THE MARKETS ROSE THEN FELL SHARPLY TODAY after the White House announced an additional 10% Tariff on Chinese goods beginning next month. The news came after a 300 point rebound from Wednesday’s interest rate cut-related losses.The 10-Year US Treasury note fell 11.3 basis points. S&P -0.90%, DOW -1.05%, NASDAQ

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

US STOCKS FELL TODAY AFTER the Federal Reserve announced it will cut interest rates for the first time since 2008. According to Jerome Powell, the 25 basis point cut is a ‘mid-cycle adjustment’ and future cuts may not be necessary. He added that it will provide insurance against global economic risks and boost inflation. The 10-year note lost 4.2 basis points. S&P -1.09%, DOW -1.23%, NASDAQ

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

CONSUMER CONFIDENCE SURGES TO 135.7 NEARING AN 18-YEAR HIGH set back in October of 137.9. Despite the strong confidence among consumers the Fed is expected to cut rates fearing damage done by the trade dispute is worse than anticipated. “Consumers are once again optimistic about current and prospective business and labor market conditions.” Gold held steady as a safe-haven asset for investors fleeing volatility. The 10-year note lost 0.5 basis points. S&P -0.28%, DOW -0.09, NASDAQ -0.24%

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

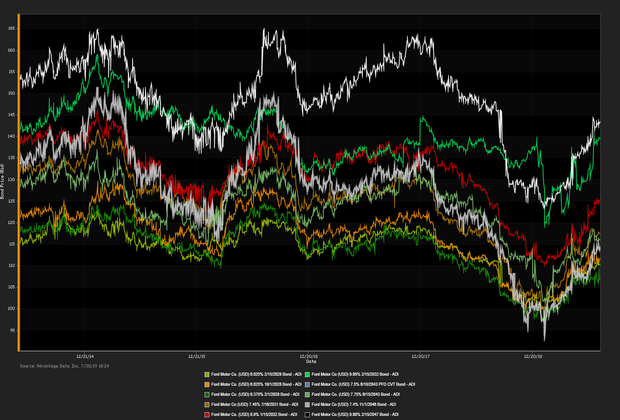

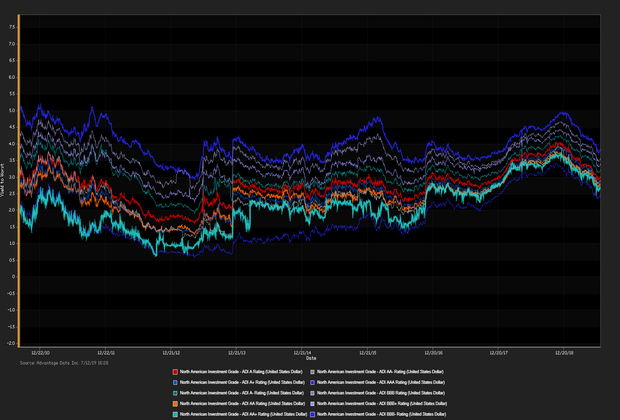

INVESTMENT GRADE DEBT ROSE AGAINST JUNK BONDS in net prices linked to actual trades. Car sales are expected to slump in July as increased costs drove prices higher preventing Americans from signing on the dotted line. Sales are expected to dip by 1.8 percent. Despite the recent slowdown auto dealers are not concerned, “While trade risk remains a threat, transaction prices continue to rise and economic growth is moderating, sales in the second half of the year could outperform expectations.” The 10-year note lost 0.8 basis points. S&P -0.18%, DOW +0.11%, NASDAQ -0.45%.

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

U.S. DURABLE GOODS ORDERS SURGED BY 2 PERCENT IN JUNE largely due to an increase in civilian aircraft orders. Core capital goods orders rose 1.9 percent on year-over-year basis suggesting the economy is picking up steam after two months of weak data. “The U.S. economy is stronger today because the rest of the world is in a recession. That’s not the way it’s supposed to work, but that’s the way it’s working now. Because the rest of the world is in a recession, our interest rates are scraping bottom. And because our interest rates are scraping bottom, our economy is actually doing pretty darn well,” said Todd Buchholz, former White House director of economic policy under President George H.W. Bush “Eighty-eight percent of our economy has pretty much nothing at all to do with exports or imports.”

Topics: High Yield, Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, Finance, Fixed Income, News, Syndicated Bonds, syndicated, research, market update

Topics: Investment Grade, Loans, Analytics, bonds, junk bonds, bond market, market analytics, New Issues, News, Syndicated Bonds, syndicated, research, market update

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)