Corey Mahoney

Recent Posts

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

EQUITIES ROSE ON FRIDAY following the nation’s largest banks passing the Federal Reserve’s stress tests. Meanwhile, investors are keeping a watchful eye on the G20 summit in Japan awaiting news of progress toward a resolution to the trade spat. “What investors expect are good talks, no implementation of tariffs right away and a continuation in negotiations.” The 10-year note dipped 1.7 basis points. S&P +0.32%, DOW +0.19, NASDAQ +0.24%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

FED PRESIDENT MARY DALY of San Francisco believes the time is not right to cut rates, “It’s too early from my perspective to know whether we should use the tool at all and what magnitude of the tool we should apply.” Mortgage rates tumble to 3.73 percent for a 30-year marking a two-and-half year low. Sam Khater Chief Economist at Freddie Mac stated, “While the industrial and trade-related economic data continues to dominate the news, the drop in mortgage rates over the last two months is already being felt in the housing market.” The 10-year note dipped 3.8 basis points. S&P +0.47%, DOW +0.08, NASDAQ +0.77%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

US TREASURY YIELDS SPIKE AS INVESTORS BECOME OPTIMISTIC a trade deal with China is likely to occur following the G20 summit in Japan. The trade spat is blamed for initiating a global growth slowdown and the Fed’s recent dovish tone suggesting aggressive rate cuts. The 10-year note spiked 5.7 basis points. S&P -0.01%, DOW +0.08, NASDAQ +0.41%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Analytics, bonds, junk bonds, bond market, corporate bonds, market analytics, New Issues, News, research, EU, market update, European

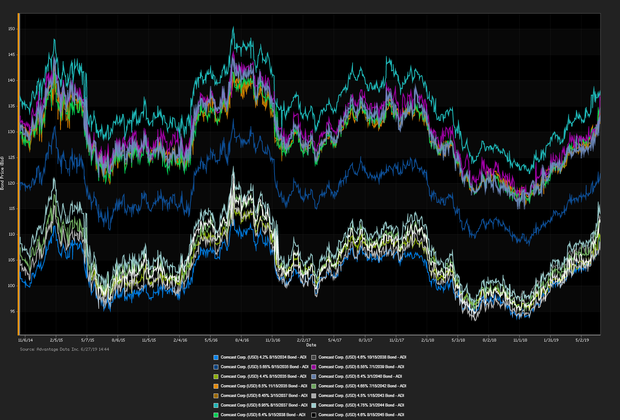

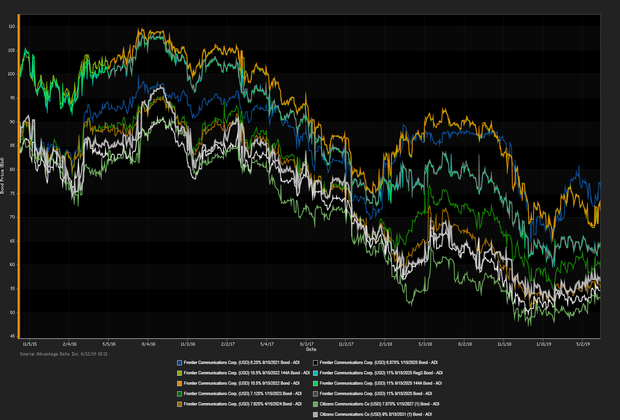

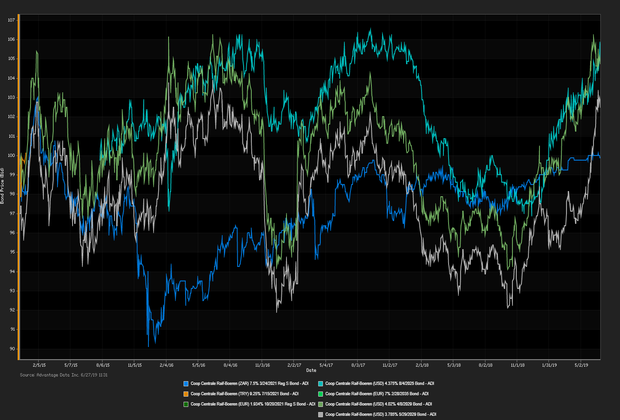

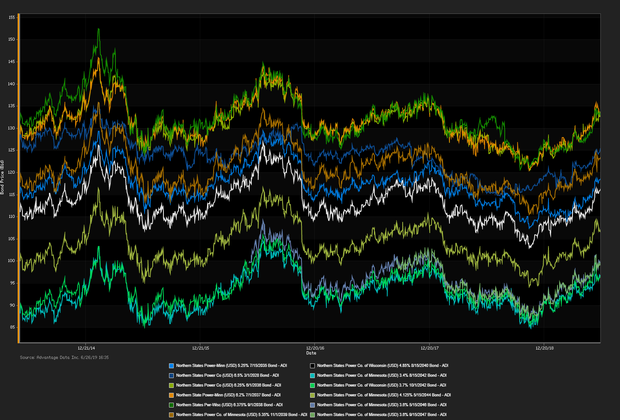

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)