BDC COMMON STOCKS

Yoked Together

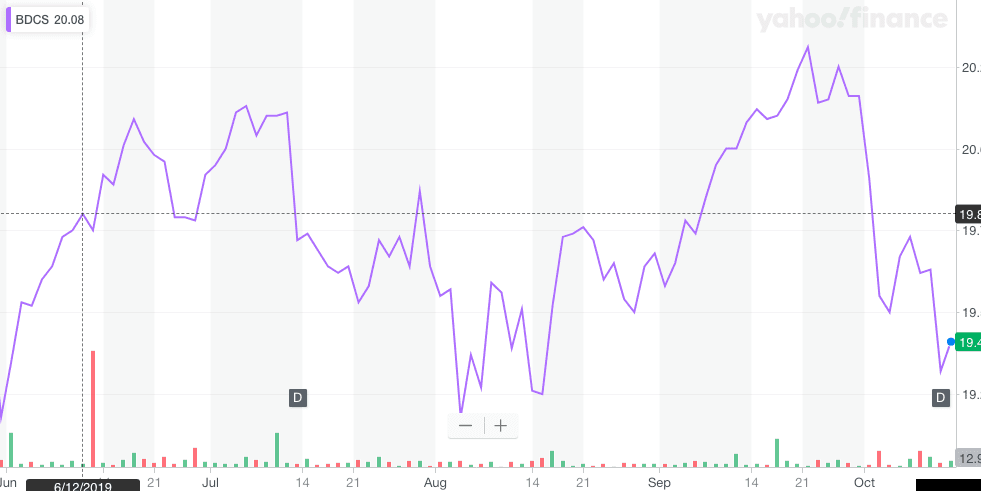

Another week and another instance of the BDC sector being synced to the S&P. Or so the numbers seem to show.

For the week, the S&P 500 index was up 0.54%. The UBS Exchange Traded Note which owns most of the publicly listed BDCs – ticker BDCS – was up 0.52%. In the approach to earnings season, there’s little else that can move the BDC sector, so why not?

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

Parts Town is coming to market next week via Golub Capital with a $788 million unitranche financing to back the add-on acquisition of Heritage Foodservice Group. The lender meeting, however, isn’t taking place in a fancy midtown hotel auditorium that can seat hundreds of investors. Instead, Golub is hosting a small group of invites to sell down only about half the deal.

Read More

Topics:

Loans,

Middle Market,

BDC,

First Lien,

debt,

business development company,

Non-accruals,

portfolio,

Direct Lending,

syndicated,

underperformers,

Direct Lending Deals

BDC COMMON STOCKS

Proof Positive

Once again, the weekly performance of the BDC sector demonstrated that its ups and downs are tied to the broader markets.

We’ve watched for weeks now BDC prices rise and fall with the major indices, which are themselves apparently fixated on the progress of the trade war.

This week was no exception.

The S&P 500 moved up 0.62%, mostly late in the 5 day period, due to the promise of a trade armistice or partial deal of some sort.

“Hurrah” said the markets, but as CNBC is reporting, second and third thoughts are already running rife so the trade tease is likely to continue.

This week at least, though, the late-in-the-week optimism brought the Wells Fargo BDC Index up 0.73%, after two prior weeks in the dumps.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

BDC COMMON STOCKS

Surprised

Halloween is still a month away but the broader markets were spooked this week by a series of negative economic reports.

That caused all the major indices to drop in unison for several days.

Appropriately enough, a positive payroll report (unemployment at its lowest level in 50 years !) brought investors back in.

At the end of the 5 business day period the S&P was barely down: (0.33%).

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

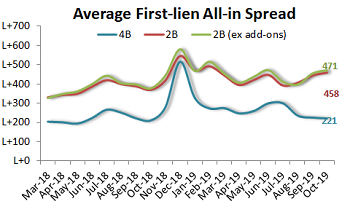

Market signals cautious tone as it enters 4Q; little activity in credits held by BDCs

Global market volatility on the heels of an active September in loans and the biggest high-yield calendar in two years has injected a further air of caution into new issues heading into the final three months of 2019, particularly with respect to the mid-to-lower single-B segment of the market.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

.png)