: bonds

SENTIMENT REMAINED CAUTIOUS, in an extension of yesterday's risk-averse mode. Sideways trending of prices remained in force for many corporate bonds, as investors awaited monetary-policy moves from the ECB (European Central Bank) and Federal Reserve. A defensive tone was abetted nonetheless by disappointing manufacturing data out of Germany, with factory orders sliding 7.4% in January. Meanwhile Aggreko PLC shares tanked 13% as of 4 PM London time, Groupe Casino SA dropped 5.2%, and Just Eat PLC moved up 5.9%, lending sector cues to corporate-bond traders.

ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-yield versus investment-grade constituents. High-yield bonds edged out high-grade debt in overall net price gains linked to actual trades. Among European high-grade bonds showing a concurrence of top price gains at appreciable volumes traded, AerCap Ireland Capital LTD 3.95% 2/1/2022 made some analysts' 'Conviction Buy' lists. Subscribe to ADI Market Summaries for more detailed corporate-bond analysis.

Topics: bonds

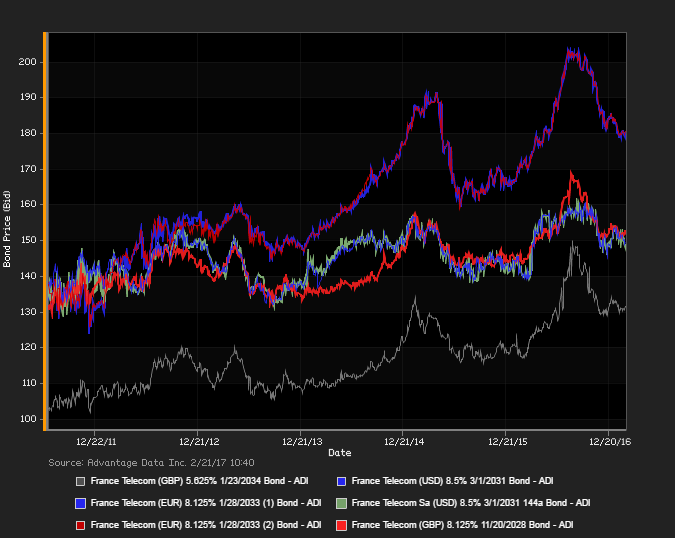

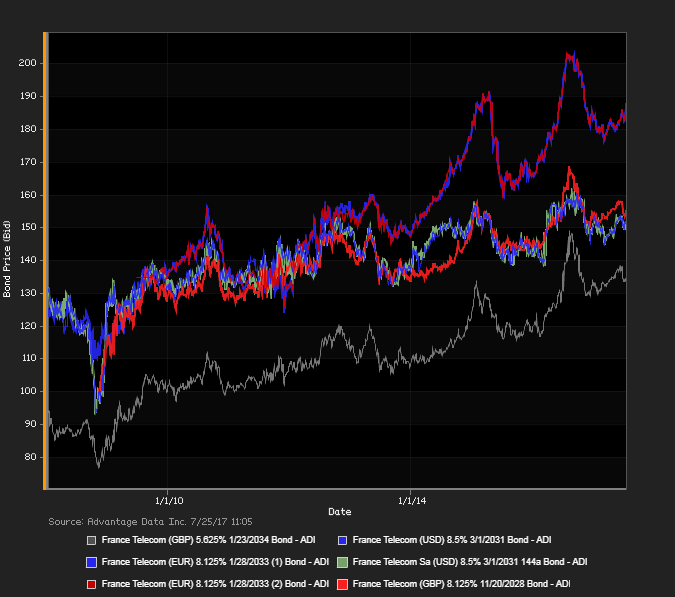

European Bond Research as of February 21, 2017

AN EXPANSIVE MARKET TONE prevailed overall, among corporate-bond traders in Europe's markets. Accordingly, European junk bonds outpaced investment-grade names in net price gains linked to actual trades, paralleling a move up in the pan-European Stoxx 600 equities index to a nearly homogeneous sea of green. The FTSE 100 index was drawn to the shallow red nonetheless, by a slide in shares of HSBC, on a $4.23 billion 4th-quarter loss, and a $1.0 billion buyback of shares. However, the mining sector drew strength from rises in shares of BHP Billiton and Anglo American PLC, on upbeat profits data. See France Telecom bonds, above. Subscribe to ADI Market Summaries for more detailed European bond research.

Topics: bonds

European Bond Research as of February 14, 2017

EUROPEAN HIGH-YIELD BONDS RETAINED FAVOR - although a narrow one, over a range of investment-grade securities. Disappointing GDP numbers for Germany and the overall euro-bloc weighed upon 'risk-on' trades, as did views of increased French political risk ahead of an upcoming presidential election. Nonetheless, a residual bullish tone after yesterday's resurgence in risk-taking in Europe and 'across the pond' in the U.S. was in play, on the heels of fresh record highs in Dow, S&P 500, and Nasdaq.

Topics: High Yield, Investment Grade, debt

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)