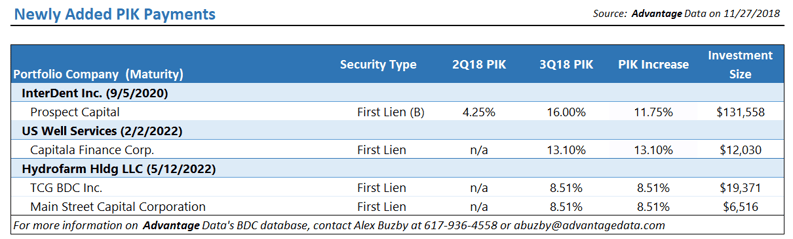

Analyzing PIK and Coupon Spread changes can be a great way to identify middle market companies that are beginning to feel pressure from lenders. Whether you're sourcing investments, consulting distressed borrowers or analyzing BDCs, utilizing alternative signs of distress as leading indicators is a great way to get ahead of the market - Download the data sample below!

BDC-filed information can be limited so informed market participants must use all data made public to its full potential. Often small changes in fair value, coupon spread, PIK and addon subordinated debt can give valuable indication of portfolio and company health well before large changes occur.

Want more BDC data or have questions? Reach out to ADI-sales@advantagedata.com!

With many more filings to come, you can also request a trial to Advantage Data's BDC workstation to quickly analyze and distill actionable information from quarterly filings.

.png)