INVESTMENT GRADE DEBT ROSE AGAINST junk bonds in net prices linked to actual trades. Total assets in US money market funds retreated from nearly 10-year highs last week as yields fall. Traders are estimating a 65 percent chance of a 25 basis point cut. “Even though the Fed will almost certainly cut rates at the end of the month, additional cuts depend heavily on the balance of economic data.” S&P-0.47%, DOW -0.30, NASDAQ -0.24% The 10-year note dipped 4.6 basis points.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

INVESTMENT-GRADE DEBT ROSE AGAINST high yield bonds in net prices linked to actual trades following weak GDP data from China revealing the country’s second-quarter growth rate fell to a 27-year low. In June retail sales and industrial production figures exceeded estimates relieving investor sentiment. S&P +0.02%, DOW +0.10, NASDAQ +0.17% The 10-year note dipped 3.5 basis points.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

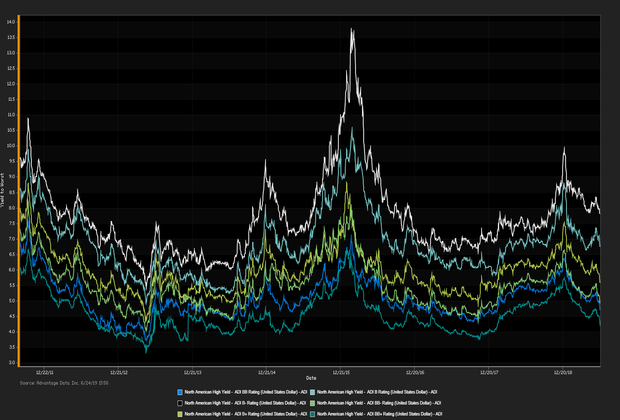

THE YIELD GAP BETWEEN INVESTMENT GRADE and high yield corporate bonds is at its lowest since 2007. Just 60 basis points separate yields of the lowest-rated investment grade debt and the highest-rated high yield debt. As trends among corporate and government debt continue to point to economic downturn, many investors are selling riskier junk bonds. S&P +0.46%, DOW +0.90, NASDAQ +0.59%

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

US MONEY-MARKET FUNDS pulled in $28 billion in the week ended Wednesday marking the third consecutive week of inflows rising to the highest levels since 2009. A weak global economic outlook and trade concerns have sparked fear in investors fleeing to assets with minimal risk. Middle market loan issuance rebounded in the second quarter of 2019 spiking 48 percent. “Clearly the volatility at the end of 2018 had a negative impact on all segments of the loan market in the first quarter.” The S&P 500 hit an all-time high rising above 3,000 for the first time. S&P +0.11%, DOW +0.71, NASDAQ -0.17%. The 10-year note dipped 6.5 basis points.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

JEROME POWELL SIGNALED A RATE CUT IS LIKELY IN JULY citing the Fed will “act as appropriate to sustain the expansion” despite global weakness and the ongoing trade spat. “Manufacturing, trade and investment are weak all around the world ... We have agreed to begin (trade) discussions again with China, and that is a constructive step. It doesn’t remove the uncertainty.” Gold rallied 1.33 percent following Powell’s dovish remarks and the major indices finished near all-time highs. The 10-year note dipped 0.3 basis points. S&P +0.45%, DOW +0.29, NASDAQ +0.77%

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)