Macro economic factors — tariffs on Chinese goods, political unrest in Hong Kong and Brexit among them — have returned volatility to capital markets, however direct lending has plowed onward with few upsets.

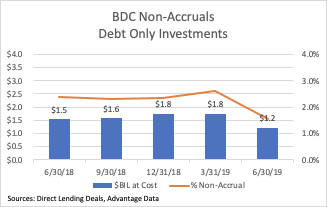

BDC portfolios show little pain in non-accruals for 2Q19, steady ahead

Topics: BDC, debt, business development company, Non-accruals, portfolio, Direct Lending, underperformers, Direct Lending Deals

The Hunt For Data: Middle Market and Illiquid Loan Valuation

Even in markets where established data infrastructure is limited, such as syndicated loans, reliable sources of data that are indicative of a liquid security’s value are available through market data vendors and broker quotes. When evaluating illiquid securities like middle market or directly originated loans, the effort of data aggregation becomes much more difficult and is often assumed to be an exercise in futility. We would disagree.

Topics: Loans, Middle Market, BDC, business development company, Valuation, Fixed Income, illiquid, download, Direct Lending, syndicated

The Middle Market Loan Advantage: A Look Behind The Curtain

[Transcribed from video]

Introducing the Middle Market Loan Advantage. The newest edition to AdvantageData’s suite of credit data products. The Middle Market Loan Advantage complements our syndicated loan and BDC Advantage modules. With [~4500**] middle market loans, the Middle Market Loan Advantage shines a bright light on this opaque market.

How do we do it? AdvantageData aggregates information from news sources, trading desks, buy and sell-side filings, and more.

Topics: Loans, Middle Market, Analytics, BDC, business development company, Valuation, Restructuring, Direct Lending, Investment Banks, Syndicated Bonds

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)