What we already know...

We know that investment professionals benefit from reliable, holistic, aggregated data. It doesn't take a rocket scientist to figure out that making data easy to find and understand translates to efficient analysts and more profitable firms.

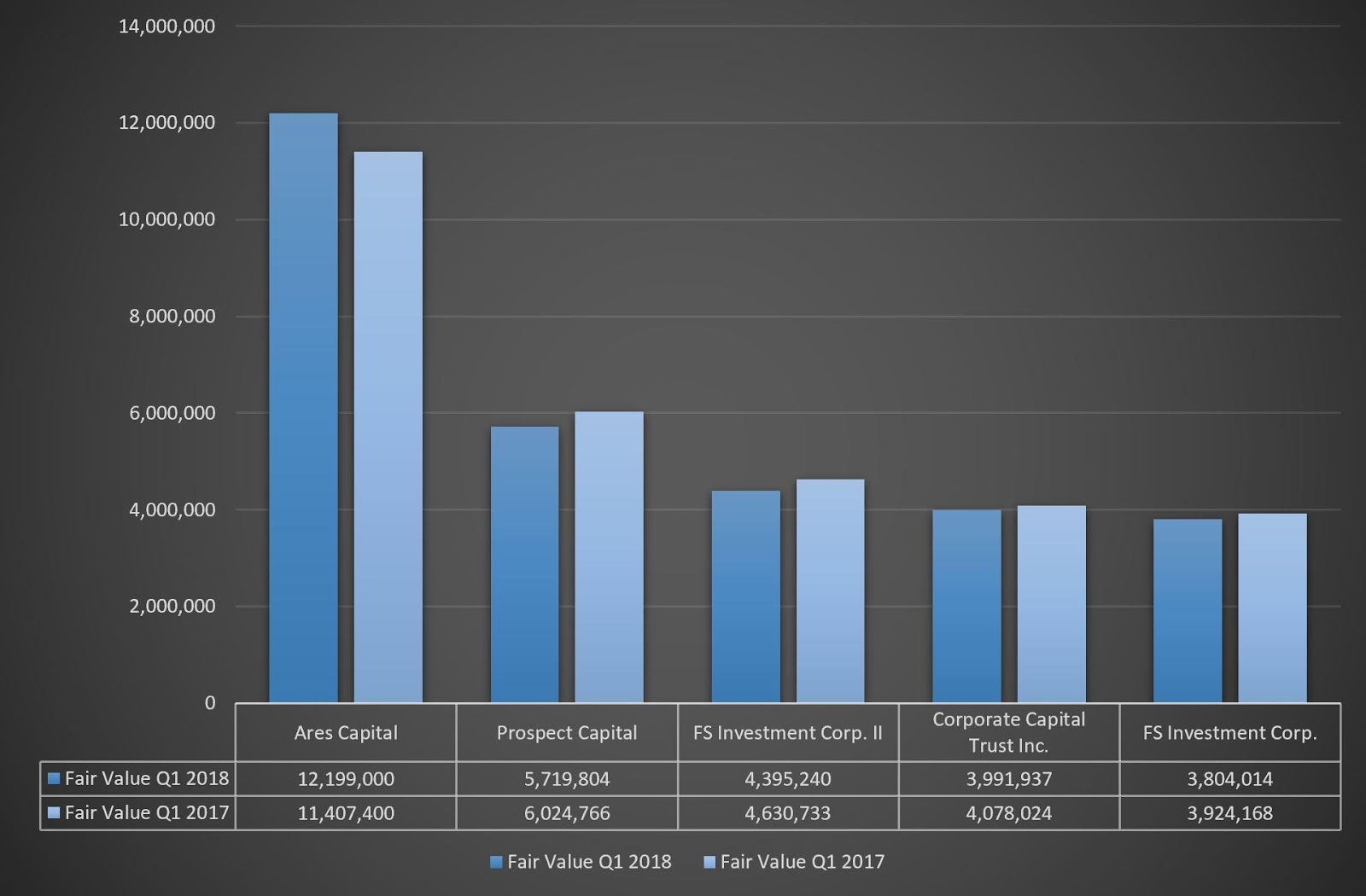

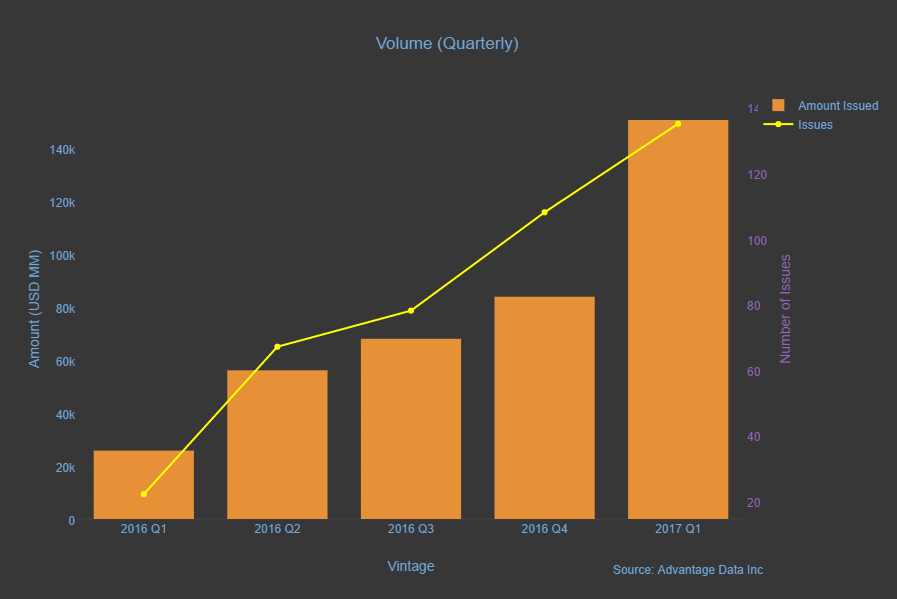

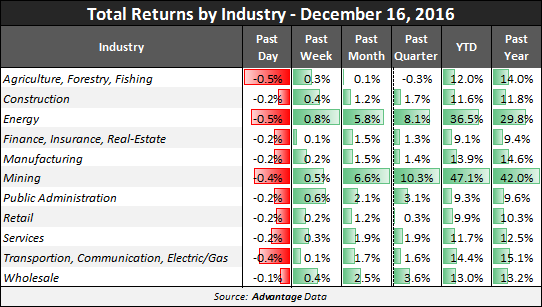

Over the past two weeks, we have shown you a few ways you can leverage business development company filing data with BDC Advantage. BDC Advantage eliminates the tedious, time-consuming process of manually compiling and standardizing BDC quarterly filings, allowing users to easily analyze data relevant to their firm.

We've shown you how to:

.png)