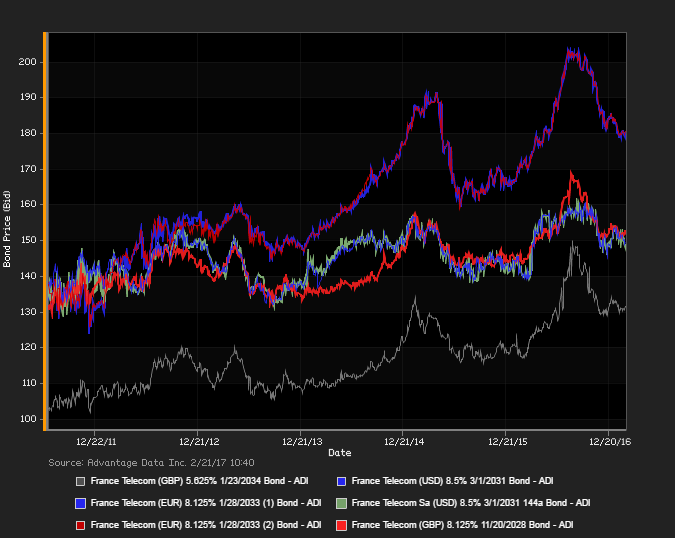

AN EXPANSIVE MARKET TONE prevailed overall, among corporate-bond traders in Europe's markets. Accordingly, European junk bonds outpaced investment-grade names in net price gains linked to actual trades, paralleling a move up in the pan-European Stoxx 600 equities index to a nearly homogeneous sea of green. The FTSE 100 index was drawn to the shallow red nonetheless, by a slide in shares of HSBC, on a $4.23 billion 4th-quarter loss, and a $1.0 billion buyback of shares. However, the mining sector drew strength from rises in shares of BHP Billiton and Anglo American PLC, on upbeat profits data. See France Telecom bonds, above. Subscribe to ADI Market Summaries for more detailed European bond research.

European Bond Research as of February 21, 2017

Topics: bonds

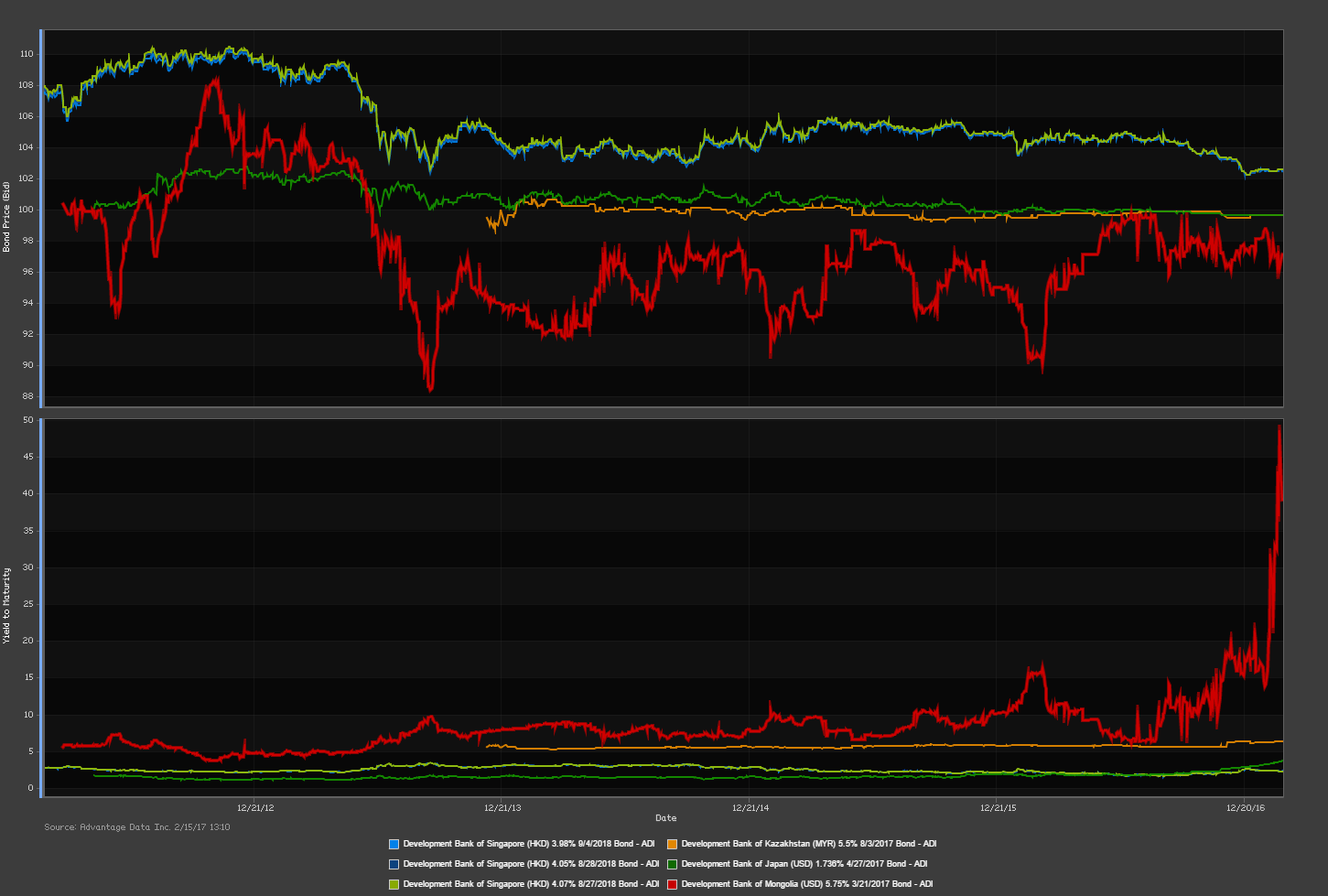

Development Bank of Mongolia Under Review for March 2017 Debt

Development Bank of Mongolia may have its 5.75% 3/21/2017 bond rating cut over concerns it may not be able to make its $580 million repayment by maturity. The mining and infrastructure financer currently does not have the liquidity to finance the repayment itself and is looking for outside help. Mongolian government has reportedly contacted China and the International Monetary Fund for assitance in the matter, but investors have their doubts that a bailout will be resolved within a month's time.

Topics: bonds, emerging markets, Development Bank

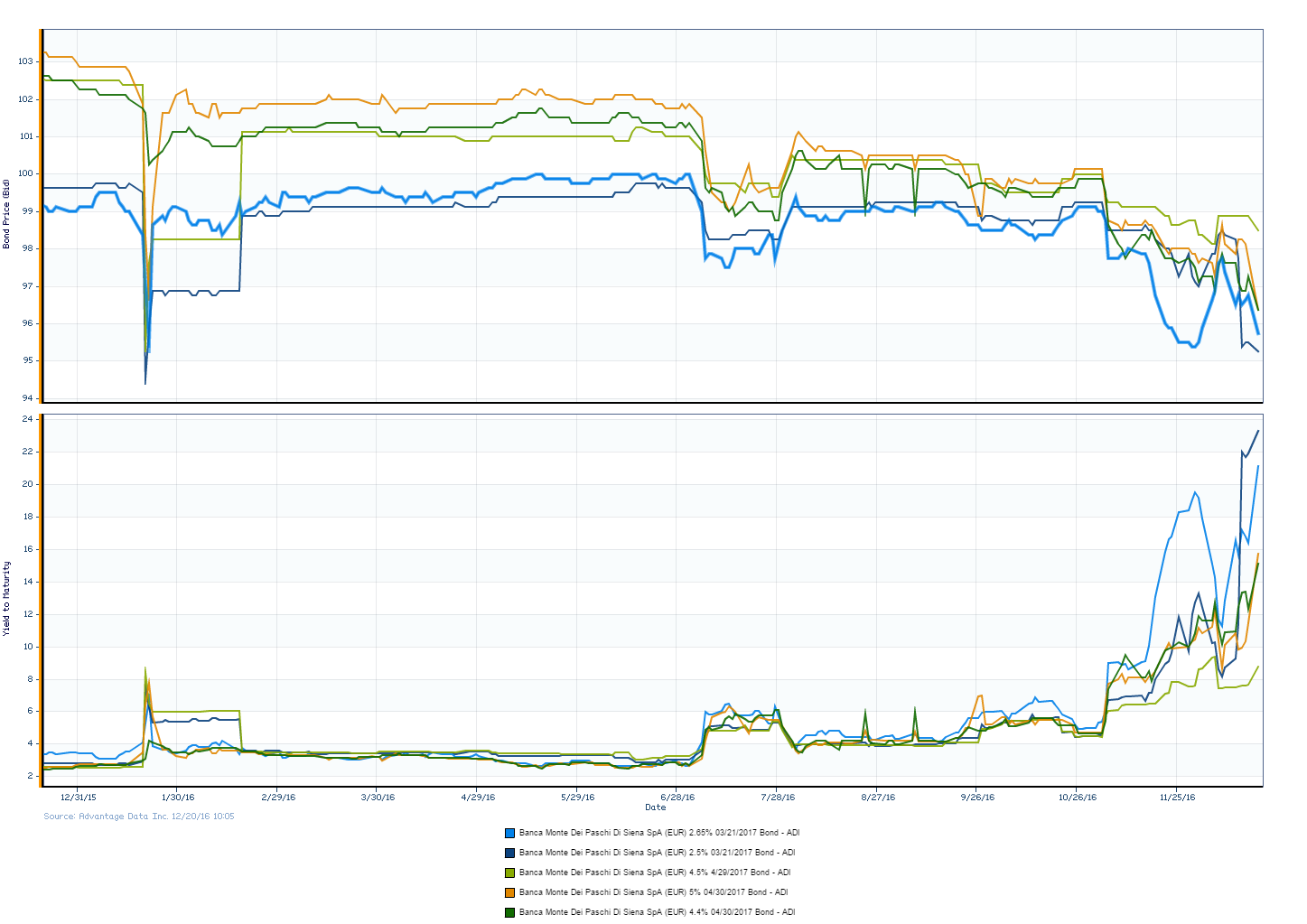

Italy Seeking 20 Billion Euros to Save Banking Sector

Italian government has decided to request approval from parliament for a 20 Billion Euro bail-out to stabilize its banking sector. A priority of this capital raise will be to bail-out the world's oldest bank and number three lender, Banca Monte dei Paschi di Sienna (IT: BMPS). In the beginning of December, BMPS, was in the news as it sought out 5 Billion Euros in order to cover debts and to dispose of toxic loans. Prior to the government meeting, BMPS, had formally attempted to raise the needed capital injection from private investors to avoid government intervention. The bank would need to secure the funds from private investors prior to the end of the year to avoid action from the government.

Topics: bonds, BMPS, Distressed Debt

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)