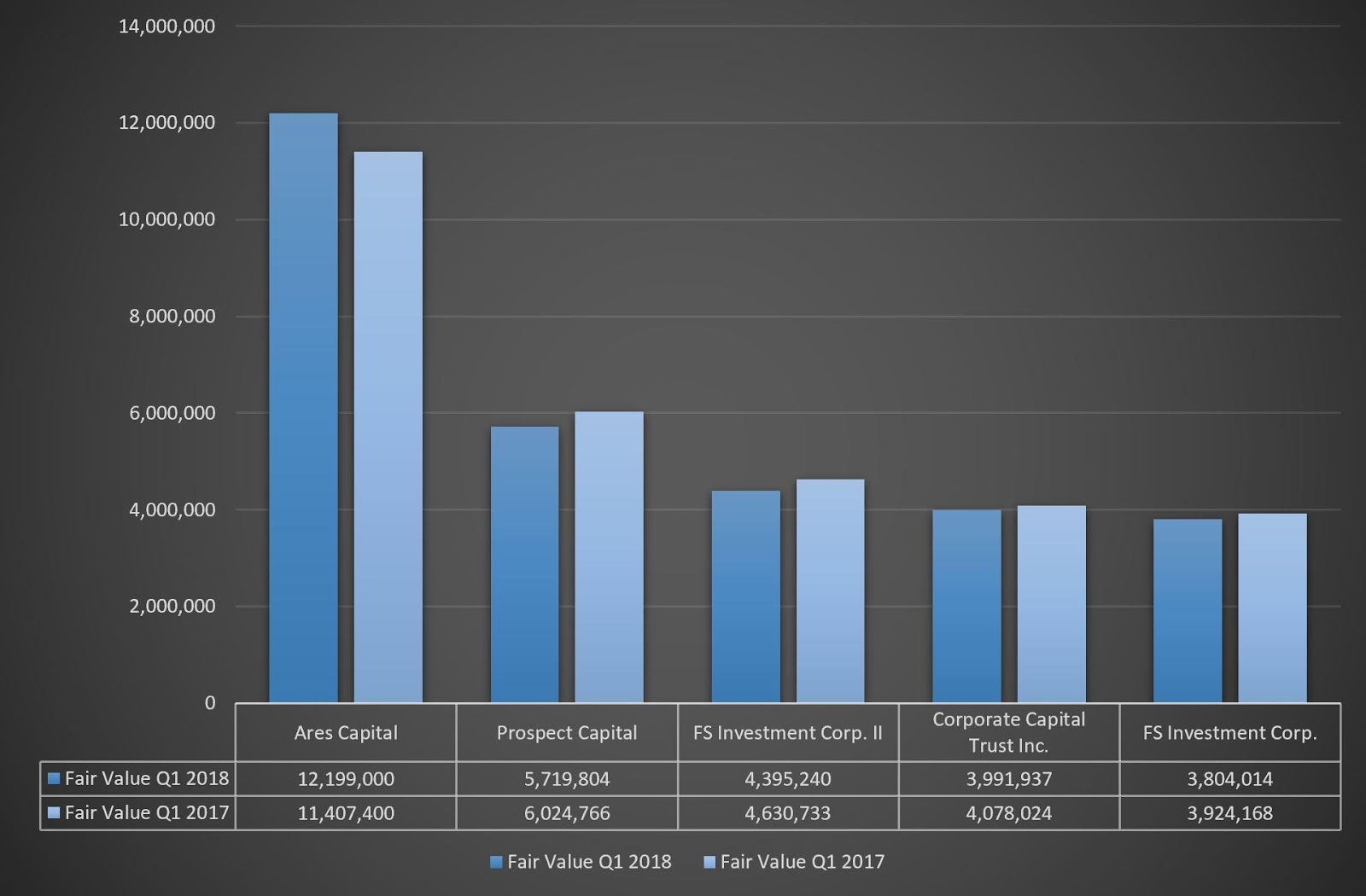

BDC Filing season is in full swing. This report will analyze nine BDCs that have filed this week. Aggregate Fair Value reported by these BDCs is 19.3 Billion USD which is approximately 20% of aggregate AUM of all BDCs.

Topics: Analytics, BDC, AUM, market analytics, business development company, Non-accruals, BDC Filings, fair value, market update, top 5, adds & exits

Comparing quarterly filings, fund breakdowns and more...

After the 2008 financial crisis and the subsequent regulatory changes, Business Development Companies (BDCs) skyrocketed in popularity, filling the funding gap in middle market companies. BDCs are closed-end funds that mostly invest in private, growing companies and, increasingly, larger later stage corporations.

BDCs are required to file quarterly reports to the SEC under the Investment Company Act of 1940. Aggregating the data from these reports is tedious, time-consuming, and lacks standardization. AdvantageData’s BDC Product gives investment professionals access to aggregated and standardized data (current and historical), allowing users to easily analyze data relevant to their firm's needs.

Topics: Middle Market, BDC Index, Analytics, BDC, AUM, market analytics, business development company, BDC Filings, Fixed Income

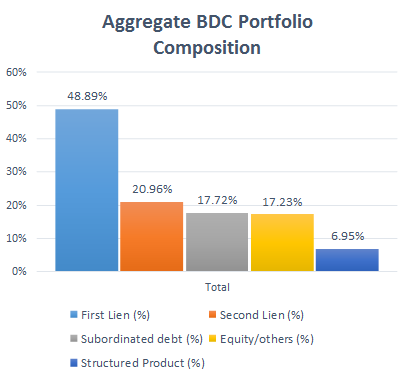

Aggregate BDC Portfolio Composition as of Q2 2016

BDC’s AUM for Q2 2016 at Fair Value was $80 Billion USD. Senior Secured investments comprised of First Lien, Second Lien and Unitranche makes up almost 70% of BDC Investments.

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)