Expansive tone continued to build regarding a spectrum of risk-assets, leading European junk debt to draw a fresh wave of bids along with equities. A strong showing by the banking sector was kindled by upbeat earnings from Santander SA, sending the Spanish bank's shares up 4.7%. The news carried along a range of other European banks as well, including France's Societe Generale SA and Germany's Deutsche Bank AG. A rally in Logitech International SA, posting share gains of over 15.5% as of 4PM London time and supporting the European tech group, provided additional sector cues to corporate-bond traders.

Topics: High Yield, Investment Grade, debt

Defensive bias stepped higher, amid increasing attention by investors to statements by the U.K.'s Theresa May, and the U.S.' Donald Trump. Accordingly, investment-grade bonds easily outpaced junk debt on the European front, reflected in price gains linked to actual trades. High-yield bonds in the banking and retail sectors gave up some of last week's gains, while airline securities followed Lufthansa shares higher.

Topics: High Yield, Investment Grade, debt

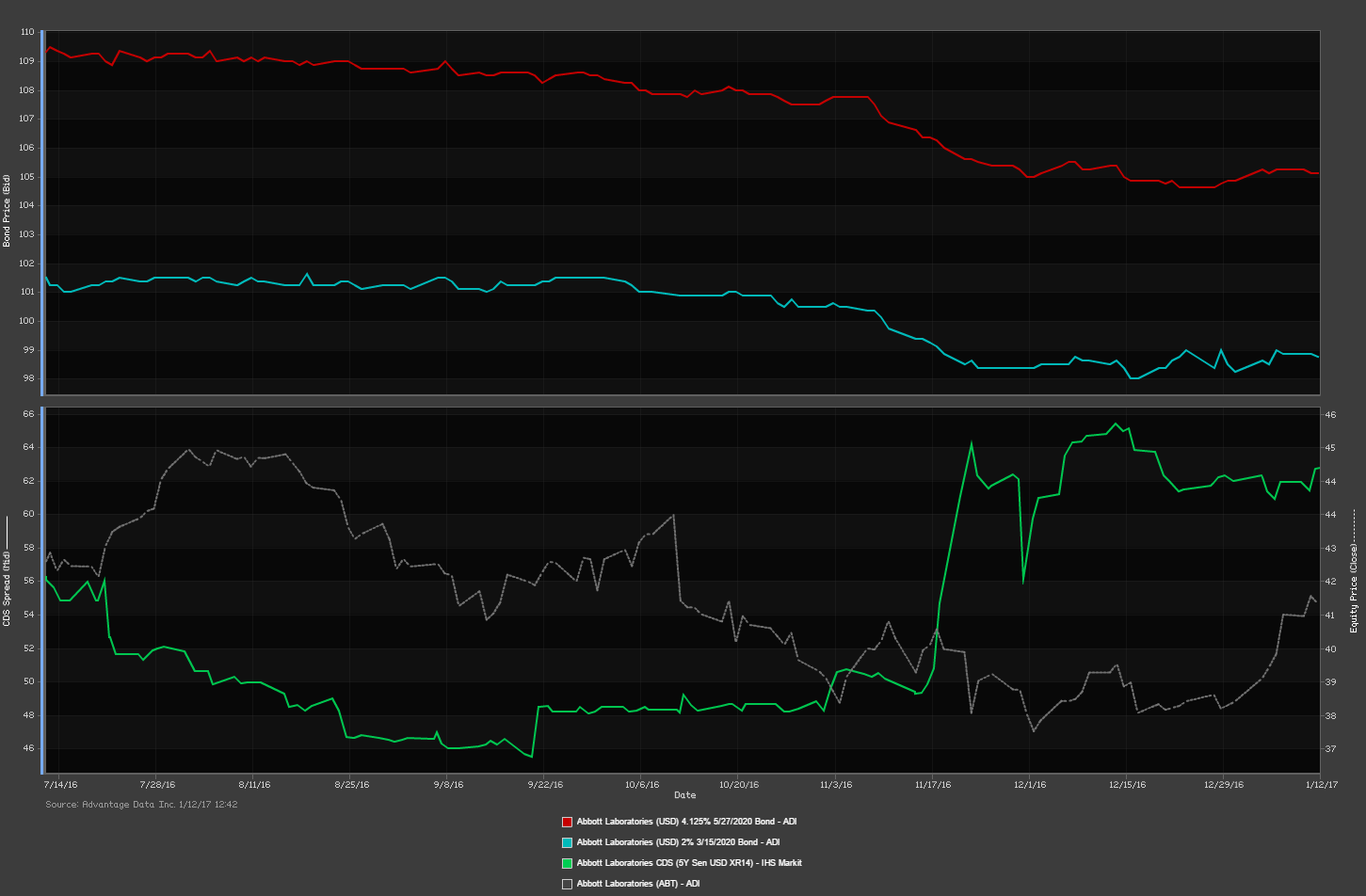

Abbott Laboratories Debt Experiences Downgrade

Abbot Laboratories (NYSE:ABT) saw a series of bond issues downgraded this past week from A2 to Baa3. This rating downgrade follows the aquisition of St Jude Medical Inc. (NYSE:STJ) on January 4th and the concerns that Abbott will struggle with deleveraging in the future. Since the acquisition and downgrade, ADI's CDS screener has shown Abbott Laboratories 5Y Sen USD XR14 CDS (green) drop and then widen to 62 Basis Points. Over the same period, ABT's equity (grey) had been on the rise until a drop yesterday.

Topics: debt, Abbott Labs, Downgrade

European high yield debt held a slight edge over investment grade names, even as the pan-European Stoxx 600 equities index stayed mired in the shallow red.

Topics: High Yield, Investment Grade, debt

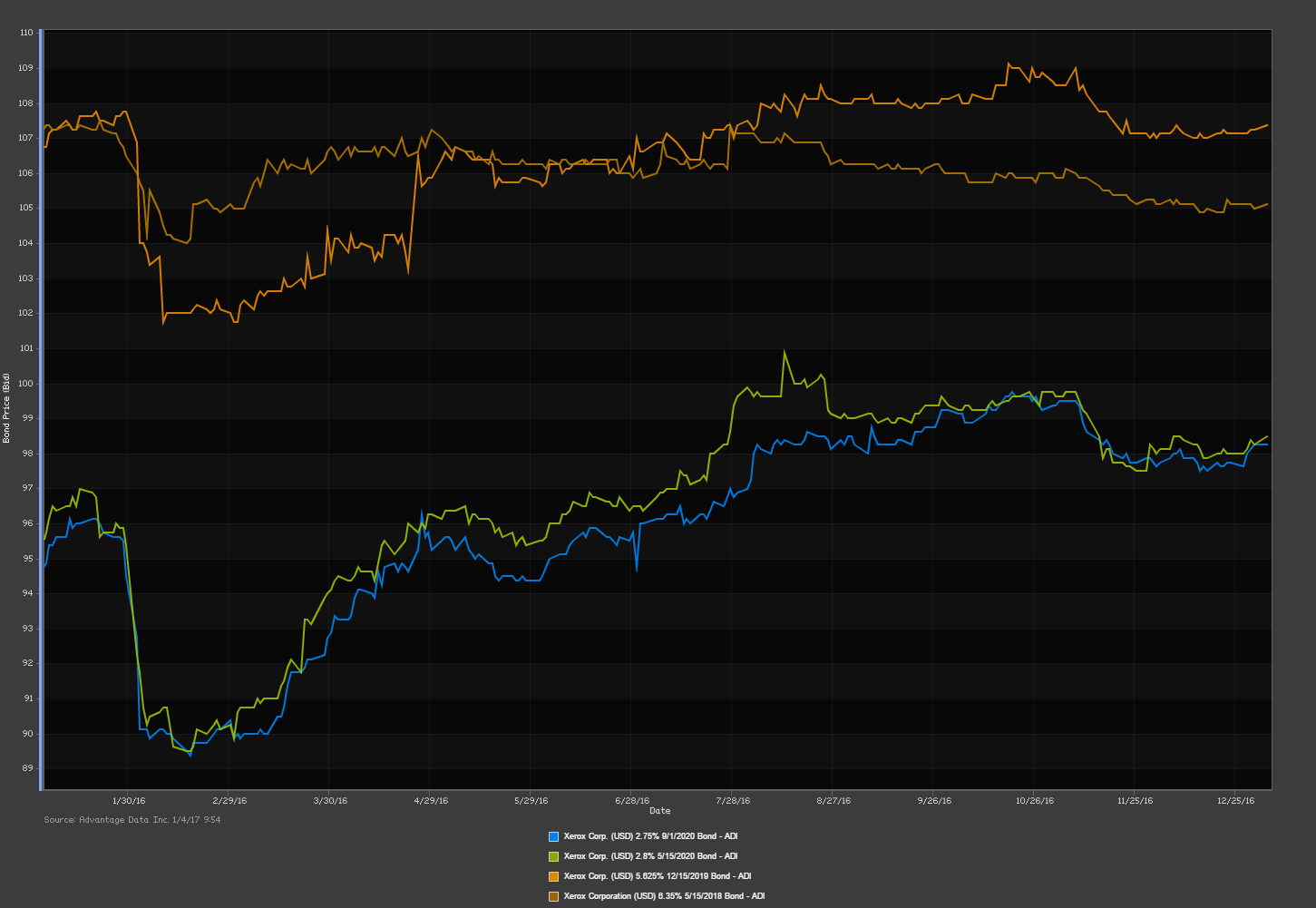

Xerox Debt Sees Rise Following Spinoff of Conduent

Xerox Corp. (NYSE: XRX) saw a jump in its bonds following the successful split of its business services arm, Conduent Inc. (NYSE: CNDT). The announcement came yesterday as the new Xerox CEO, Jeff Jacobson, announced that, "The successful completion of the separation sharpens our market focus and commitment to our customers". In addition to the ability to resharpen the focus of Xerox to its bread and butter of the technology and hardware business, it also received a $1.8 billion cash transfer from Conduent to help pay off around $2 billion of outstanding debt.

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)