Corey Mahoney

Recent Posts

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

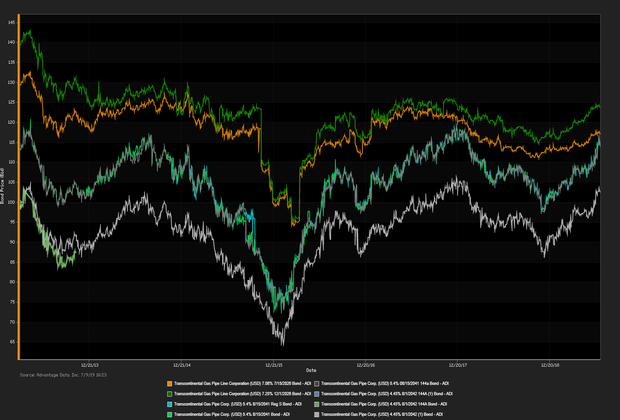

BOND INVESTORS TURN BEARISH on longer-dated U.S. government debt following the release of asound June payroll report and reducing bets the Fed will cut interest rates this month. Analysts say a prolonged inverted yield curve is a predictor of a recession and has foreshadowed the last nine recessions. “It has to stay there for a couple of months before you start to worry. One month or so, we wouldn’t consider it a lengthy period of time,” said Falconio. “We believe it’s an indicator of a long-term recession, however, it isn’t signaling a recession any time soon.” The spread between the two and ten-year notes narrowed to 14.2 basis points, the closest since May 31st. The 10-year note advanced 0.8 basis points. S&P +0.12%, DOW -0.08, NASDAQ +0.54%

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

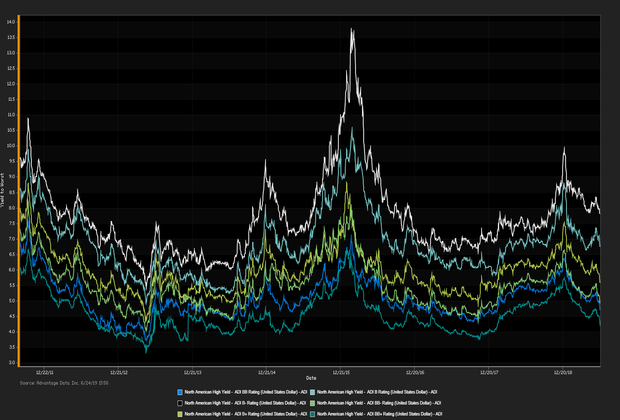

SAFE-HAVEN ASSETS ROSE against junk bonds in net prices linked to actual trades once again driving the 10-year note below 2 percent. Gold rallies Tuesday following its sharpest daily drop in more than a year “as global slowdown worries are growing” among the markets. Investors anxiously await payroll figures to be released on Friday after the Independence Day on Thursday to decide on their risk appetite. The 10-year note sank 4.8 basis points. S&P +0.29%, DOW +0.26, NASDAQ +0.22%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

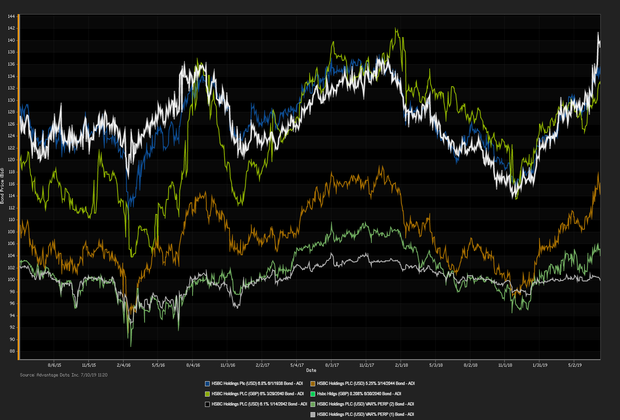

MANUFACTURING ACTIVITY DECLINES IN JUNE to nearly a three year low indicating the trade spat with China is impacting factory output. The gauge of activity slipped to 51.7 from 52.1 marking the third straight month of deteriorating data. Senior money market economist Thomas Simmons at Jefferies mentioned, “If the White House is able to forge a solid trade deal with China, both investment spending and manufacturing activity will again improve.” The 10-year note advanced 2.0 basis points. S&P +0.77%, DOW +0.44, NASDAQ +1.06%

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)