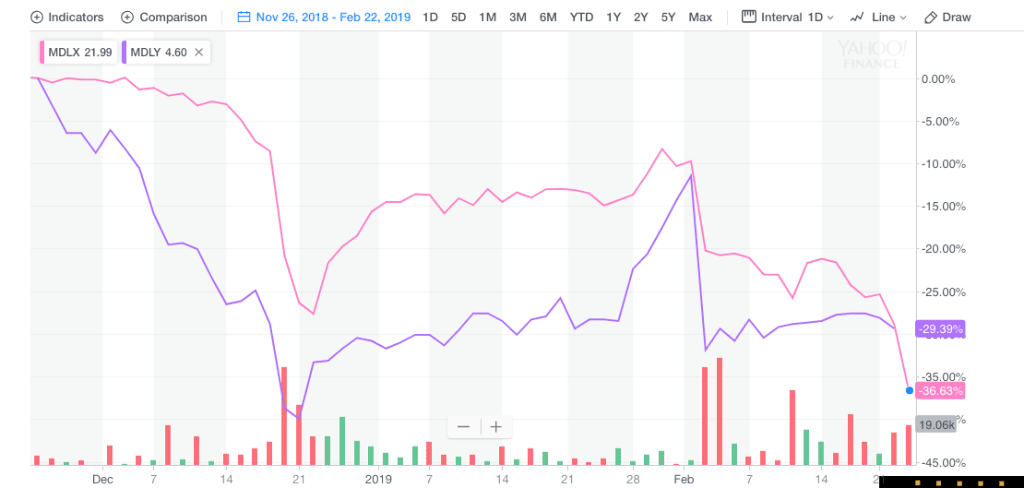

Better Late Than Never: The most interesting news of the week will occur on Friday when the shareholders of the three Medley Group related companies finally vote on whether to merge together or not. Of course, the vote has now been twice suspended, apparently due to governmental delays relating to the Federal shut-down. Last week, after the vote was delayed at the last minute, very little was said by the parties involved, except confirmation of the date and times of the votes. Even the BDC Reporter did not have anything new to say, nor do we now. We’ll have much more to say once the votes have occurred, the last of which is scheduled for 11:00 a.m. EST. Then there will be fireworks of one kind or another.

BDC Preview: Week Of March 11-March 15, 2019

Topics: Loans, Analytics, BDC, market analytics, business development company, bdc reporter

SORENSON PLANS FULL REFI OF DEBT HELD BY FSK, MAIN, HMS, AINV

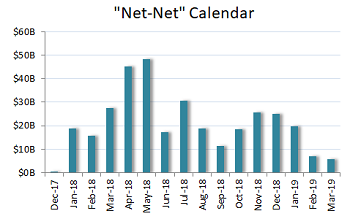

As the loan pipeline continues to ebb, opportunistic issuers are beginning to wade back in, spurred by bifurcated conditions that are allowing well-regarded repeat issuers to price tight to the broader market. Though the secondary rally stalled out last week, the appreciable improvement in the secondary market following the February rally eases the difficulty of layering in fungible new money at previous years’ more advantageous pricing levels.

Topics: Loans, Analytics, BDC, market analytics, business development company, LevFin Insights, News

Oaktree vehicles hold Windstream’s prepetition debt

Although a pair of competing industry conferences took many buysiders out of pocket in the first part of last week, high-yield activity roared back to life late in the week via a procession of drive-bys, while loan arrangers launched a trio of large LBO deals off the pipeline as the secondary market continued to move higher. Several secondary situations also kept market participants on their toes, what with Windstream Services filing for bankruptcy, Neiman Marcus disclosing the framework of an extension/exchange plan and issuers releasing a flurry of earnings reports.

Topics: Analytics, BDC, market analytics, business development company, LevFin Insights, News

BDC Preview: Week Of February 25 – March 1, 2019

Earnings: This is going to be a busy week for BDC earnings as the season rolls on. We’re already blanching at the prospect, with 11 separate releases coming. Far and away the most important will be the report by FS KKR Capital (FSK). This will be the first time since the merger with Corporate Capital Trust (ex-CCT), and after a name and ticker change. More importantly, we’re going to hear more about the ever huger BDC’s credit status. Reviewing the filing and listening to the Conference Call should tell investors whether the ambitious folk at this unusual arrangement between a firm best known for raising capital and another for investing capital will be successful at lending capital. To be honest, our impression from reviewing the portfolios at both entities (CCT and FSK) for some time now is that management is going to be in turnaround mode for some time to come. Much of that – if we’re right – can be laid at the underwriting taken by FS Investment’s prior partner in leveraged lending GSO Blackstone, which was not shy about taking some very large positions on behalf of the shareholders of multiple FS Investment funds in what now appear to have been some dicey propositions. KKR – now in charge of day to day investment management – re-underwrote those assets when taking over and adding their initials to the door and will have to be responsible for the consequences, if not the original credit decisions. However, KKR will benefit from being in control of many of the debt tranches through the multiple funds now under their co-tutelage with FS Investment, which will aid any work out efforts (but also prolong the time it will take to determine the final outcome). Also worth mentioning – as Oaktree Specialty Lending did last week (OCSL) when discussing their own escape from under two troubled portfolio companies – is that the LBO market remains flooded with private equity buyers with huge untapped resources; hungry lenders of all stripes and an economy which is humming along (despite all the “next recession is around the corner” talk). As OCSL’s management noted, with a little luck and those favorable conditions, FSK may be able to dig itself out of the hole dug by another party, but which they enthusiastically adopted.

Topics: Loans, Analytics, BDC, market analytics, business development company, Finance, Fixed Income, News, bdc reporter

Amynta add-on deal would boost margin on debt held by Ares Capital Corp.

Last week’s holiday-abbreviated calendar offered little action in the primary markets—loan arrangers launched a mere six deals for a paltry $3.2 billion of volume, while high-yield offered a string of well-received, refinancing-related drive-by deals. However, the week offered real drama as market participants digested the fallout from the bombshell news that Windstream Services lost a default ruling to Aurelius Capital Management. That ruling cast a long shadow over the nearly $10.5 billion of debt issued by Windstream and spinoff Uniti Group.

Topics: Loans, Analytics, BDC, market analytics, business development company, LevFin Insights, News

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)