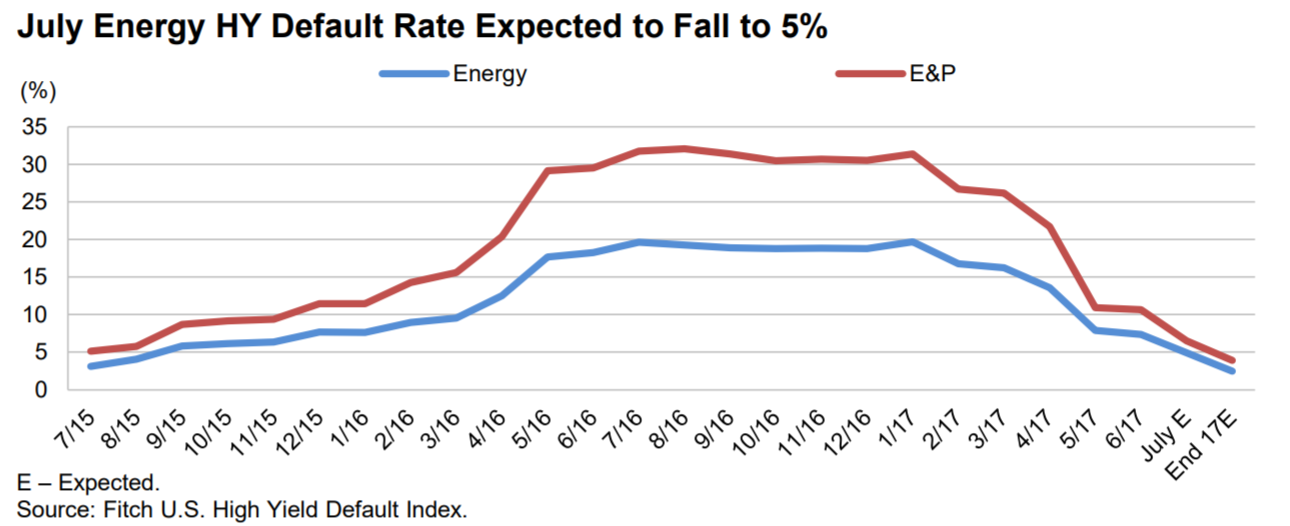

The U.S. trailing 12-month (TTM) high yield default rate dipped below 2% for the first time since March 2014, according to Fitch Ratings in a new report.

Fitch: US High Yield TTM Default Rate Falls to Lowest Level Since March 2014

Topics: High Yield, Loan Default Rate

July HY TTM Default Rate Dips Below 2%; Energy Rate Lowest Since August 2015

July Default Rate Below 2%: The July U.S. TTM high yield default rate stands at 1.9%, down from 2.2% at June 30. This represents the seventh straight month the rate will have fallen and marks the lowest level since March 2014. Chinos Intermediate Holdings’ (J. Crew Group Inc.) distressed debt exchange (DDE) and Armstrong Energy Inc.’s missed payment were the two July defaults registering $766 million. The month’s total is well below the $4.7 billion rolling off the TTM universe.

Topics: High Yield, energy

Sears Holdings (NYSE: SHLD) announced its concerns on Tuesday about its ability to stay afloat after years of losses and declining sales. The U.S. retail giant has failed to turn an annual profit since 2011. At the end of its fiscal year in January, the company had said that it was hoping to reduce its costs by $1 billion and cut its debt and pension obligations by at least $1.5 billion. It currently has liabilities totalling around $13.19 billion. In efforts to boost its liquidity, Sears said that it has taken action to sell its Craftsman tool brand for $900 million to Stanley Black & Decker Inc (NYSE: SWK).

Topics: High Yield, Loans, retail

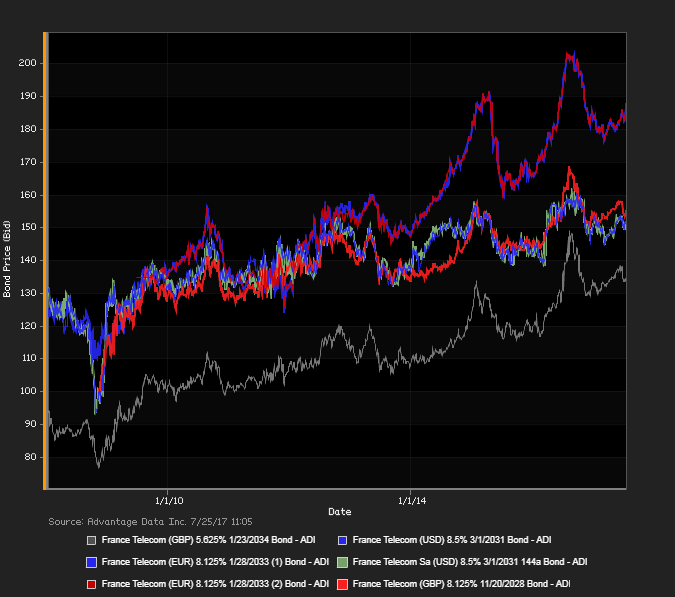

European Bond Research as of February 14, 2017

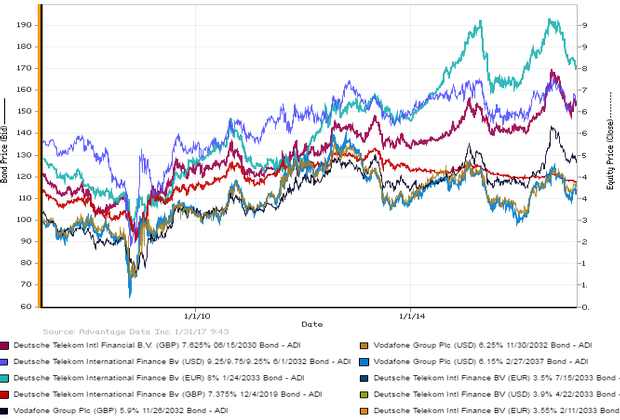

EUROPEAN HIGH-YIELD BONDS RETAINED FAVOR - although a narrow one, over a range of investment-grade securities. Disappointing GDP numbers for Germany and the overall euro-bloc weighed upon 'risk-on' trades, as did views of increased French political risk ahead of an upcoming presidential election. Nonetheless, a residual bullish tone after yesterday's resurgence in risk-taking in Europe and 'across the pond' in the U.S. was in play, on the heels of fresh record highs in Dow, S&P 500, and Nasdaq.

Topics: High Yield, Investment Grade, debt

'RISK-OFF' SENTIMENT WAS TONED DOWN relative to yesterday's levels, among a spectrum of European corporates. Investment-grade debt edged out junk bonds in net price gains nonetheless, amid continued attention to political risk emanating from 'across the pond' on the U.S. front. Corporate-bond investors took sector cues from gains in Deutsche Bank AG shares, moving up 2.1% before profit-taking set in. Upbeat views on financials were offset a bit by a 3.4% pullback in Italy's UniCredit SpA, as of 4 PM, London time. However, gains in retailer Hennes & Mauritz AB, Ocado Group PLC, and Alfa Laval AB buoyed the pan-European Stoxx 600, limiting its descent into the shallow red.

Topics: High Yield, Investment Grade, debt

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)